Hi!

We keep seeing our portfolio get back to its initial value, and on the few last updates we were seeing some adjustment opportunities.

Today I have made the adjustments, by transferring $30 in value of EOS (which pumped today about 30%) to BTC ($10) and ETH ($20), which have been a bit underrepresented in the portfolio lately according to the target values and have been pretty stable for the last few days.

I always like to adjust "pumped" coins into stable ones, because it is a way of locking some gains for EOS in this case and balancing the portfolio into some coins that have a better price.

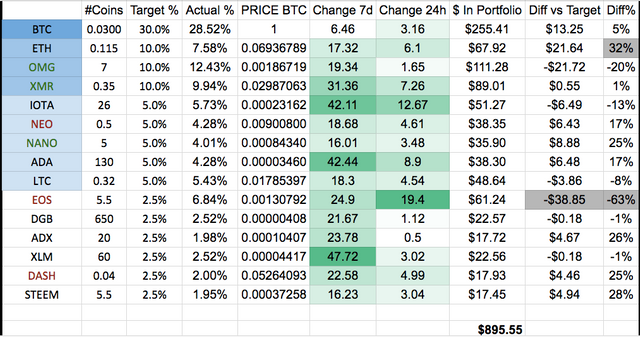

Here is the status BEFORE the adjustment:

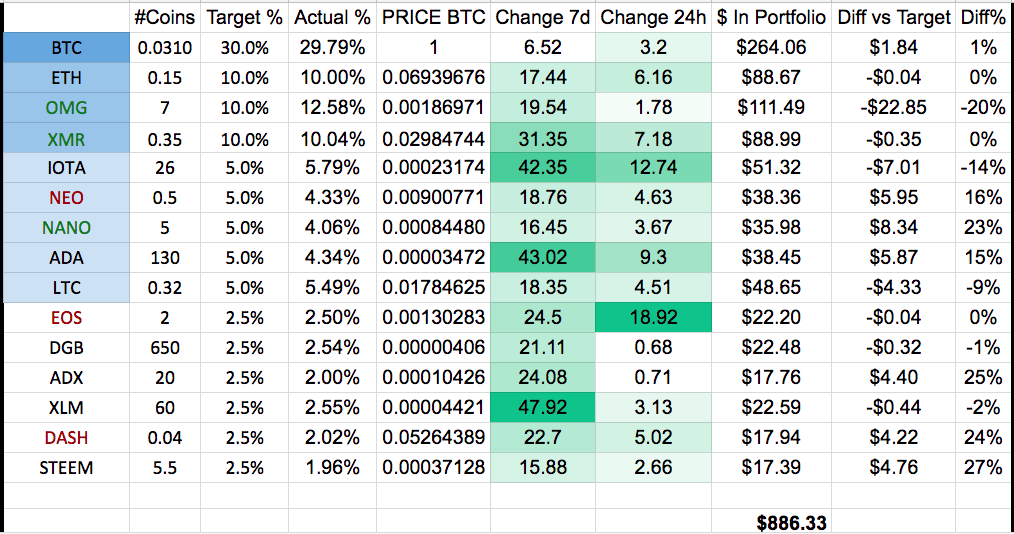

And this is the current HODLfolio status:

The small before and after difference is due to the changes in price during the portfolio adjustment.

Not much to comment for today, portfolio is balanced now and we will keep checking the market and preparing the big party when we get back to gains!

HODL and have fun!

@savitend, I like the discipline and structure of what you are doing, however, with projects advancing at different speeds, new promising ones surfacing and some existing ones losing momentum, what is your strategy to adapting your portfolio to these changes?

Also, don't you think that by selling the outperformers and putting the gains into the underperformers you are limiting the growth of your portfolio?

In no way I am saying what you are doing is wrong or incorrect so don't take above as criticism. I am simply interested in your strategy and thoughts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi andrius1,

These are two very good points, here is my take on both of them:

1.- New additions.

My strategy focuses a lot on high and mid-caps, since the volatility of these kind of projects is usually lower than low cap coins. For good projects that may end up in the portfolio, or rotating some of the projects included in it, i am of course all about it.

I have had some percentage rotations in the past due to different speeds in the projects and the expectations in them, so these are things I have under consideration, but I do not want to be trading very often, since this is a long term portfolio. An addition is done looking years into the future, and I am happy with having certain percentage of a coin in my portfolio for the long term, which takes us to point 2.

2.- Selling outperformers, buying underperformers.

This is a balancing strategy, and a way of realizing profits in a certain coin. One of the things I value most about the portfolio is the diversification, and the way of having a steady diversification over time is keeping percentages as planned.

As a way of rotating overrepresented coins in my portfolio, I choose selling after a significant increase in price, as it is a way of locking profits and at the same time averaging down (if possible) for another coin I have in the portfolio. I will complement this strategy in the future by having some part of the portfolio as "Free USD", in case there is no obvious rotation in case I want to lock in some gains.

I hope this clarifies a bit my thoughts and strategy, I may be 100% wrong, but it makes sense to me to try and reduce some volatility and keep things simple in this crazy market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey, Do you think its worth it to HODL Bitcoin at the moment? Followed you too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! Thanks for the follow! I think there is a lot of market manipulation in the short term, but BTC is a solid hold for me in 2 years. That is the case for the rest of my portfolio, I try to see things in the distant future and not just one or two months down the road.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit