The Russian Finance Ministry drafted a new bill on cryptocurrency on Friday in hopes the state Duma will ultimately sign it into law, moving Russia further ahead in the world of digital currency trading.

The bill legalizes the term "digital financial asset" as a security in electronic form, "created using encryption methods, of which the legal title of ownership is verified by making a digital record in the register of digital transactions," also known as a blockchain. The bill states that cryptocurrencies are not an authorized means of payment in Russia. Therefore, cryptocurrency -- based on this draft -- is not money. The opinion by the Finance Ministry rightly reflects the position expressed last year by Central Bank president Elvira Nabiullina.

The draft bill mentions cryptocurrency and tokens, another form of digital money used as payment for a start-up company's services. Tokens can be exchanged on cryptocurrency exchanges like stocks, leading to wild speculation in pricing worldwide.

Russia's government promised legislation to regulate cryptocurrency this year.

"The purpose of these bills is to define the scope of action and of the regulations of cryptocurrencies, not their prohibition, and this is good news for Russia," says Anti Danilevski, CEO of KickICO, a blockchain platform for fundraising in crypto that raised over $80 million in 2017 in their initial coin offering, or ICO.

Back in 2014, the Russian central bank called bitcoin "quasi-money" and has said that it was being used to launder money from criminal activities, and tax evasion.

"For us, as a company, it is important to act legally...so once you get a better sense of the rules, it allows projects from the real economy to launch their ICOs here, instead of doing it in other countries," Danilevski says.

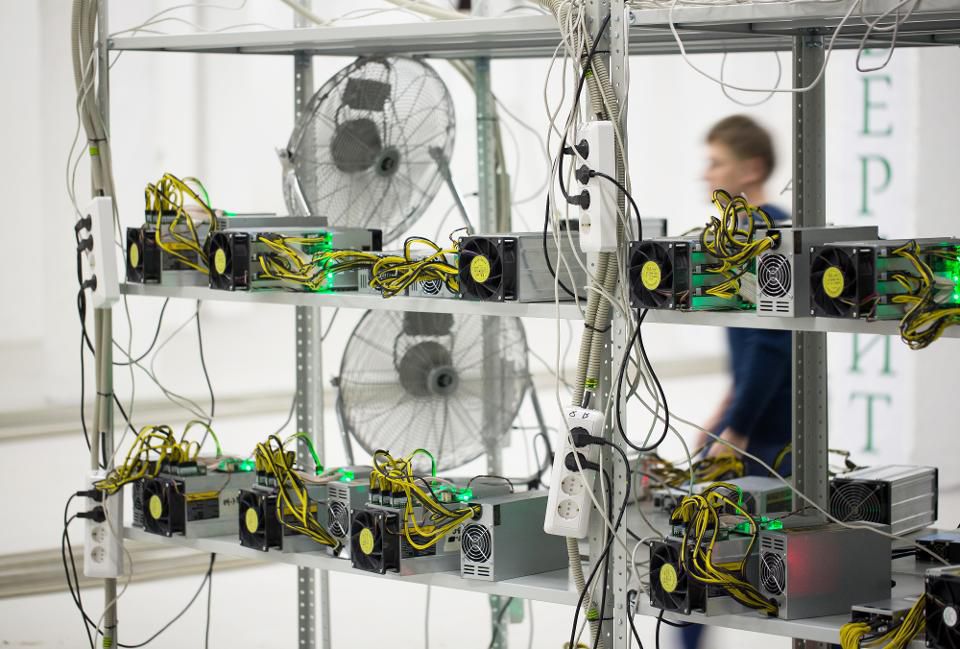

The bill also defines bitcoin mining as an entrepreneurial activity aimed at creating cryptocurrency and/or validating transactions in exchange for payment in cryptocurrency. This could require Russian bitcoin miners to incorporate as a legal entity or register as self-employed persons offering services in exchange for bitcoin, or any other cryptocurrency.

Moreover, the Finance Ministry wants to allow only for the trading of cryptocurrencies on licensed exchanges of digital financial assets, or through existing trading platforms that have stock exchange licenses.

Individuals who are not registered as qualified investors are only allowed to invest 50,000 rubles ($900) in ICOs.

"The bill needs to go through Parliament and, no doubt, will be amended," says Olga Sorokina, a partner with KeyICO, a professional services and consulting firm helping start-ups launch an ICO. "We can at least see the base and the shape of the future law now: the Russian authorities want to tightly control the cryptocurrency and tokens turnover (as they do) with the securities market. Any legal crypto transaction should go through a licensed operator, being under the state control," she says.

Under the draft law, private individuals would have to open special accounts and wallets with operators similar to brokerage accounts.

Not everyone in Russia is bullish on the government's view of the crypto space, Sorokina says.

"I think ICO procedures will get rather complicated in Russia, and...local ICO projects will definitely lose many potential crypto investors," she says.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.forbes.com/sites/kenrapoza/2018/01/29/russias-newly-drafted-cryptocurrency-bill-crypto-not-cash/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit