The distribution of cryptocurrencies is non-uniform across the globe. While in some countries, like the US, some European and Asian nations, bitcoin and altcoins have garnered significant support in local communities, other regions are almost crypto-deserted. For that reason, any crypto-related startup in such realms may boom and thrive. However, obstacles placed before such innovative startups may differ in various countries.

The distribution of cryptocurrencies is non-uniform across the globe. While in some countries, like the US, some European and Asian nations, bitcoin and altcoins have garnered significant support in local communities, other regions are almost crypto-deserted. For that reason, any crypto-related startup in such realms may boom and thrive. However, obstacles placed before such innovative startups may differ in various countries.

Africa as a region is commonly recognized as a prospective domain for development of cryptocurrency businesses and services. With most of the continent’s economies graded as ‘developing’ and biggest part of the population unbanked, Africa is a market where cryptocurrencies may find its own unique niche. The financial inclusion situation is more or less similar for most of African countries.

Kenya for instance lacks any reliable financial system on the background of thriving corruptive practices and unpredictability of local financial services. Credit cards there may not work all the time, and their servicing is expensive. Additionally, most Kenyans are completely unbanked and have no credit cards whatsoever. In most cases, their only option is to effect cash transactions, which involve serious fees. In previous years, the Kenyan and ugandan Central Bank issued a warning about hazards of bitcoin, mostly reiterating provisions found in other similar notions published by regulators across the globe. The most important of them is lack of any protection for users in case anything goes wrong. However, there is no official ban imposed on cryptocurrencies in those countries.

Meanwhile, the Central Bank of Nigeria prohibited the country’s citizens to the use of their plastic cards abroad. The regulator’s move is commonly associated with devaluation of the country’s national currency, Naira, which, in its turn, is caused by global trend of oil cheapening. This may cause cryptocurrencies to inure in Nigeria, as it might effectively become the only option for Nigerians, who still wish to purchase goods and services abroad, or to effect international transactions. Bitcoin is neither regulated, nor prohibited in Nigeria for now, so the technology is likely to blossom in Africa’s largest economy.

Africa is a country where people interact with money in different way than the rest of the world. There is in excess of a billion mobile devices. Most people prefer using their phones instead of computers. The one who manages to connect mobile devices and the blockchain, thus helping people save their money, will inevitably succeed. I think, many entrepreneurs see this opportunity at the market. But for now, it’s more like a minefield where de-miner startupers roam. Those more experienced still await for an opportunity and the emergence of projects to invest in

The one who manages to connect mobile devices and the blockchain, thus helping people save their money, will inevitably succeed. I think, many entrepreneurs see this opportunity at the market. But for now, it’s more like a minefield where de-miner startupers roam. Those more experienced still await for an opportunity and the emergence of projects to invest in

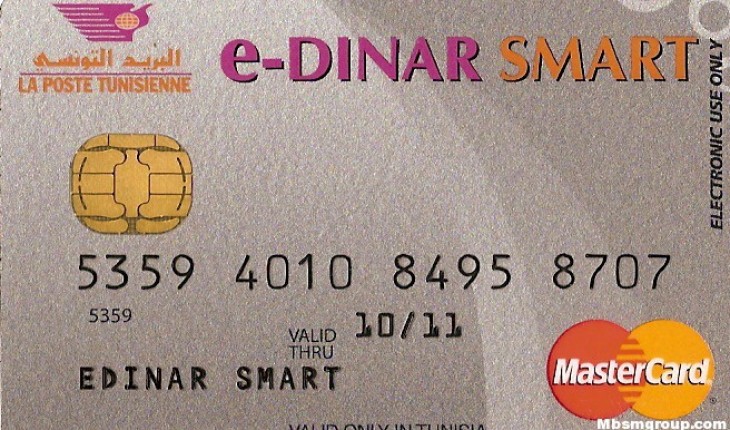

However, North African Tunisia is going to become the world’s first country to operate its national currency via blockchain. The blockchain in question, however, is an advanced version of the bitcoin’s one developed by Monetas. With population of about 11 million, Tunisia has more than 3 million people unbanked. However, 600,000 of them using eDinar, a digital version of the national currency via La Post Tunisienne (The Tunisian Post), a state-owned public company being the only non-baking entity entitled to collect savings. In Tunisia, Monetas operates alongside with the Post, and local startup dubbed DigitUs. The existing 600,000 eDinar users will have their accounts and services transferred to the new technology as soon as due diligence is complete.

However, while some investment goes on, and some projects still manage to lauch, crypto-technologies are not as included in the continent’s financial systems as they are in the U.S. or Europe. This leaves the whole paradigm a great room for development.

In conclusion

The concept of propagating Bitcoin and crypto-technologies in countries with mostly unbanked population may underpin the very idea of so-called “killer app” for virtual money. However, while Africa definitely lacks financial inclusion in general, it mostly lacks any attractive alternatives thereto. For that reason, crypto-solutions may change everyday lives of the continent’s dwellers for the better more drastically than in nations with developed banking infrastructure.

While in the latter case crypto-technologies may become a viable alternative to existing systems, in the former case they are capable of providing a superior solution incomparable to anything available there nowadays.