Lessons from the 2017-18 Crypto Boom

The cryptomania that took the world by storm in late 2017 came out of nowhere. Everyone has a story of how they, or someone they knew, were here or there and should have been millionaires. There is an old saying, ‘when the bell boy is giving you stock tips, sell’. That rang very true in the 2017-18 boom. All my friends previously knew nothing about investing, and now they were financial advisors overnight. Of course, that all ended quickly. Most of my friends are now lucky to have lost no money, but unfortunately most did.

I have learnt a few things during this crash. Firstly, dumb money is fickle, and that probably explains the large volatility in the crypto markets. The second was to never listen to the bell boy, instead let the bellboy have all the short-term sugar hits of an overinflated market.

In retrospect, the overall psychology of the market was very simple. Investors from all over the world saw an opportunity to get-rich-quick. The crazy overnight millionaire stories were broadcast all around the world, and they were irresistible. They were sold on the jargon of what was quite a complex idea. Notice that I didn’t say ‘product’ or ‘company’, although many believed that they had invested in one. A perfect example of this was when I asked my friends what this Ripple thing was that they invested in. I received a pitch about this great company that was signing major partnership deals and solving the problem of slow international money transfers for major financial institutions. I quickly discovered that my friends didn’t invest in this great company, although they thought they had, and they probably didn’t care as the price of Ripple began to skyrocket. I found that this Ripple token that they had invested in was not required to be used by the company’s partners and was most likely a great marketing side-product.

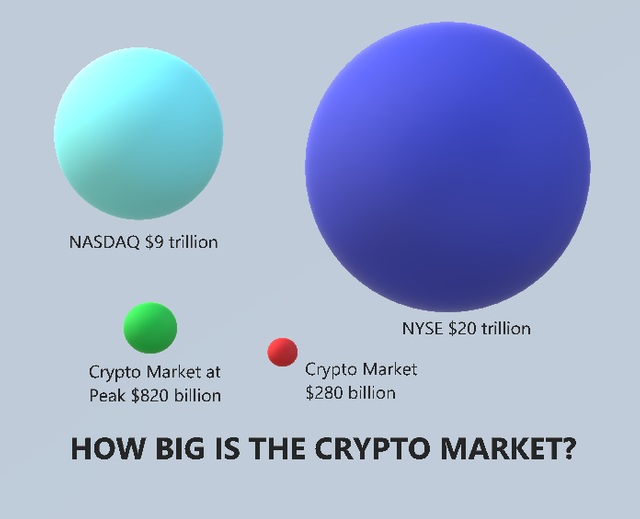

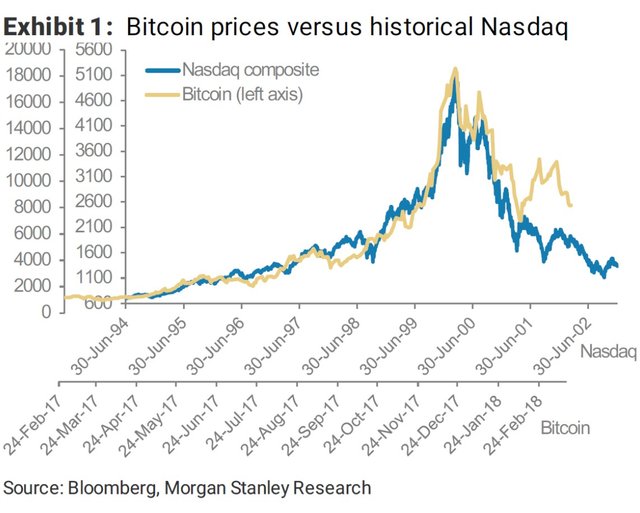

Before the boom, most crypto holders had zero investing experience, and would likely equate investing to gambling. But none the less, these investing juveniles were undeterred and found it all too easy to turn their hard-earned cash into digital tokens. For a while there these investors were kings. They had finally found out how to break the wealth gap and get-rich-quick, or so they thought. A few weeks into January the greater fool theory had run out of luck. Unexperienced investors who didn’t do their homework panicked. They had begun to realise just how speculative their bets were. And as is all too common with unexperienced investors, they bought high and sold low. Now toward the end of this great boom and bust the crypto market cap has now shed 70% of its market cap from its peak. Interestingly, this is like the dot-com bubble that shed 78% of its market cap from its peak.

There are a few things that the crypto community needs to take from the 2017-18 boom and bust. The first is that we need to recognise that a lot of people were hurt financially by this big crash, and that this could happen again. We need to work on mitigating this risk. The second is that there are a lot of highly-risky and mostly outright fraudulent pyramid schemes operating in this space. These products are not suited for unsophisticated investors, of which most of the crypto community comprises of. As a community we need to be more prudent in calling out these get-rich-quick schemes when and where they pop up.

I wanted to stipulate my sentiments about the market before I started telling you about all the good stuff. It is important that we are balanced in our optimism toward the space, and that we are honest about the short-comings that many pessimists often point to. What I have just discussed explains the general eye-brow raising from those who are considered professionals in the investment space. If we want cryptocurrencies to be treated seriously in the future, then we need to be more honest about the many and quite major short-comings. Without further a ado, lets take a look at some of the things that are holding back the macro crypto environment from another fantastic run.

Regulation

Regulation has undoubtedly been one of the biggest setbacks this year. In February of this year, the SEC met to discuss the future of cryptocurrencies. One of the many positives of that hearing, which was almost not discussed at all, was the general optimism the SEC had for the application of cryptocurrencies. There wasn’t a fearful tone. They seemed to really want to find a way to safely emancipate this new asset class into the American financial system. Almost six months on from that meeting however and we still don’t have a regulatory framework. There is no need to panic though, as good regulation will take time, and many other countries (like Malta) have taken steps of their own to try and claim the crown as the capital of cryptos.

But why does having a sound regulatory framework matter? After all, cryptos were originally an anti-government project. Institutional funds have guidelines for their investing practices that they agree to with their investors. This means that they can invest in assets that meet these standards that their investors have agreed to. For example, one of the clauses might require the fund to only invest in countries with an AAA credit rating. Or in some cases the funds will only be permitted to invest in companies in a certain indexes. Investment fund managers have a fiduciary responsibility to invest in assets that are clearly defined by the legal system. In the crypto case, it is extremely irresponsible for invest managers to invest in cryptos as there is too much ambiguity about how the new asset class might be treated by regulators. To explain this ambiguity further, some of the cryptos are currencies (i.e. Bitcoin), some of them are platforms (Cardano, Ethereum, Tron), some are equities (i.e. Modum), and others are purely venture capital. All these asset classes have their own set of regulations and treatments, and some have aspects of all but are not the same as any. The SEC and other regulatory bodies around the world are trying to define these assets.

Another potential pitfall for the regulatory environment is the conflict of interest of the SEC in preserving the structure of the traditional financial and economic system and uprooting an existing structure. Just imagine the threats to governments around the world that a fully functioning third-generation cryptocurrency might pose. Tax-avoidance, black-market transactions, regulatory loop-holes, money laundering, terrorism financing… There is a whole laundry list of problems that a legitimized crypto currency system could pose. Not to mention the pressure that a fully functioning currency could have on the hegemony of the US dollar. Considering the real threat to governments that completely distributed networks could have, you might then think it unlikely for cryptocurrencies to reach a successful stage without bringing the governments on board too. Again, these problems come down to the libertarian nature of these projects, and a lot of these anti-government consequences were entirely intended.

Let me just iterate again, institutions need these cryptos legally defined into asset classes and the SEC needs to create legislation that isn’t going to create problems down the track.

Security Implications

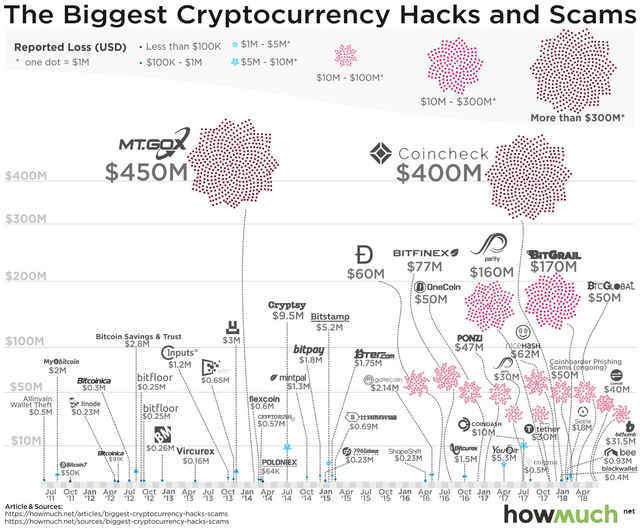

How many hacks have you heard of in the past month alone? In June, $71.5 million was stolen from both the Bithump and Cointrail hacks. It appears most market dips involve an explanation along the lines of an exchange being hacked. I want you to have a look at this great graphic produced by howmuch.net.

As you can imagine this gives serious investors, particularly those managing other people’s money, cold feet. This trend has started from the Mt Gox hack, where approximately $420 million was lost from what was the largest exchange at the time. I’ll beg the question, could a lot of these ‘hacks’ covers for insolvent exchanges and their inability to manage their customer's funds?

These security implications relate to the third-party risks involved in storing your funds with an exchange. Ironically cryptocurrencies were designed to eliminate the middle-man. However, a lot of people prefer a trusted third-party to store their funds with.

If we look holistically at the cost of these hacks, then it is easy to see that they are quite a small problem money wise. In saying this, the hacks need to be tampered down in the future if we want another cryptocurrency boom. Even though hackers might take small funds in comparison to the overall market cap from no-name exchanges, the bad press is a killer and creates a lot of angst amongst investors and prospective investors.

Illegal Activity

Bitcoin was made famous through the Silk Road. In fact, you will notice that the early booms with the first-generation crypto were in tandem with its rise. The major problem with this is that it gives cryptocurrencies a dirty name. A lot of professional or ethically focused investors tend to not want to be associated with such things. For this reason, Bitcoin has probably done more harm than good. Satoshi Nakamoto tried to dissuade silk-road and other platforms from adopting Bitcoin back in the early days. He figured that being associated with illegal activity early on in the development would only hinder the reputation and prospects of the technology.

The major issue here is how do you secure the integrity of a transaction and keep the anonymity of the user. There seems to be a trade off at play between the privacy of the platform and the integrity. The rampant use of cryptocurrencies in illegal activities gives the projects a dirty name, one that it needs to shake if it wants to become mainstream and global. So far, I understand that Charles Hoskinson is trying to work on an innovative solution to this problem for the Cardano platform.

Pump and Dump Schemes & Reporting Requirements

The Crypto community needs to collaborate to crack down on pump and dump schemes and dumb money schemes. By dumb money schemes I mean schemes that may not intend to rip investors off but are essentially doing just that by taking advantage of the immaturity and easy money within the market.

The good news is that a lot of these schemes have already started to filter themselves out, with over 1000 coins essentially hitting zero this year. I think that the community needs to look to exchanges and websites such as coinmarketcap.com, who can act as gatekeepers and ward off many of these scams. This would be a standard procedure, as most stock-exchanges around the world have codes of conduct that all listed companies must adhere to.

Binance is best situated to play this role, and in so doing they could cement themselves into the wider crypto market. As a part of the code of conduct they would need to stipulate a set of basic but crucial reporting requirements that can help investors. As a side note, reporting requirements would reduce the volatility in the market, as they would provide fundamental indicators that are currently absent from the crypto space.

Just remember that no middleman currency shouldn’t mean no rules. It is up to the community to self-regulate and enforce a sensible code of conduct, of which these gatekeepers have the power to do.

Can all of this happen?

Sometimes I feel as though I can’t see the world changing. That I can’t see a world where we put our life-savings into a blockchain and pay for our groceries in Bitcoin. But as I get deeper and deeper into the blockchain technology and many of the pioneers in the crypto space, I just can’t see this failing. In some form or other cryptocurrencies are here to stay.

I will always remember a Newsweek article from 1995 titled, “Why The Web Won't Be Nirvana”. In it the author Clifford Stoll describes the chaotic mess that was then the Internet. He reiterates in objection the many optimists of the day claiming that the internet will move malls, libraries and media into the modems. I sympathise with Stoll’s pessimism of the day. In a lot of ways, he was right, the internet was a mess, and it sure as hell wasn’t in a place at the time to change the world. Obviously, Stoll couldn’t have been more wrong in the end. Over 20 years on and we live in a world that is built around the Internet, and it is arguably the greatest invention of all time.

However, we need to consider the time frame in which that change happened. The Internet boom really took off five years after Stoll’s article. It took a long time for the ‘I told you so’s to come his way. If cryptos are anything like the Internet (which they have been so far) then the next boom and mass adoption might not come around by Christmas.

Here is what I want to see happen in the future:

o The SEC define cryptocurrencies into an established asset class.

o Exchanges such as NASDAQ or the NYSE accept trading of certain cryptocurrencies.

o A framework for reporting requirements and best practices is established.

- (This could be done without the involvement of government as plenty of industries self-regulate with best practices organisational and industrial bodies.)

‘The best holding period is forever.'

- Warren Buffet

✅ @slaviev, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ru

Приветствую. Представляю студию блокчейн-копирайтинга. Предлагаю наши услуги по написанию WhitePaper, созданию видеороликов , написанию уникальных статей и обзоров (в том числе для steemit), переводов. Огромный опыт и большой штат сотрудников. Списко наших услуг и портфолио в нашем телеграм канале или на сайте.

En

Hello everyone! I present to you our blockchain copywriting studio. We propose to you next services: writing WhitePaper, creating videos, , translations, writing unique articles and reviews (Including for steemit). Extensive experience and highly qualified team. List of services and portforlio in our telegram channel or on our website.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit