I have been active in crypto since September 2017 and this time was enough to make me give up almost any notions about people's rationality in this space. What I have seen was pure behavioral finance filled with FOMO, FUD, colourful marketing campaigns generating tens of millions of dollars and humans behaving more like monkeys than intelligent or innovative investors. I think it is time to try to bring some rationality into investing in crypto and especially in ICOs. Cannot say that I'm a super-duper professional to do this 100% right (still just a big irrational monkey) but I want at least to try.

It goes from my heart, so let's see where we will come.

The number 1 issue I want to address is Tokenomics.

Definition

It is an ecosystem built around a utility token, participating which users can get certain benefits, rewards or get punished.

In other words, users obtain a utility token and utilize it in a number of ways in order to achieve a certain outcome, which, when iterated many times, results in forming of persistent behavioral patterns.

All about incentivizing people for a particular behavior.

This is tokenomics.

Why is this so important for crypto?

Because no matter how great and successful the business idea, the team, advisors, the implementation of a project are, if there is no sound token utility, in the long term the value of the project's token will go down. If you buy tokens and instantly want to use the product - it's fine. But if you buy it as an investment and hope that you will sell it after the price increases (I'm sure >90% people do exactly this) BEWARE as you don't buy shares of the company, which give you a portion of profits, you don't buy bonds, which give you fixed income, you buy a UTILITY TOKEN, which is supposed to be used in the project's ecosystem and if it is not, there will be no demand other than speculation, which is unstable and shaky.

What is the scope of the problem?

Well, “A recent article from Bloomberg reported that of 226 ICOs and token sales analyzed, only 20 of the corresponding tokens were actually used in the running of their networks, demonstrating utility of some sort – that’s less than 10 percent” [1].

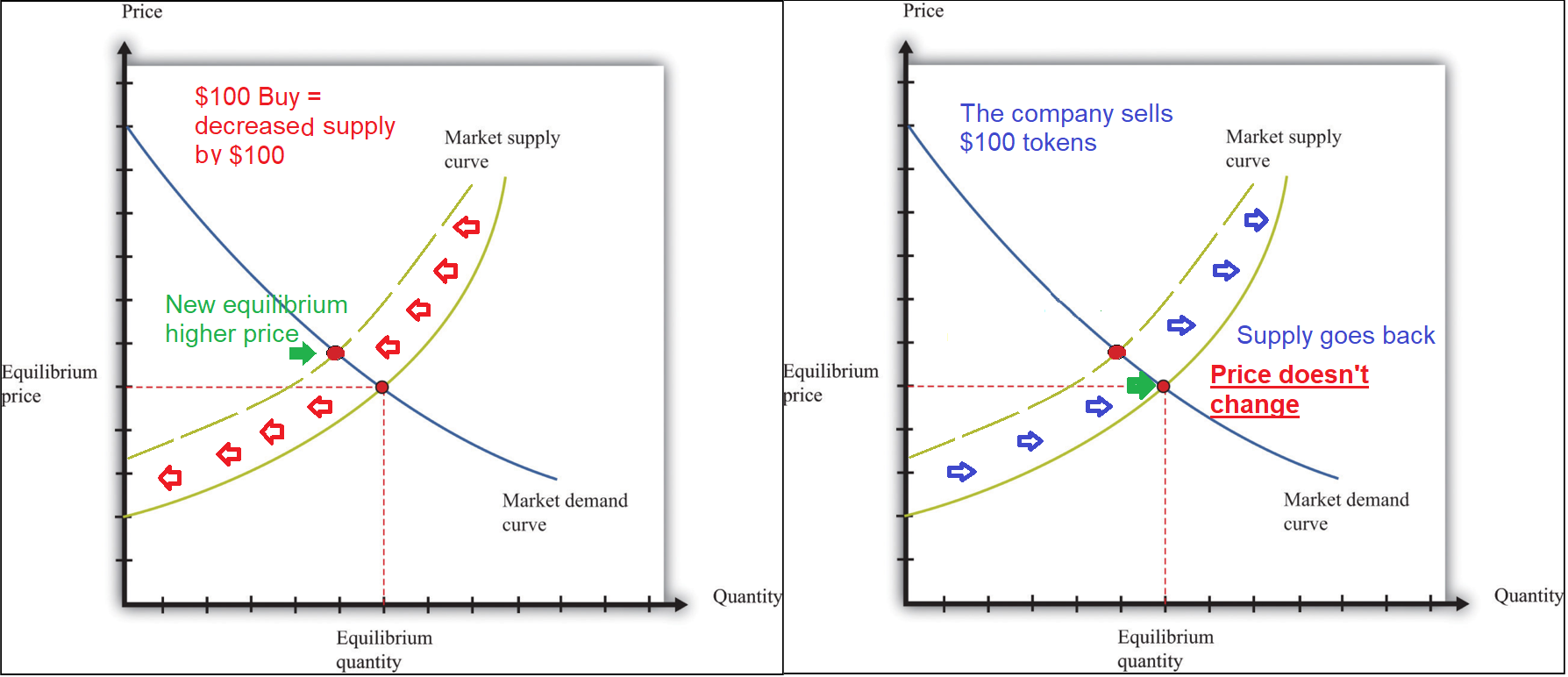

Moreover, just demand is not enough for increasing the value of the token. Let's say we are in the demand/supply equilibrium. If someone buys tokens for $100 just to instantly use the product, he or she takes them out of supply only for a short period of time. Because what will the company do after it receives tokens for its service and cannot use it in any way other than purchasing its own products? It sells them, returning tokens back into supply, and thus pushing the price back down = no price increase for investors.

What to do if you are a long-term investor then?

Look for developed tokenomics (ways of using the tokens), which in one or another way incentivize to HODL tokens.

Why hold? Because, in this case, if somebody buys $100 of tokens he or she will take them out of supply. Thus, the next buyer will have to set higher price to incentivize holders become sellers. However, the stronger stimulus to hold is, the higher the new price needs to be.

How to create such stimulus? To provide token holders with benefits and rewards for holding the tokens. Some examples are:

- A company can offer even more tokens for holding of tokens.

- Discounts based on the number/time of tokens holding

- Rights or additional benefits depending on the time/number of tokens

There can be many combinations and additions to the above. The blockchain and crypto are such innovative things because they allow not only the possibility of reducing middlemen but also, they allow to create new and unique tokenomics ecosystems, which can completely change the way companies interact with their customers. In a business model with a sound token ecosystem, user experience goes beyond just consumption of the product and involves him or her into the further interaction with the platform.

And of course, for the investors it would mean that with the increasing number of users, who hold, the token price goes higher and higher, compensating early supporters for their faith and patience.

If you are a long-term investor, look for the incentives to hold.

Hope that you have found my thoughts useful in any way.

“If you are not willing to own crypto for 10 years, don’t even think about owning it for 10 minutes.” - Crypto Warren Buffet

.png)

I’m just starting to write such short articles, so feel free to leave your opinions and feedback in the comments. I will be happy to hear it out!

The next article will, probably, be about fundamentals of Dogecoin. Don’t hurry to write it off as a childish topic, it is more interesting then you think!

My Twitter: https://twitter.com/IvKrll

My Telegram announcement channel: https://t.me/sellthehype_ANN

In case you want to support or tip me:

Bitcoin: 1KTmAWQ5cjKVjhVCjum73mKtWQqiSny5gu

Ethereum: 0x1e7F481Ad51cb706f8DaDe68BB2e94CB651D4724

Doge: DEphBHAxTEr6aQUySErLxojPiCNozjgWbj

Sources:

Congratulations @sellthehype! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit