With my first article on Steemit, i presented you the reason behind the current and future on going bullishness in the crypto space and its stellar drive up. It is the rising world debt level.

Today i will go one layer deeper and show you why the central banks printed so much money in the last decade. The rising debt in china and also in almost any country on this planet has a profound source.

It´s about the GROWTH of our economies, whether we speak about the industrial or the emerging economies. No economy on earth really had a sound growth after the epic mortgage crash in the US Housing markets of 2008/09. To make clear, that printing money does not create growth, central banks are believing in this lie.

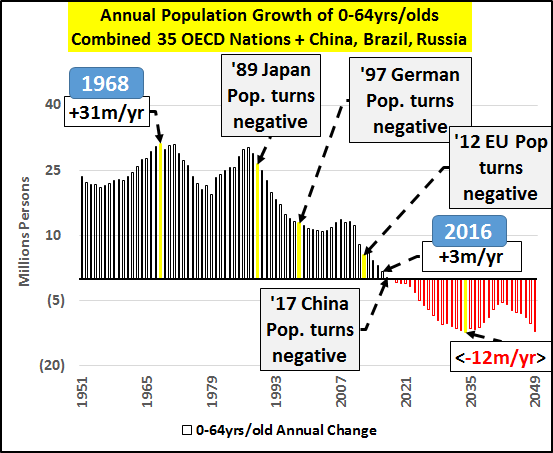

This chart shows you what´s really going on. The populations of the world are overaged and THE DRIVER OF WORLD GROWTH CHINA has turned too. Since 2017 the chinese population is now an overaged one either. You can see why the communist government has ended its 1-child policy in 2015. That was way to late.

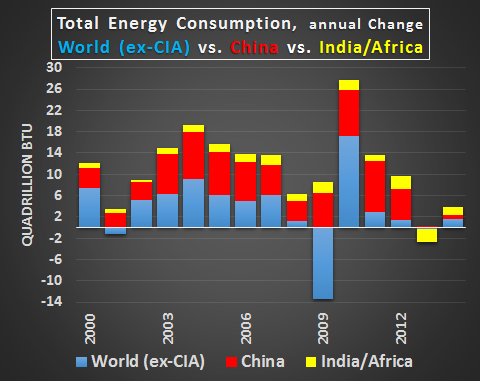

The Chinese were the main driver of global growth for a very long time. Thats long gone. Total Energy Consumption is a very good and reliable indicator for that.

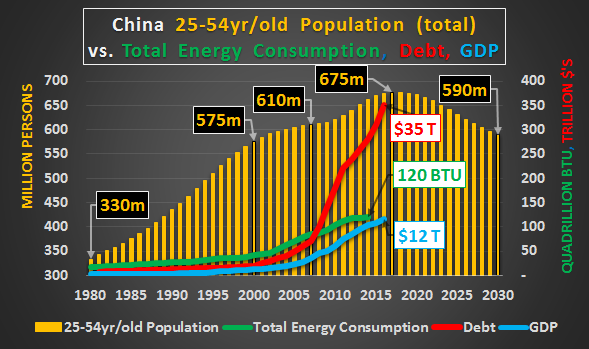

With a rapidly core population growth decelerating, they rely more and more on debt fuled growth. But as you clearly can see, printing money is not growth. It´s holding a reached GDP Level at all.

The PBOC just made the same errors as the western central banks. Maybe they should have read some books of Ludwig von Mises or other Austrian Economics :-)

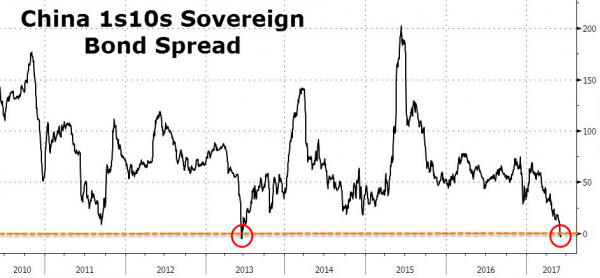

So we come to the current issues on the markets. We have again the most inverted yield curve in chineses bond spreads in history, more than in June 2013, when an unprecedented cash crunch jolted Chinese markets and nearly brought the nation’s financial system to its knees.

For me this looks like a liquidity crunch. If you are the first to panic, its not a panic :-), just need to be the first. ^^

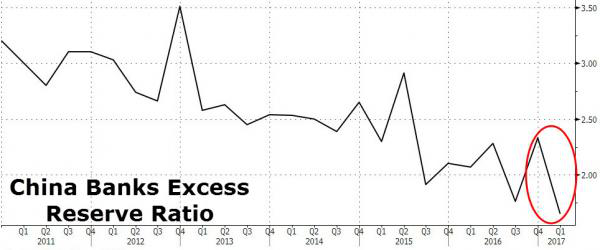

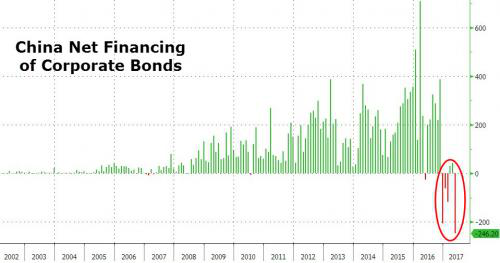

Do you think it can not get worse? Ha Look at this two charts ->

The chinese monetary money base M2 is contracting to a record low and new debt via corporate bonds is not issued anymore. Is all this debt printing coming to an end???

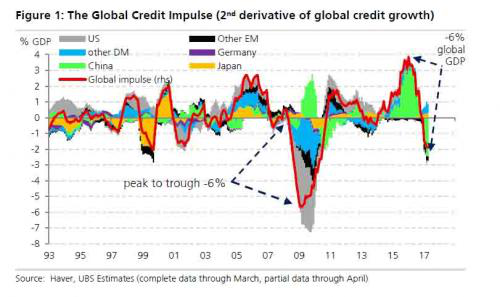

I don´t think so, because the global credit impulse is crashing immensly and...

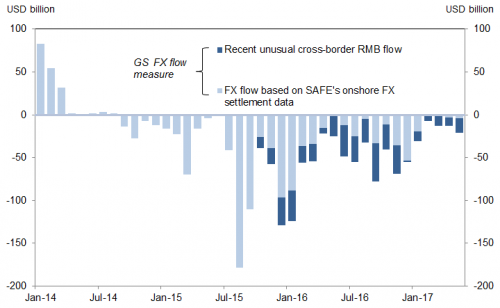

Capital Outflows are very bad and accelerating again.

For me as a veteran trader i only can expect one from the communist rulers.

PRINT MORE, PRINT MORE, PRINT MORE!!!!

If they don´t print another TRILLION DOLLARS very very soon, the music will stop and the party will end. Be the one who leaves the party just in time.

So nothing more to say, as

BE AWARE AND TRADE ACCORDINGLY.

Yours

Simon the Ravager

- Dasheroni & Anarcho-Capitalist

http://www.zerohedge.com/news/2017-02-16/global-economic-growth-all-about-china-nothing-china

http://www.zerohedge.com/news/2017-06-13/china-yield-curve-inversion-deepens-liquidity-fears-rise

Thank you for sharing this, following you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ty awesome, i hope you like my new article too https://steemit.com/cryptocurrency/@simontheravager/ico-value-analysis-part-1-quantitative-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the good information!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. Thanks very much. China, Russia and Japan, along with other Asian nations like, Vietnam, Thailand and South Korea are going to be huge drivers of the new blockchain era! Great graphs btw.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely, south korea is coming and getting massive into cryptocurrency. Just in the last 24h the volume for won in DASH exploded

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Truth! Thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit