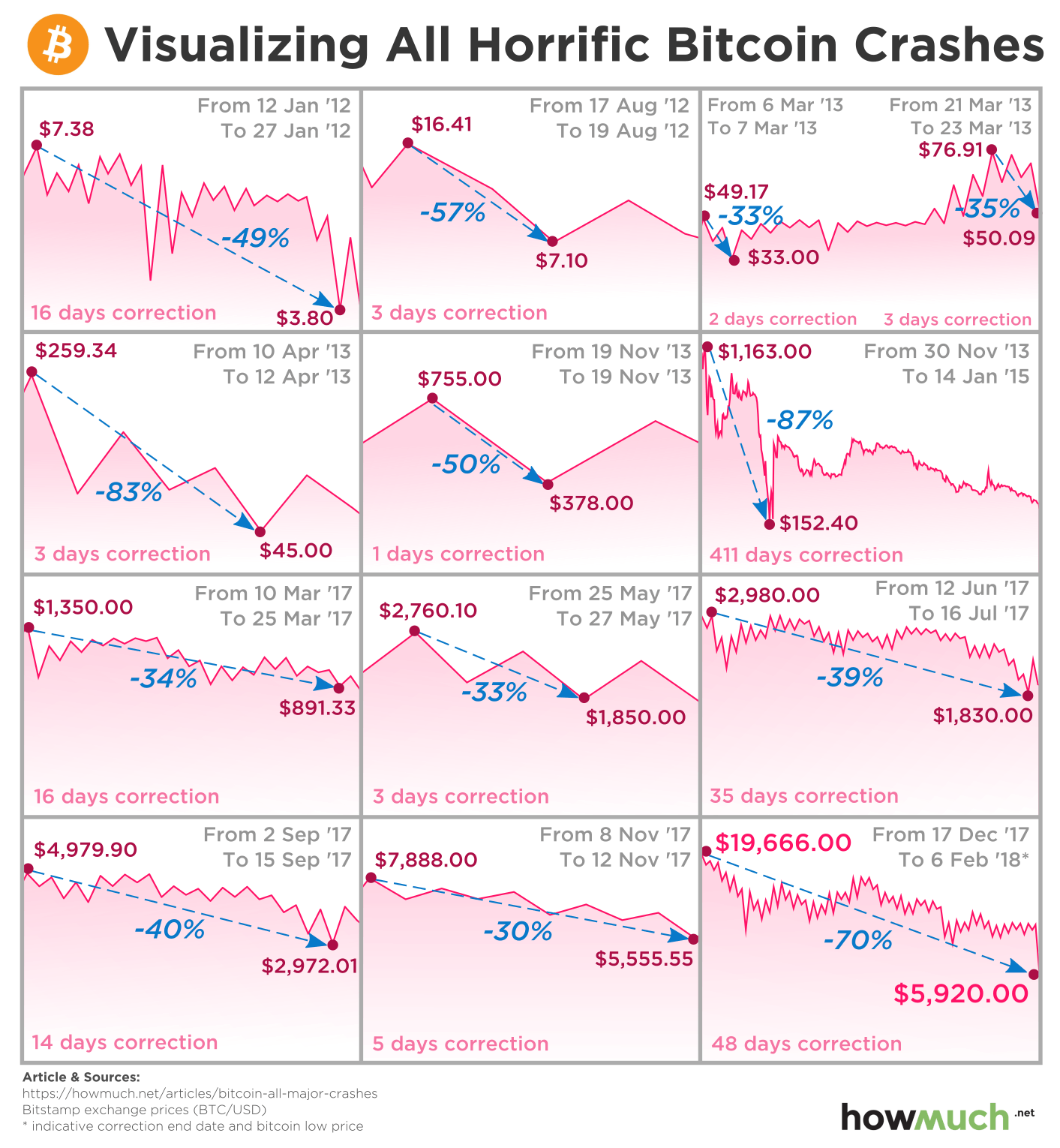

1. The cryptocurrency market has huge potential but is also very risky

Every time when there is a new disruptive technology it almost always comes with a bubble.

For example:

Although most people think of a bubble as something negative, this is not a bad thing as in this time awareness for the new technology is raised which is necessary for mass adoption and also a lot of money is pumped into the market making a lot of early adopters rich.

But during this time the market is mostly driven by speculation and holds next to gains also the risk of a crash and a bear market with people losing most of their investment.

We don’t know if we are still in the early beginning of a bubble, if it is about to pop, if it already popped or if it will ever pop. It’s just good to keep in mind that despite the hype about cryptocurrencies and their potential it is still a very risky investment.

![Screenshot-2018-3-5 6 861,29 [17 48] - NASDAQ Index Kurs, Chart News (A0AE1X US6311011026)_bearbeitet-1.jpg](https://steemitimages.com/640x0/https://steemitimages.com/DQmRoN3ygmACibgTUFYDuTkQ5LtQkd98WmF4zBuUbfQBT13/Screenshot-2018-3-5%206%20861%2C29%20%5B17%2048%5D%20-%20NASDAQ%20Index%20Kurs%2C%20Chart%20News%20(A0AE1X%20US6311011026)_bearbeitet-1.jpg)

2. Don’t invest more than you can afford to lose

You can basically read this everywhere but it’s also very true.

The cryptocurrency market is very volatile and corrections occur way more often than in traditional markets. If you have invested more than you can afford to lose you not only put yourself at financial risk but you are also not going to have a good time investing having to worry about your future every time your portfolio loses value.

Having said this it is obvious that you should also never take a loan to invest into cryptocurrencies, seriously don’t do it.

3. Do your own research

There are people getting paid to promote certain coins on social media, upvote posts or write comments. A lot of coins get hyped for some time until the price pumps. Then the people who initiated the hype sell with a huge profit and everybody else just loses money.

Also, people tend to hype coins that just had huge gains and made them money.

So when it comes to investing try not to follow the hype or fully trust anyone but also do your own research and understand the coins you invest in.

Secure sources for information are:

- the official website

- the official whitepaper

- official interviews

4. No one can consistently predict the market short term

When trying to predict the market short term you may get lucky. You may even get lucky several times and think that you can foresee price movements. But keep in mind that most of the times you were able to foresee price movements it was probably just luck.

In a bull run people who invest in any coin are very likely to make money and think they good investors when in reality just the whole market went up.

After a big price movement, we often hear experts talk about why the price went up or down. We like to think that we understand the price movements and can predict the next ones. In hindsight everyone is an expert on why the price moved.

Don’t overestimate yourself and make risky plays. It is next to impossible to predict prices short term and way easier to predict that prices go up long term. If you are uncertain what to do most times it’s just better to hold.

5. Don’t let the price of a cryptocurrency fool you

The price of a cryptocurrency is basically irrelevant without the supply of the coin.

If the price of “Coin A” is $1 and there are 1,000,000 coins and the price of “Coin B” is $1000 but there are only 1,000 coins then both coins are valued the same.

This valuation is called market capitalization:

Market cap = (circulating supply) * (last price of the coin)

The market cap would be $1,000,000 for both “Coin A” and “Coin B”.

A detailed analysis of price, market cap, circulating, total and maximum supply and why this is one of the most important aspects when investing into cryptocurrencies will follow.

%20price%2C%20charts%2C%20market%20cap%2C%20and%20other%20metrics%20CoinMarketCap_bearbeitet-1.jpg)

Great post, especially point 4. People always say "I see X coin going to X dollars" but the reality is no one has that knowledge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post for beginners and long term crypto buyers alike. Pump and Dumps are a real concern to all investors, and buyers based on them can surely hurt ones investment capital. Nice explanation about coin worth and market cap also. I’m resteeming your post and I’ll come back and upvote it later when my upvoting power is restored to a better level. Best Regards. 👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much. I will post an in depth explanation of price, market cap, circulating, total and maximum supply and also inflation within the next days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @teemit! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @teemit! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit