During the days of the dotcom boom in the late 90s, investors could toss money into an IPO, an ‘Initial Public Offering’ and be almost guaranteed exceptional returns.

Various companies experienced huge first-day gains, but ended up disappointing investors in the long term. But there were investors who had the knowledge and foresight to get in and out while making huge gains in the process. Even some of those investors found Amazon, eBay, and Priceline which were some of the few winners to make it out of dotcom boom.20 years later and enter an ICO, or ‘Initial Coin Offering’. Cryptocurrency start-ups raise money by offer tokens which fund the firm’s operations. Early investors hope to get in early enough that the cryptocurrency will be successful. Many of these ICO’s are offered at fractions of a penny, in hopes of rising exponential in value down the road.

However, no investment is a sure thing. And even if you have a long-term focus, finding a successful ICO will be difficult. ICOs are a new industry venture and have many unique risks that make them different from an IPO you will find on the stock market. If you do decide to take a chance on an ICO, here are five points to keep in mind:

1. Find out everything you can about the development team

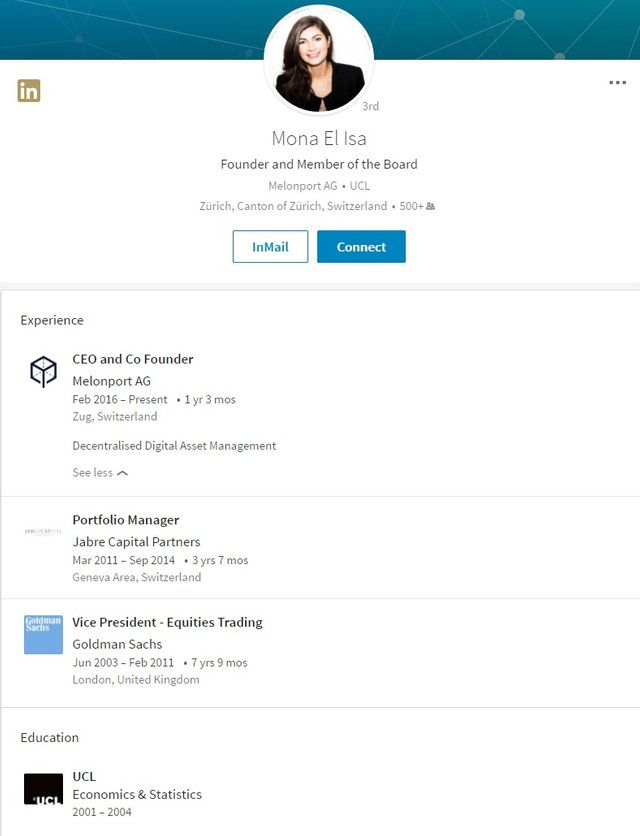

When I first find an ICO that I’m interested in buying, I go straight to their website and look at the developer page. The developers of the ICO must use their real name and have a picture to go along with that name. Under no circumstances should you invest in a coin with an anonymous developer team.Once you find who the developers are Google their name and find out as much as you can about them. Where did they go to school? What did they study? Where did they previously work? Do they have any experience in this industry?

A good sign of a potential ICO is if the developers link their LinkedIn, GitHub, or Twitter handle on the ICO’s website. Research their credentials and past posts on Twitter. I am not suggesting becoming an online stalker but you should find out as much about their professional experience as possible. But I have read stories of large capital investors purchasing background checks on developers of ICOs.

Melonport_ CEO, Mona El Isa, has impressive credentials, with experience as a Goldman Sac's equity trader and a degree from a London University_

Melonport_ CEO, Mona El Isa, has impressive credentials, with experience as a Goldman Sac's equity trader and a degree from a London University_

2. Read the ANN thread on BitcoinTalk.org

www.BitcoinTalk.org is a message board where people interested in the technical details of the development of Bitcoin and other cryptocurrencies. New altcoins will usually have an Announcement [ANN] on the announcement message board. This is usually the best way to find the first announcement of an ICO, what the coin has to offer, ask questions with the developers of the coin and other BitcoinTalk.org members. BitcoinTalk.org's announcement message board is a great way to find new ICOs

When researching a new ICO, find the [ANN] thread of the coin and read every single page in the thread. Many first questions can usually be answered in the ICO’s announcement thread. Make sure to pay special attention to questions that have been answered by the official developers. Are they answering all questions and concerns? Or do their posts seem vague and fishy?

A simple trick to use when searching on BitcoinTalk is search the name of the ICO along with red flag words. Words such as “con”, “scam”, “MLM”, “hack”, and others. If any posts are found with these words I usually start reading why the red flagged term was mentioned.

3. Read the whitepaper

If a cryptocurrency firm wants to raise money through an ICO, it creates a plan on a whitepaper which is simply called the whitepaper. The whitepaper states what the project is about, how much money is needed to undertake the project, how much of the coins the developers will keep for themselves and how long the ICO campaign will run for.If you’re going put all your faith in to an ICO you should never skip reading the whitepaper. It may be a dry read, but the whitepaper lays out the company's risks and opportunities, along with the proposed uses for the money raised by the ICO. For example, the whitepaper will lay out if the coin holder is going to have voting rights, or if the coin pays out dividends and whether those dividends will be monthly, quarterly, annually, or other. One of the biggest things to be on the lookout for while reading the whitepaper is an overly optimistic future outlook, vision and goals.

4. Don't put all your eggs in one basket

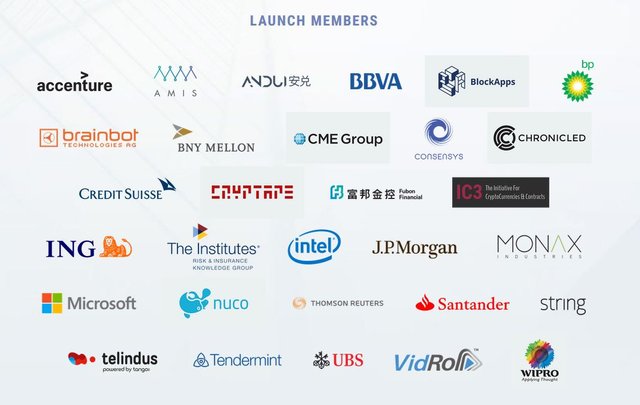

Just like with any other potential investment you must learn to spread risk. Don't put all your eggs in one basket and invest in one coin thinking it is going to rise substantially. Find five ICO’s that you have done extensive research in and then narrow it down to the top three. The Enterprise Ethereum Alliance_ connects Fortune 500 enterprises, startups, academics, and technology vendors with Ethereum subject matter experts._

The Enterprise Ethereum Alliance_ connects Fortune 500 enterprises, startups, academics, and technology vendors with Ethereum subject matter experts._

One year ago, it would have been perfectly acceptable to invest in one cryptocoin such as Ethereum, Ripple, or even Bitcoin but now things have gotten a little bit different. With the creation of the Ethereum Enterprise Alliance, the blockchain is currently being accepted in billion-dollar market cap companies such as Microsoft and Intel. This increases the legitimacy of Ethereum’s future vision and success. The ICO’s currently being launched on networks such as the Ethereum Network have gained some of that legitimacy as well.

5. Be cautious and do your own extensive research

Skepticism is a positive attribute to have in this new and exciting market. As mentioned earlier, there is always a lot of fear, uncertainty and doubt surrounding ICOs, especially online. Be careful of information you read on message boards and do your own research. Trolls, FUDers, and bagholders spread misinformation and outright lies about speculative investments. If an ICO is constantly being posted by a few posters, you should exercise increased caution.The Bottom Line

At the end of the day, there will be some ICOs that should be absolutely avoided. A conservative strategy is 99% of all ICO could be junk. Do your due diligence and learn how to sniff out the 1%. Investors who have bought coins at the ICO price have been rewarded generously by the companies in question In the next year there will be more and more ICO offerings coming out every month as this technology becomes more mainstream, so it will be become more difficult to filter out the riffraff and find the cryptocurrency firms with the most potential.

*Feature picture belongs to https://www.ethereum.org/*

Excellent article and timely advice! Thanks a lot!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! It was my first Steem posts. Looking back on it I see the markup is all messed up. lol. Glad you liked it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this! Following you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! Followed you right back!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Followed and re-steemed. Great post with advice for the new as well as the vets in the digital currency space.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great content! I have re-steemed this post and I'm following you too. Well done, @scrarpoochi !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @maryfavour

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice does anyone have current 2018 Q1 or Q2 Feb, March April May ICOs coming up?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome information, thanks for sharing! I have a couple of questions though:

Where can you participate in the ICO's? As in, where can you go and actually buy the coins?

Are most ICO's on the Ethereum Enterprise Alliance, or are there other places these ICO's are going?

Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great read!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @thereceptionist. Glad you enjoyed it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

These are all really great points to bring up. I feel like we need a website or place which goes in depth about ico's. We need an unbiased website or community which rates ico's based on things like developer credentials, potential roi, popularity, etc.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post. Nice to see I'm not the only one who thinks like this. Buy and hold for the upcoming 3 years and the blockchain market will find it's way. We really need more insights in the market and previous investment results (even though they don't deliver any guarantee for the future). Does anyone know about: https://www.coincheckup.com They researched and analyzed every tradable coin out there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very useful article and reccomendations! Thanks)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great Article. I have found a similar article written by a successful investor about how to gain from ico. It may help you to make a decision Take a look : https://steemit.com/crypto/@bijeeshtk/how-i-made-566-gains-by-investing-in-icos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit