This is part one of what I intend to turn into a frequently updated resource on crypto-regulation. Each section will consist of collection and analysis of the whole body of regulations for a given region — from a government’s stance on security tokens, to its position on crypto as a medium of exchange, taxation policies, banking options, etc. — while also including historical context. My intention is that this will serve as a resource for:

1. Crypto startups beginning their regulatory arbitrage research.

2. Speculators looking for reliable information on the regulatory environment of the projects they’re speculating on.

3. Long-term crypto investors looking for insight into the evolution of government policy and how that may affect their holdings.

4. Locals looking to understand the crypto-related laws in their country and how their government is likely to craft future laws.

Introduction

Crypto regulation: Who cares?

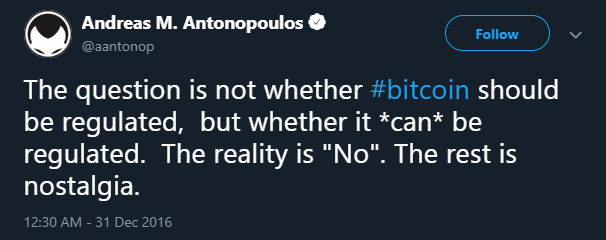

Particularly when it comes to crypto purely as sound money, I agree with the crypto-fundamentalists who argue that regulation is meaningless at best and dangerously misleading at worst. Bitcoin, after all, didn’t ask for permission and in many ways doesn’t need it:

Nevertheless, I decided to write this series because:

The regulatory decisions made by governments around the world provide fascinating insight into how they view the technology. For crypto-fundamentalists, this insight can provide warning of impending government crackdowns, clarity for how to circumvent government interference, and insight into the best places to live out a crypto-retirement.

Like it or not, the regulatory landscape influences the pace of growth and adoption of crypto. It also influences the type of crypto products that are introduced which, in turn, affects growth and adoption.

Regulatory arbitrage is real, and serious startups care about compliance.

What makes a crypto-friendly nation?

Lack of regulation can sometimes mean temporarily favorable conditions for crypto enthusiasts. Case in point: raising 18 million USD through an ICO subscribed by unaccredited investors, as Ethereum did in 2014. However, today’s “tolerant nations” (read: ignorant) could easily become tomorrow’s hardliners. When a country that at first appeared tolerant suddenly wakes up to a rapidly growing industry that it scarcely understands, the result is often a blanket-ban, as in China’s reaction to the ICO craze of 2017. For this reason, when evaluating crypto-friendly nations, the real test is to determine which governments have diligently considered the implications of their decisions, then crafted measured policies that we can expect will be long-lasting. Strong bias must be given to countries that have taken concrete action but, as it is still early days for crypto, official statements that strongly indicate a positive stance are enough for a nation to gain acceptance to the list of crypto friendly nations.

For this evaluation I will consider specifically a country’s:

1: regulatory stance

2: taxation policies

3: banking options

Part I

Singapore: traditional financial hub striving to be fintech incubator

History of crypto regulation in Singapore

Singapore, a city-state built on a swampy tropical island with no natural resources, has become a global financial hub with one of the highest standards of living in the world. Surrounded by much poorer countries and composed of three major ethnic groups, Singapore manages the tensions inherent in its diversity by strictly enforcing the rule of law. At the same time, Singapore embraces its diversity and fosters innovation through a transparent and collaborative democratic process.

Aiming to replicate its success in the traditional financial sector, Singapore is applying the same mix of openness and authority to the rapidly evolving fintech revolution — and that includes crypto.

In the last several years Singapore’s regulators have watched the industry closely. They have called for input, provided timely regulatory guidance, issued fair warnings to both consumers and businesses, and now, having weighed the scales, passed a forward-thinking regulatory framework.

On Jan 14, 2019 Singapore passed the long-anticipated Payment Services Bill, making it among the first in the world to introduce a regulatory framework for what it calls “digital payment token services.” The bill paves the way for cryptocurrencies to become a legitimate payment method and encourages the continued expansion of – thanks to the measured approach of the last few years - an already thriving blockchain industry.

The bill, which was called by ASEAN Today “the key to driving fintech growth across the island-nation” also incorporates six other payment service sectors (such as e-money issuance and point of sale terminals) within a single activity-based legislation.

The bill was the result of a collaborative process that started with an initial consultation undertaken in August 2016. A few months later, in November 2016, Singapore unveiled a regulatory sandbox that allowed fintech startups to operate under certain conditions for six months without any special licenses.

The Fintech Regulatory Sandbox Guidelines contained an introduction that illustrates the progressive attitude of lawmakers in Singapore:

“Singapore aims to grow a smart financial centre where innovation is pervasive and technology is used widely to enhance value, increase efficiency, manage risks better, create new opportunities and improve the lives of Singaporeans.

In circumstances where it is less clear whether a new financial service complies with legal and regulatory requirements, some…startups may err on the side of caution and choose not to implement it. This outcome is undesirable as promising innovations may be stifled and this may result in missed opportunities.”

Published by the Monetary Authority of Singapore (MAS), the city-state’s de facto central bank, the Sandbox Guidelines also emphasize the MAS’s strict role as top financial watchdog for banks, insurers, and asset managers, stating bluntly: “MAS will determine the specific legal and regulatory requirements which it is prepared to relax for each case.”

A quote from MAS Managing Director Ravi Menon in an Oct 2018 interview with Bloomberg sums up the thought process of financial regulators in Singapore: “There is an inherent tension in our policy objectives. It is how the two — regulation and promotion — work in concert to create an environment that promotes innovation while ensuring safety and public confidence.”

In that spirit, the MAS published an initial Guide to Digital Token Offerings in November 2017. Although not a legally binding document, it offered forward thinking regulatory guidance. Digital tokens were divided into three categories, each falling under different regulatory auspices.

Legal utility tokens make Singapore an ICO hotspot

Critically, so-called utility tokens — such as those used in exchange for decentralized computing services — would need hardly any regulations.

This was the green light that would allow Singapore to become a dominant hub for Initial Coin Offerings (ICOs) using utility tokens in their business model. In 2017, 25 such ICOs incorporated in Singapore, raising almost 500 million USD according to ICORating’s 2017 Annual Report. This made Singapore the number three location for ICOs in 2017 in terms of both number of projects and amount raised.

MAS Director Ravi Menon repeated the agency’s position in 2018, stating: “If they are not a security, then we don’t have a problem with it. We’ve seen quite a lot of ICO activity that is not security related. And there’s a lot of interesting business models out there trying to raise capital in interesting ways, which as far as the consumers are aware of what these are, we have no issues,” as reported by Bloomberg.

Thanks to that clarity, Singapore would remain a top destination for ICOs through 2018, moving into the number two spot with 160 projects raising slightly over 1 billion USD (in the United States, 1.2 billion USD was raised by 184 projects) also according to data from ICORating.

Security tokens strictly regulated

Security tokens — such as those used for an investment fund or any other business model with profit distribution — would have to comply with the applicable securities laws, which in the case of Singapore are the Securities and Futures Act (SFA) and the Financial Advisers Act (FAA).

When it became clear that some crypto projects were overstepping the bounds laid out in the MAS’s 2017 Guidance, the watchdog took swift action. In May 2018, the MAS issued a statement saying it had warned eight unnamed cryptocurrency exchanges that they shouldn’t facilitate trading in tokens that are securities or futures contracts without approval. In other words, Singapore based crypto exchanges could only trade utility tokens and payment tokens (like Bitcoin). In the statement, the MAS also mentioned that it had asked one ICO issuer to stop offering its digital tokens in Singapore because “its tokens represented equity ownership in a company and therefore would be considered as securities under the SFA.” Interestingly, the MAS did not impose fines on either the exchanges or the ICO issuer, and chose to keep the privacy of all involved parties intact.

In the Guide there were 11 detailed case studies to help crypto businesses decide if they would come under the regulatory burden of the MAS. In true democratic form, the MAS then called for further input and collaboration with an eye to drafting a legally binding bill. There was a November 2017 Consultation Paper for the proposed Payment Services Bill, then a feedback period, followed by a Response to Feedback Received Paper in November 2018 before the bill was finally read in the legislature in December 2018 and passed in January 2019.

Crypto exchanges flourish (without security tokens)

It should be noted that, despite not being able to trade in security tokens, crypto exchanges are thriving in Singapore. Among those establishing their presence in the country in 2018 were Tokyo-based Line Corp., Japan’s biggest messaging service, which started its Bitbox exchange in July and is currently seeing trading volumes amounting to more than 500 million USD per month according to crypto market analyst CoinGecko. Top 3 Korean crypto exchange also Upbit launched in Singapore in 2018 (in October), offering another trusted onramp from Singapore dollars to cryptocurrencies.

Payment tokens: recognized and regulated

For businesses dealing with payment tokens — such as Bitcoin — the MAS still hadn’t issued crystal clear regulatory guidance; that is until the Payment Services Bill was passed in January 2019.

The Bill introduces three classes of licenses for payment service providers: a money-changing licensee, a standard payment institution or a major payment institution. In line with its aim of encouraging innovation, any payment service provider below a specified transaction flow limit would be regulated more lightly. In the second reading of the Bill on Jan 14th, Minister For Education Ong Ye Kung stated, “We want to ensure that measures are not too onerous or stifling. That is why we adopted three classes of licenses.”

Specifically, to be eligible for the less burdensome regulations, a payment service provider is not allowed to have a monthly transaction volume exceeding 3 million SGD (2.2 million USD) for any one payment service, or 6 million SGD (4.4 million USD) in respect of two or more payment services, or a daily e-money float exceeding 5 million SGD (3.7 million USD).

Ye Kung added, “the regime mimics a ‘permanent sandbox’ environment to encourage innovation and enterprise.” In line with its hardline approach to money laundering, however, all providers of “digital payment token dealing or exchange services” will have to meet anti-money laundering and counter financing of terrorism (AML/CFT) requirements due to “the anonymous and borderless nature of the transactions they enable.”

As for personal payments, the bill initially sets a stock cap of 30,000 SGD (22,000 USD) and annual flow cap of 5,000 SGD (3,700 USD), meaning digital tokens effectively can’t be used for large purchases, at least in the retail payments space. Notably, these caps will not apply to merchant payment accounts that cater to business uses.

Security token offerings in Singapore: Stricter than the US and EU.

Moving back to the issuance and trading of security tokens, the MAS has indicated that such offerings are regulated as securities under the Securities and Futures Act, meaning issuance is subject to the filing and approval of a complete prospectus, capital requirements, and more. There are some potential exceptions to the full regulatory burden SFA, and they are as follows:

The STO does not exceed 5 million SGD (3.7 million USD) within any 12-month period;

The offering is made to no more than 50 persons within any 12-month period;

3.The STO is made to accredited investors only, or

- The STO is made to institutional investors only.

Notably, for all of the above exemptions, it is prohibited to publicly advertise the offering, and it is this critical point that marks Singapore as stricter than the US and EU. Proof of Singapore’s seriousness in this regard came in January 2019 when the MAS issued a cease and desist to an unnamed STO that had relied on the exemptions for their offering but had according to the MAS, “failed to comply with the advertising restriction when its legal advisers put out a LinkedIn post accessible to the public calling attention to the offer.”

By comparison, the US and EU both of which have exemptions for small offerings where the issuer is allowed to advertise to the public. Regulation D in the US contains a sub-regulation known as Regulation CF (Crowdfunding) that allows for a raise of up to 1 million USD from non-accredited investors and which permits advertising to the public. As for the EU, according to a Nov 2018 post from GateToBaltics — a group of corporate lawyers with almost 20 years’ experience specializing in company formation — individual EU member states may exempt offers where the total consideration does not exceed 8 million EUR.

Security token trading: difficult now but possibly a bright future

Although there are as yet no recognized or approved exchanges for the trading of securities tokens in Singapore, according to Cryptocurrency Lawyer and partner at Singapore law firm CPN Law Quek Li Fei, there “may be an emergence of STO Platforms in Singapore in the near future.”

The regulation of exchanges that handle securities in Singapore falls until the Recognized Market Operator (RMO) Regime, and currently the requirements for becoming an approved RMO are such that it’s virtually impossible for startups. Global private capital platform CapBridge, for instance, spent two years obtaining the appropriate license, and was only just approved to run its private securities exchange platform called 1exchange in November 2018. Interestingly, in an interview with Bitcoin Magazine, CEO and founder of CapBridge Johnson Chen said that when the exchange is more established with further protocols in place, it will offer various crypto-based services including the listing and trading of security tokens.

To its credit, Singapore’s regulators — with their vision of creating a fintech hub — have made an effort to accommodate the changes brought by the technological innovation that is blockchain. In May 2018 the MAS published its Review of the Recognized Market Operator Regime in light of “the emergence of new business models in trading platforms, including trading facilities that make use of blockchain technology, or platforms that allow peer-to-peer trading without the involvement of intermediaries.” In the review, the MAS proposed a three-tiered structure to facilitate ease of entry for new operators.

At the lowest tier, which is “designed to facilitate new entrants,” the capital requirements are proposed to be reduced to just 50,000 SGD (37,000 USD) with the application process based on self-certification and the review period by the MAS a maximum of only four weeks.

Just as with the Payment Services Bill, it is widely expected that the proposed changes found in the RMO consultation paper will eventually become law, meaning it will soon be much easier for operators to legally trade security tokens. Here again it appears Singapore is moving towards fulfilling its stated goal of making the nation a hotbed for financial innovation.

Taxation policies: Laissez-faire

Any company or individual using cryptocurrencies for purchases in Singapore is required to pay the 7% Goods and Services Tax (GST) on the value of the transaction, but does not incur additional taxes for using crypto as a medium of exchange. According to the Inland Revenue Authority of Singapore (IRAS), “businesses that accept virtual currencies as payment for goods or services should record the sale based on the open market value of the goods or services in Singapore dollars. The same applies for businesses which pay for goods or services using virtual currencies.” In other words, crypto can be used as medium of exchange just like the Singapore dollar.

Singapore is also a great place to hold crypto long-term. Capital gains tax does not apply to long-term investments into cryptocurrency as Singapore currently has no capital gains tax system in place. This means that businesses and individuals buying for long term investment will enjoy tax free capital gains on any profits made from the sale of digital currencies. However, if trading cryptocurrencies is your day job in Singapore, your earnings will be taxed as income under the nation’s progressive tax rate of between 0%-22% depending on your total annual income.

Banking options: tough but not impossible

The views of the Singapore banking sector on cryptocurrencies are mixed. In November of 2017 Singapore’s largest state-owned bank DBS called Bitcoin a “Ponzi scheme.” In 2017, at least 10 crypto businesses in Singapore reportedly had their bank accounts closed, including digital token wallet service CoinHako, which was shut out of DBS.

The challenge is that because all banks in Singapore are expected to comply with the customer due diligence requirements laid down by the MAS on preventing money laundering and the financing of terrorism, they are reluctant to deal with the, in the words of Ravi Menon, “indeed quite opaque” activities of crypto company. The MAS head has also been quoted as saying, “I would not blame the banks for not opening the bank accounts,” as reported by Bloomberg.

Recently, however, banks in Singapore appear to have taken a more positive outlook on crypto businesses. This could be in response to Menon’s attempt to smooth ties between crypto startups and the banking sector. He has publicly stated on the issue: “What we are trying to do is to bring the banks and cryptocurrency fintech startups together to see if there is some understanding they can reach.”

Behind the scenes, banks in Singapore — as in the rest of the world — understand and see the potential of blockchain technology and cryptocurrencies. Indeed, a consortium of banks (including DBS) have been working with the MAS since 2016 on a project to conduct inter-bank payments using blockchain technology. Their initial proof of concept has since evolved into Project Ubin. A 2017 report commissioned by Project Ubin consortium member Deloitte titled Project Ubin: SGD on Distributed Ledger lays out a case for “a tokenized form of the Singapore Dollar on a DLT” (distributed ledger technology) and declares “Singapore may be the first major financial centre in Asia to fully explore the benefits of DLT across a broad set of transformative applications.”

MAS and The Association of Banks in Singapore (ABS) announced in October 2017 that its initial proof of concept had completed phase two in which it had developed software prototypes of three different models for decentralised interbank payment and settlements with liquidity savings mechanisms.

Future outlook

The proposed changes to Singapore’s Recognized Market Operator regime give the green light for digital asset exchanges to thrive in Singapore. This will eventually include the issuance and trading of security tokens, opening the possibility of disrupting traditional asset exchanges.

The recently finalized Payment Services Bill legitimizes cryptocurrencies and provides a clear framework for their legal usage among businesses in Singapore. This could lead to a much wider adoption of cryptocurrencies in retail payments in Singapore, opening-up the possibility of competing against established intermediary-based payment services like GrabPay.

The major banks, having made efforts to understand and implement blockchain technology — and having been encouraged by the MAS to work with crypto companies — are less and less an obstacle to the growth of crypto businesses in Singapore. With the island-nation’s regulators’ efforts to encourage fintech startups in the hopes of creating a fintech-hub, the future of crypto seems bright in Singapore.

Hello @stonegraham! This is a friendly reminder that you can download Partiko today and start earning Steem easier than ever before!

Partiko is a fast and beautiful mobile app for Steem. You can login using your Steem account, browse, post, comment and upvote easily on your phone!

You can even earn up to 3,000 Partiko Points per day, and easily convert them into Steem token!

Download Partiko now using the link below to receive 1000 Points as bonus right away!

https://partiko.app/referral/partiko

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @stonegraham! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit