*disclaimer: The below is not meant for financial advice, its only my start into an exciting new world and is aimed at people that are new to cryptocurrencies.

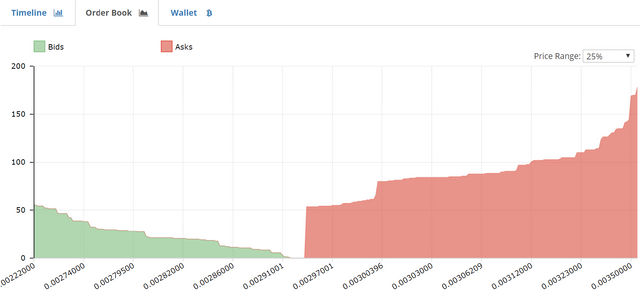

As I write this, I'm glued to the buy vs sell volume charts on the other half of the screen anxiously awaiting the next big high around the corner... This time its Monaco card (MCO) and its about to be listed on a new exchange - BINANCE . The slack channel is going crazy with others that are equally anxious, equally hopeful as to the direction it is going to take. These aren't just a few dollars on the line for most, its blissful futures, houses, flash cars. There's a 62 bitcoin wall ahead, a whale holding back the price (?), manipulating the market and keeping everyone at the gates ready to release them as the currency could potentially make a similar bullrun to the 400% gains in an hour seen the week earlier. Others think the new Exchange listing is going to cause a dump of the coin. Either way, I know my plan, HODL....

But I'm getting ahead of myself. Three months ago I wouldn't have known what 90% of those terms even meant. I was sat at work, off the coast of West Africa on a vessel doing construction operations. My shift supervisor was telling me about the 'next big thing' as they so often do. "Ethereum, its the future","blockchain", "Smart contracts"... He could have been speaking Russian. However, what really captured my attention were the returns. Everyday for two to three weeks he would walk in with a smile and announce the previous days earnings. He started with a $500 investment and was soon at $1500. Of course, the internet wasn't good enough offshore to sign up whilst I was on the vessel, so the minute I was on land I started to navigate the daunting world of crypto. What I couldn't understand to begin with was how much of a pain in the a$$ it would be to buy in. I eventually found somewhere (that somewhere I now understand to be selling at an absolute premium!) and jumped on the ETH train at a price of $78. The next two weeks were insane for me: I watched as my balance quadrupled - telling just about everyone I could about it in the process! Naturally, all the family and friends screamed to cash out. Afterall, "this is a bubble" they said, "what can you do with the cryptocurrency anyway, its not like you can spend it". But I was now captured by cryptocurrency, I couldn't (or rather didn't want to) get out. Ethereum (ETH) was up over 4000% in the year, Bitcoin (BTC) 400%, you get the idea. 200% gains in a day weren't uncommon. This isn't the 1-2% of traditional stock markets. I was now reading about the blockchain and how it was going to change the world as we know it. But don't take my word for it, try having a listen to the below TED talk:

https://www.ted.com/talks/don_tapscott_how_the_blockchain_is_changing_money_and_business

The first lesson I learnt was that in some ways my family were right, the world of cryptocurrency, despite being 8 years old, is still in its infancy and there are some teething problems. Before long, there was a market correction, during which Ethereum (ETH) happened to have a succession of ICO's (initial coin offerings). These are essentially cryptocurrencies version of a kickstarter campaign, only you get access to the companies coin at the end. Each of these coins have a completely different function. They are generally run from the Ethereum Network and at this time were gathering serious momentum... In this new world, rather than going to banks or VC's, companies could conduct ICO's and all they needed was an idea, a white paper and a wallet to store the coins. They are completely unregulated and were instantly creating hundred million dollar companies. The issue; the ICO's were funded with ETH and once the ICO's were complete those same companies were cashing in the ETH for dollars. This was putting huge strain on the ETH network. This is exactly what happened as I came to withdraw my now 4x profits from the money I had made on the ETH rise from $78 to $410. Bancors $150 million ICO had completely locked up the network. People were panicking and trying to cash out. Just as quickly as I had watched in amazement as my balance had gone up, it was now utter despair as it was going down and there was nothing I could do to withdraw. When I did eventually get out, I did so via the same source that I had initially got in with and ultimately sold them my Bitcoin at a very poor price. All in all, I had doubled my money and got out. I was happy and I weren't going back in...

.....until I heard about Monaco Card and this time I was drawn deeper into the cryptoworld. At this point I found the Lykke app - a much cheaper/easier way to buy/sell Bitcoin, but Monaco aimed to go one step further.

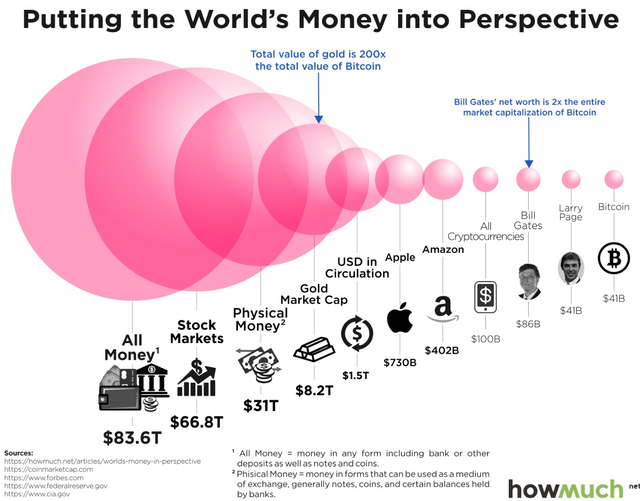

Their marketing and their message captured me. They were trying to solve a real issue, the issue of spending cryptocurrencies through the use of a debit card. Furthermore they weren't crypto currency guys trying to break into the 'real world' like their TenX competition, they were Fintech guys in cryptocurrency world. This matters. Why? Because the market capacity of cryptocurrency is still tiny in real world terms and they aim to bring it to the mass market with an easy and cost effective way of investing/spending coins. The team have experience with major corporations and players like Visa. Whilst it can often feel like you're in a sea of money in crypto and you're playing with amounts you have never been used to, the truth is cryptocurrency isn't even a blip on the map yet.

This is ultimately great news, for with time the market capacity will grow (it has already grown by 50% since I have been invested) and in turn, so should the value of a lot of the coins.

So, back to Monaco... being Fintech guys in a new cryptocurrency world, they made some mistakes at the ICO start-up and it led to many people screaming 'Scam'. I soon learnt that this is common practice throughout the cryptoverse and that people were naturally weary, even after the Monaco team had addressed the concerns. See, in this new world the rulers aren't wall street traders or bankers dotting the i's and crossing the t's on every trade - they're students, web designers, teachers, just regular folk like you and me. As such it can be like the wild west out there and this is where I found the community side to this story. I joined the Monaco Slack channel (essentially a thread conversation for a company with other 'investors' aka MCO coin holders).

In this slack channel you come across people from all walks of life and seriously different financial backgrounds. From students that have turned £1000 into £100,000, to new starters starting out with a few hundred dollars, to multi-millionaires. The common glue that holds these people together is their passion for the project in which they are invested but more importantly their willingness to help each other out in trying to make money. Experienced traders commonly give advice on reading the charts and upcoming buys/sells. Millionaires help out breaking through sell walls and pushing up the price and people give trade advice on good upcoming coin investments. The kicker to all this is that in the slack channel is a direct line to the CEO of the company who regularly pops in to give updates and info and generally remain open to the community! This is the crazy new world that is ahead... A world not closed off by huge intermediary corporations, but instead open communities with common interests and an outlook to increase the wealth of all those involved. I was hooked and the rollercoaster had only just begun. You can't sleep at night for checking the slack and the charts, yet they say that crypto is the best coffee for the morning. You wake up with an instant excitement of what's around the corner.

Monaco didn't get off to the greatest of starts, I paid roughly $2 an MCO at the ICO stage. As it listed on the exchange it dropped to as low as $0.70. By this point I had learnt that you never sell at a loss and that when things go down (contrary to what your head tells you) you buy more if you believe in the project. I did exactly this, and have now reaped the rewards during one of the most exhilarating days I have ever experienced. Monaco went from $3 an MCO to $19 an MCO (albeit briefly) before settling around $11. I was at work at the time and easily could have cried at watching the computer screen. Other members of the group were equally excited and it really was excellent to see the celebrations all round. This was just the start, for the app launch is scheduled for just around the corner (31st August) and the passion and excitement of the Monaco team around unannounced features is detectable in the way the CEO talks about the project. I still believe Monaco is a massively undervalued company with a market cap of just under a third of that of TenX. If they were to obtain a similar market cap then each MCO would be worth a total of $40-$50.

Without going into too much detail, the MCO token works in a similar way to that of its competitors. 1% of all cryptocurrency spends of all users of the card will go into an asset contract that is spread amongst the MCO token holders. The big advantage that Monaco has here is that there a lot less MCO than TenX PAY tokens. The asset contract will increase in value the more people that have and use the card. The asset contract will therefore be an accumulation of the most popular cryptocurrencies being spent and any increase in their value will also increase the value of the asset contract. Users can chose to 'burn' the MCO tokens at any point in order to redeem their value. This will reduce the total number of MCO in circulation and in turn drive the price up. For more details, refer to the Monaco White paper.

Regardless of whether people are invested in TenX (PAY), Monaco (MCO) or Token (TKN), one thing is for sure, they will all provide a solution to common problem - spending cryptocurrency. Furthermore, they also provide an easy way for the mass market to invest in cryptocurrency and in-turn I think could open the floodgates to a whole new market. If this happens, new money will flow into the various blockchains at rates that have yet to be experienced. This is the missing link that has yet to be provided.

Of course the flipside of all of the above is the route most of the mainstream media have taken - that cryptocurrency is in a bubble and one that is about to pop at anytime. This could very well be true. Afterall, Bitcoin (the current 'daddy' of Crypto) is all based on speculation. An agreement of its worth. However, what currency isn't in reality? The media have been saying that bitcoin is in a bubble since its inception yet with each of its crashes it has grown more stable and more valuable... All I know is that this has been one exciting and profitable adventure so far and one I hope to continue. The times they are a changing...

@smithappens Thank you for this! I am brand spankin' new into the crypto world and it has been super exciting to learn about. I have been doing some research on the different cryptocurrencies, but I haven't been able to figure out how to buy in. You mentioned that you also had a hard time figuring it out. What was the site you used to buy into the market? Thanks! I'm shooting you a follow :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi mate. I hope its as prosperous for you as it has been for me so far. Buying into BTC totally depends on where you are in the world. Eg, most of the US users use coinbase. I'm from the UK and use the Lykke app (highly recommended). Just remember to look around at the spreads (how much you are buying for vs how much you are selling for). Coinbase and Lykke both have very good rates I find. Coincorner and quickbitcoin were what I was initially using and these spreads were MUCH higher (£100+).

Again, this is something Monaco aim to address making it easy for newcomers to the crypto world.

Finally, if you're new then I highly recommend getting Slack and joining a few slack channels of coins you're interested in. I have found it invaluable for advice. I'm very bullish on MCO too as you can tell by the article, I still think it has strong gains ahead.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bittrex is likely your best bet for buying into alt coin market from BTC fyi.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great article! I am also holding some MCO. Incredible to see that Bill Gates is worth the total market cap of Bitcoin! Really puts into perspective the embryonic stage crypto is still in.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love it :) Crypto is so exciting sometimes but it can also take a toll on your body. Make sure you spend a healthy amount of time away from the computer and just buy something, set it and forget it. That works the best especially if you make sure you aren't buying into the hype. Buy after the graph has pretty much flat lined.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @smithappens! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit