This is the first article in a series of posts which we hope will educate newcomers into the world of cryptocurrencies and arbitrage. Always remember that cryptocurrencies and arbitrage involve financial risk. We are not encouraging you to seek risk, however, if you are already interested in arbitrage this article may be worth a read.

Introduction

Greetings world, from SwyftEx! Thank you for taking the time to read this article on the profitable topic of arbitrage. What is arbitrage? Should I care? How can I profit from this? Hopefully, this article will provide more clarification for you all.

This article aims to help you familiarise yourself with a practice that has been exploited in the financial markets, black markets, in your local shopping area—basically, anywhere where there can be a sale of something of value at more than one place. Money managers, investors, traders on Wall street have been making billions from arbitrage. Understanding how arbitrage works and applying the strategy in your daily trading practices, will help you to put that extra (bit)coin into your wallet!

So, what is arbitrage?

Arbitrage is the practice of taking advantage of price discrepancies in something of value in a minimum of two markets or places of exchange. Profit is made through the simultaneous buying at a lower price and selling at a higher price. This opportunity can arise in a bull, bear and frozen (sideways moving) market. Arbitrage can also apply to anything with value from gold, silver, shares in a company (stocks) or even tomatoes, and yes, our favourite cryptocurrency!

We’re going to run through some simple examples of various forms of arbitrage practised from ancient to modern times. Please note these examples have been selected to give the average investor a conceptual understanding of how arbitrage trading works. Arbitrage can be a very complex trade strategy, involving multiple exchanges and currencies. Note that its real-time sensitive nature makes it only ideal for specific scenarios.

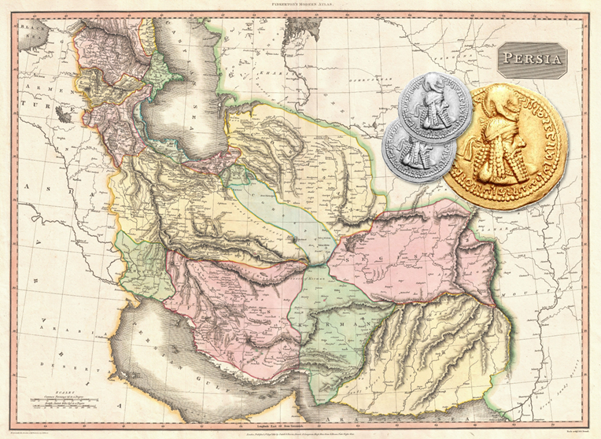

Back in the day in ancient Greece.

In the Athenian Empire, approximately in 500-400 BC, the coinage of gold and silver provided a stable and medium of exchange for items, food and land. This was a geographical adoption and was also taking place in Persia during the same period. In Persia, however, the value of silver was worth less with respect to gold compared its value in Greece.

International traders and merchants soon learned this. They realised that they could turn price differences in these precious metals into a profitable trade business that was in the form of arbitrage. From this concept, an export market of silver from Persia to Greece grew due to the arbitrage opportunity that existed.

Here are some numbers to clarify how it worked. Note that this is purely for demonstration purposes: the prices have been simplified.

In Greece:

• 5 Silver pieces = 1 Gold piece

In Persia:

• 10 Silver pieces = 1 Gold piece

In this scenario, traders in Greece would do the following to profit from the arbitrage opportunity:

• Buy 10 Silver for 1 Gold pieces (in Persia)

• Sell 10 Silver for 2 Gold pieces (back home in Greece)

• Profit = 100% or 1 piece of Gold :)

In reality, this process was obviously a lot more complex. For this arbitrage profit to be realised, the merchant would have to take into the consideration the cost of transportation of gold to Persia, the risk of getting robbed and other labour costs. So, the opportunity is not riskless, but, profitable if all went to plan.

Here at @SwyftEx, it’s not our way to paint everything with a rosy pink hue, nice as that may look. The stark reality is that arbitrage involves many of the same risks today as in ancient Greece, albeit in very different forms:

• Theft: criminals are actively seeking to steal cryptocurrency both from exchanges and wallets.

• Price fluctuations: the volatile market means prices may change significantly, within seconds.

• External costs: still need to pay for labour, but in other ways like transaction fees, electricity and hardware costs.

A modern example: across the Channel to France.

In the UK it is common, especially on a public holiday, to take a day trip to France. This usually involves either jumping on the Eurostar trains or taking the Ferry to Calais (I recommend taking the Ferry to see the white cliffs of Dover). It is also a common fact that alcohol is much cheaper in France compared to the UK. This is mainly due to a higher alcohol duty tax in the UK.

Now, suppose you wanted to treat yourself to a of bottle of wine while in France: what benefit exists compared to the purchase of the same bottle of wine in the UK? Let’s do the math!

Suppose that the FX (foreign exchange) rate from British pounds (GBP) to Euros (EUR) is 1.20 and the bottle of wine that you want to purchase costs £10 in the UK but EUR 10 in France.

• Cost of the bottle of wine in GBP is EUR 10/1.20 = £8.33

That is a saving of a whopping £1.67. Not much here, but consider that this works out to almost 17% saved. Imagine you bought 10 bottles, and you start getting the point. By purchasing in another domain, there is an opportunity to buy what you want at a cheaper price. This is a more trivial example of benefiting from a price discrepancy factoring in the FX rates.

Note that if you took the trip just to buy the bottle of wine, you’d be at a loss. The cost of travel would be greater than the saving. However, if you’re already lucky enough to be on holiday, why not pick up an extra bottle or two? Again, not everything is rose-tinted, but in the right scenario, opportunities can arise for the astute arbitrage seeker.

Equity markets: stocks and dual listings.

First, some background. If an investor wanted to invest in a company, an option to the investor would be to take ownership in that company’s stock. These stocks are listed on exchanges all over the world and just in the US, the equity market capitalization is in the trillions of dollars (USD). Some of these companies are sometimes listed on more than one exchange across the globe. This is known as a dual listing.

For example, let’s take BHP Billiton Limited (BHP). BHP is dual listed on the London Stock Exchange (LSE) and the Australian Securities Exchange (ASX). This means that although the stock is the same, the price is quoted in two different currencies, one in British pounds (GBP) and one in Australian dollars (AUD). Is there a possible arbitrage opportunity available when FX rates or prices become volatile? Yes, however, there is a FX risk involved.

Here are some numbers to give you an idea of how trading stock arbitrage works. Note that these numbers are not current market prices and are shown as an example so that the concept is understood. Suppose the FX rate for GBP/AUD is 1.70 and the price of BHP is 17 GBP on the LSE and 30 AUD on the ASX:

• Buy 10 BHP shares on the LSE for 289 AUD (17 GBP x 10 x 1.70)

• Sell 10 BHP shares on the ASX for 300 AUD

• Profit = 11 AUD or 11/1.70 = 6.47 GBP

Although 6.47 GBP may seem like a small number, if the number of shares in the trade is increased, the arbitrage profit also increases.

And finally, cryptocurrency!

We’re saving the best until last here. Yes, over the past few years cryptocurrency has taken over the world. The market capitalisation has increased from approximately 20 USD billion in January 2017 to over 830 USD billion in January 2018, and, all the way back down to 300 USD billion at the time of the post. Market moves have been driven by speculation and fear. These drive price movements and thus arbitrage opportunities appear. These opportunities exist not only due to the market moves, but also due to many of the exchanges being decentralized. Please note that the following setup is required before trading arbitrage in the cryptocurrency space:

• Live user accounts on multiple exchange (e.g. Kraken, Coinbase, Bittrex).

• Ownership of cryptocurrency or fiat on the exchanges for arbitrage trading.

Suppose, the crypto arbitrage trader noticed a price discrepancy on two exchanges such that the cost of 1 BTC (bitcoin) is 7440.00 USD on Kraken and 7054.57 USD on Coinbase. Is there an arbitrage opportunity? Yes, due to the price discrepancy. The trader will have to do the following to benefit from the opportunity:

• Buy BTC on Coinbase @ 7054.57 USD

• Sell BTC on Kraken @ 7440.00 USD

• Profit = 7440.00 – 7054.57 = 385.43 USD or 5.64%

Here, the trader will also have to take into consideration the time it takes to transfer BTC to Kraken before the sell execution and any associated fees from the sale and transfer. The fees will result in a reduced profit, and, due to the price volatility during the BTC transfer, may result in an increased or decreased profit. To minimize risk of price fluctuation you should look to minimize time between buying and selling. This is achieved by already having that 1 BTC ready to sell on Kraken, even before the arbitrage opportunity exists. This requires one to have the currencies at the ready, on multiple exchanges, ready to transact at a moment’s notice.

From these examples we hope that you can see that arbitrage opportunities exist everywhere. The concept is simple: buy low, sell high. Be ready for opportunities, don’t shuffle funds to chase opportunities: have them ready to go.

Here at @SwyftEx, we love data, tools and analysis. We’re currently developing a web platform called @ArbHunter, which helps to identify arbitrage opportunities in the crypto market. We’ll be looking to publicly release @ArbHunter soon, so stay tuned!

We hope this article has provided a gentle introduction to the world of arbitrage. If you’ve got any questions, suggestions for topics or otherwise, please leave a comment below, and we’ll do our best to respond!

In the upcoming articles, we’ll be exploring risks related to the cryptocurrency space.