This post is written to let you guys know what happened and how it happened. I hope it's also going to help me to put things in order again and let me think straight.

What happened?

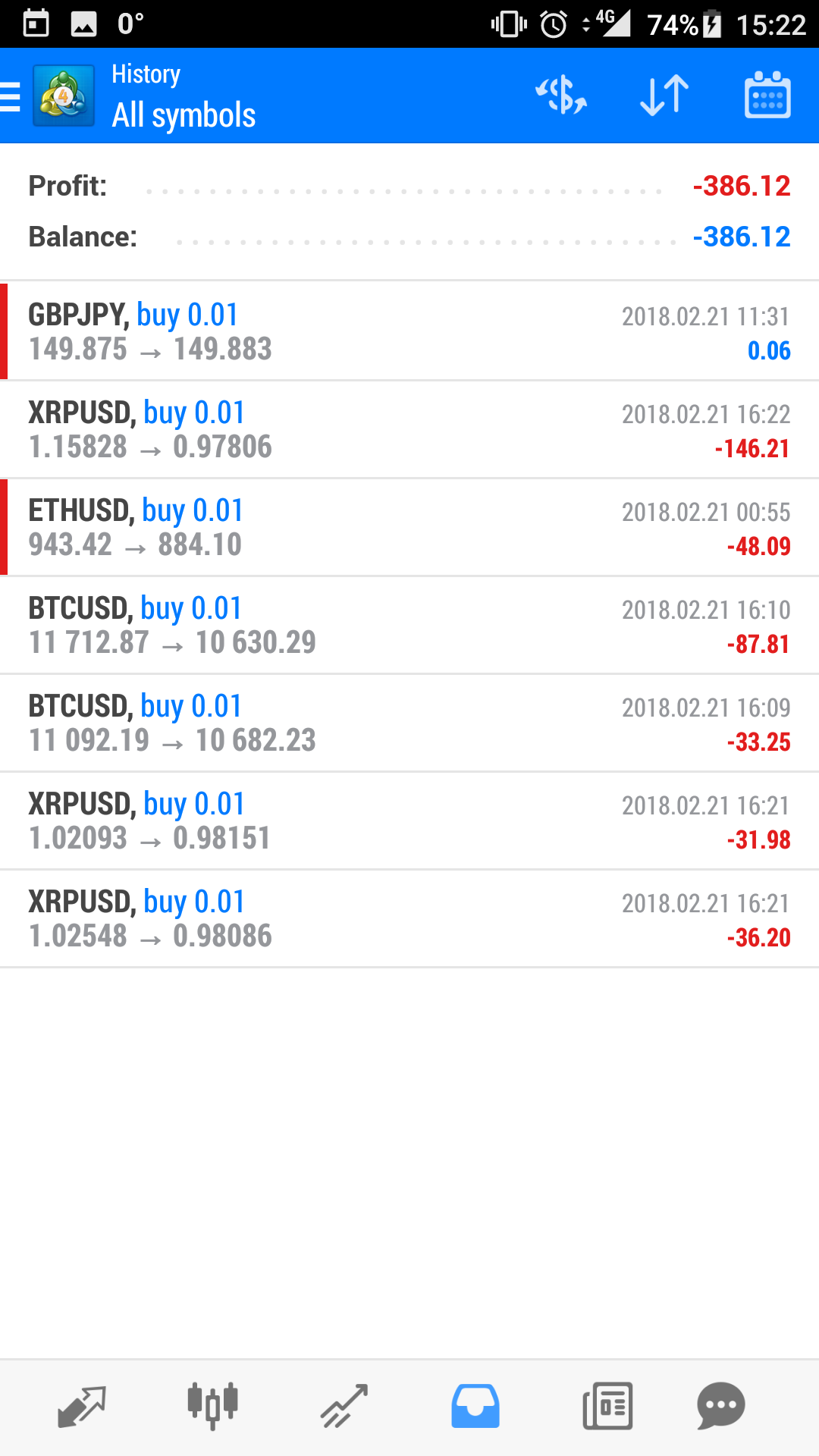

So let's explain; I opened a trading crypto account with leverag and deposited €150. That €150 became €500 after some good trades. The next trades that I took were XRPUSD, BTCUSD and ETHUSD.

My emotions took over yesterday and I added onto losing positions. Hoping to catch the reversal, that actually was just consolidation. This morning I woke up and saw a big drawdown. Couldn't cut the losses so I waited and waited... The reversal never came. So I had no choice, but close the positions to prevent a margin call. These are the closed trades from today. Yesterday I already closed 1 losing position though.

What did I learn from this?

After all I made some notes in my journal and wrote down what happened. Besides that, I tried to find what I could've done better. First thing was; risk managment wasn't there taking the trades. Second; never add to losing positions. Last; don't be greedy. The market can turn around and take you out in a minute.