Over the previous year, bitcoin has taken off in esteem, achieving trade rates as high as $19,000 per coin. However, what is it, and how are individuals getting rich off this innovation?

The greater part of these financial specialists purchase entire or portions of coins and utilize these property like a stock or a bond, purchasing low and trusting that coin esteems increment, later exchanging them for U.S. dollars. There are a developing number of retailers that acknowledge bitcoin as a type of installment, including Microsoft, Overstock.com, Expedia, Dish Network, the worldwide philanthropic Save the Children, Wikipedia, Tesla, the understudy book shop at MIT, and the online retailer Shopify.

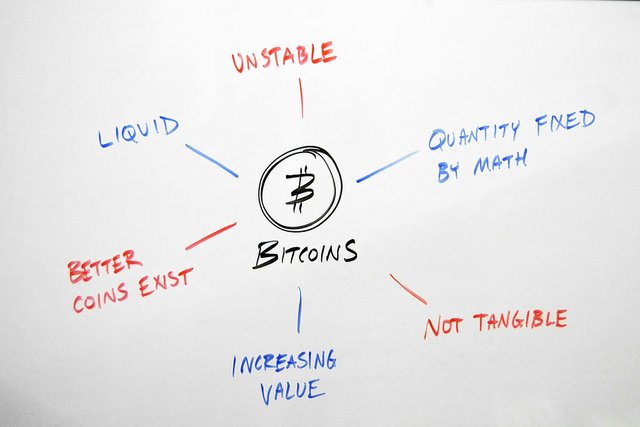

The issue with utilizing bitcoin as a money and the danger of utilizing it as a venture—particularly amid this unusual positively trending market—is the outrageous variances in return rates, and the way that coin esteems are not upheld by a ware like gold, the way the U.S. dollar initially was.

Photograph demonstrates a shop window put with stickers indicating types of acknowledged installment, including a sign for Bitcoin

Picture inscription: 'Bitcoin acknowledged' sign in the window of a café in downtown Zurich, Switzerland in January, 2015

"Like some other resource or security, bitcoin costs are driven by free market activity," says Jim Liew, a collaborator teacher at the Johns Hopkins Carey Business School who represents considerable authority in huge information machine learning and riches administration. "In the event that there are a greater number of purchasers than dealers, the cost will go up. On the off chance that there are a larger number of venders than purchasers, the cost will go down."

The bitcoin organize doesn't have a brought together organization or armada of staff individuals who keep up the blockchain—that is the place the bitcoin excavators come in. They utilize very particular PC processors to ensure nobody has spent the same bitcoin twice. These processors, called ASICs, are exceedingly effective at working in the encoded organize, so part of the mining procedure includes explaining complex numerical conditions. These conditions falsely back off the mining procedure and help keep it aggressive.

In spite of the effectiveness of the ASICs, mining still requires a significant measure of power to control the PC processors, and as the system develops, so does the vitality required to look after it. So much power is required, truth be told, that the bitcoin organize alone apparently utilizes as much power as 3 million American families.

Mineworkers are repaid for their work—and their power—with bitcoins that have been crisply stamped. In a manner of speaking.

Cryptographic money is alluring as an equitable arrangement of back, yet bitcoin has specific restrictions that contending alt-coins have looked to move forward. In spite of the fact that the bitcoin blockchain is scrambled, it's not so much mysterious, for instance. Open keys are utilized as advanced marks so it's conceivable to track exchanges—and sometimes figure out who is behind an installment.

Green, the Johns Hopkins cryptographer, intended to address this protection insufficiency when he created Zerocoin, which enables PCs to confirm exchanges on the blockchain without depending on specifically distinguishing data.

This is an important post about Cryptocurrency. But Where is is good news?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit