Post by: @CryptoLanger

Coin Forks:

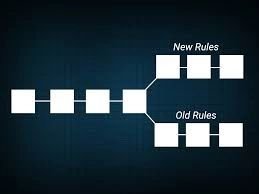

A Coin Fork is when a majority of Miners mining a coin see a need for change in a coin’s protocol. IF the majority of miners mining a coin can reach a consensus, they can do a direct Hard Fork from the current coin and create an “edited version” of that exact same coin. The reason for this is that once a coins protocol like Bitcoin was created, it can’t be changed. Some of these miners see a need for change in the current protocol in order to make the coin more functional, scalable, etc. Since they can’t change the protocol they have to create a new protocol directly off the old protocol.

Let’s use Bitcoin as an example. A Majority of miners found bitcoin became too costly in transactions and became harder to scale and they reached a majority consensus to create a new bitcoin protocol that met those demands. They then created Bitcoin Cash. This Bitcoin Cash coin came directly off the Bitcoin Protocol. Meaning; whoever held Bitcoin at that time received an equivalent amount of Bitcoin Cash via Airdrop in their wallets. A coin can have numerous forks; Bitcoin has Bitcoin Cash, Bitcoin Gold; to name a few.

A Coin fork is great to fix problems on an existing protocol and at the same time is great for somebody with a big bitcoin wallet. IF they were to be holding 1,000 BTC they would have been given 1,000 BCH for free. Which at its peak before this writing BCH sold for over $3,000 USD each.

Now just because a coin forks it doesn’t mean the old version of the coin goes away. They now act as two stand alone coins and its up to the community to decide which coins they prefer. IF over time everybody stopped using Bitcoin and went to Bitcoin cash; then one day Bitcoin Cash would eventually become the new Bitcoin. Much like, Ethereum Classic was the old version of Ethereum and the new version of Ethereum is now called Ethereum.

There is no limit as to how much a coin can be forked. The community will decide if they like the forked coin or dislike the forked coin.

The following is information from CoinTelegraph on Coin Forks in 2017:

Segregated Witness:

The cryptocurrency community as a whole grew increasingly frustrated with the issues plaguing the Bitcoin protocol and different solutions have been proposed over the past two years.

Segregated Witness grabbed headlines in 2017, proposing two-fold changes to the Bitcoin network. The soft-fork, in August 2017, cut a Bitcoin transaction data in two, moving the signature or ‘witness’ data to the end of the transaction, effectively reducing the size a transaction takes on a block which speeds up the network.

The second proposed change, which was ditched at the eleventh hour, is known as SegWit2x. This is a hard-fork, which would see block sizes increased from 1 mb to 2 mb to allow a greater number of transactions to be stored on the Blockchain.

Many of the original signatories of the New York Agreement, which comprised of the world’s largest exchanges, miners and wallets, weren’t comfortable with the hard fork coming so soon after SegWit’s activation. That led to the eventual postponement of SegWit2x.

Bitcoin Cash:

The decision to drop SegWit2x inevitably caused a rift between two parties. The ‘big blockers’ who were adamant that an increase in block size would further solve scalability, and ‘Core’ who strongly opposed the hard fork solution.

This led to the creation of Bitcoin Cash, which forked away from the original Bitcoin Blockchain on Aug. 1, 2017.

Bitcoin Cash has been the subject of much debate, as the literal fork has been mirrored by unending debates by parties for and against.

The likes of early Bitcoin investor Roger Ver maintains that Bitcoin Cash is the ‘real Bitcoin.’ saying it stays true to Satoshi Nakamoto’s original whitepaper.

Nevertheless, Bitcoin Cash is nearing six months of existence and fears of a pump and dump situation have subsided.

There are clear differences between the two cryptocurrencies, nevertheless it’s support on exchanges like Coinbase prove that the cryptocurrency is growing in popularity - even amid controversy of it’s launch on GDAX in December 2017.

It seems increasingly clear that Bitcoin Cash is here to stay and it’s survival could well end further debate of a proper SegWit2x revival on the Bitcoin Blockchain.

Bitcoin Gold champions the cause of the everyday mining enthusiast, who dreams of making a steady income mining cryptocurrency with high powered graphics cards (GPU). As their website states, Bitcoin Gold aims to making ‘Bitcoin mining decentralised again.’

By simply diverging from Bitcoin’s proof-of-work algorithm SHA256 to equihash, individual miners using GPUs can mine Bitcoin Gold easily, with mid-range GPUs. The fork took place in October 2017.

Bitcoin Diamond is another hard fork from the original Bitcoin Blockchain which took place in November 2017. Created by mining pools Team EVEY and Team 007, BCD will have a total of 210 mln tokens, 10 times as many as Bitcoin and Bitcoin Cash.

Bitcoin Diamond mining uses the X13 hashing algorithm, which favors mining using GPUs much like Bitcoin Gold, opposing ASIC miners needed to mine Bitcoin, which are expensive.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/forks-in-the-road-2017-bitcoin-forks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great information! Thank you for the good post! If you interested in Cryptocurrency and the trending news about, you more than welcome to check out my page @arnab1996 where I provide daily news on trending topics about Cryptocurrency! I WILL FOLLOW YOU BACK

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit