Among the most controversial aspects revolving around cryptocurrencies is whether the crypto craze is actually a bubble. First things first, the term bubble refers to a significant and fast increase in the price of an asset followed by its steady collapse. To give an example, a price fall of 40% in a time frame of a few days is typically seen as a substantial market crash. As for the causes, this phenomenon is typically engendered by speculation and frantic enthusiasm rather than an intrinsic increase in the value of the asset.

So, are cryptocurrencies a bubble or not?

Two complementary views must be taken to tackle this aspect.

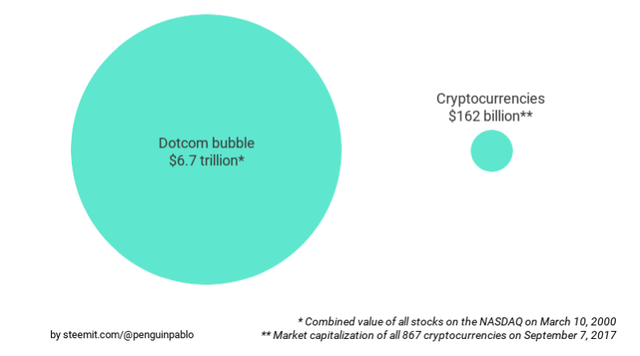

At macro level, a number of analysts have claimed that the crypto market is looking very similar to the dotcom bubble. But if we consider the market size of crypto against that of the dotcom bubble when it exploded, we can see that the crypto market was roughly 2.5% that of the dotcom bubble in September. As of today, that percentage rose to roughly 6.5%. So, while we may not know whether crypto will be a bubble in the future, it is definitely not looking like one right now.

At micro level, it is important to distinguish between the different crypto assets on the market. Bitcoin is, by far, the most valuable crypto currency out there with a market cap of $285B (as of December 12th 2017). But it must be noted that the Bitcoin system is inflatory by nature. In fact, if we consider central banks, they have the power to affect the supply of money in an economy thereby controlling fundamental characteristics of the market such as inflation and interest rates. In Bitcoin, this is not possible. In fact, the total number of Bitcoins is fixed — and we all know that when an asset is scarce, the price will naturally go up. But not only, the supply of Bitcoins to be traded is actually decreasing for many reasons ranging from the loss of private keys to the death of the token holder. This factor makes it an even more naturally inflatory currency, so it is difficult to distinguish between the human led market frenzy and the prince increase naturally engendered by Bitcoin’s governance system. But even if we suppose that the rise is fully attributed to the latter factor, the current market cap of Bitcoin is still nowhere near that of many other companies/assets being traded on a daily basis (i.e. gold, Apple or Amazon etc.).

Of course, not all cryptocurrencies are governed by the same structure: in Ethereum, for example, the supply of Ether is not fixed but gradually increasing (moving from M92 to M96 in roughly half a year), thus allowing for a less inflatory context. And as we move down the long list of alternative crypto coins, we can see that their currency governance models are disparate and that their market capitalization is millesimal compared to Bitcoin. So, there is really no basis to postulate that the whole industry, which is as nascent as one can be, will crash any time soon or that the fate of thousands of crypto currencies will be determined by that of Bitcoin.

Having said that and coming back to our initial question: to this day, cryptocurrencies as a whole are too nascent of a phenomenon to be considered a market bubble and by looking at its market capitalization, they won’t be one for a while.

Lastly, from a big picture perspective, even if the bubble were to pop in the not so distant future, the good projects would still be around. Just like many valuable internet ventures survived after the dotcom bubble burst.

If you want to keep up with our latest progress please:

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/tendswiss/cryptocurrencies-rationalizing-the-bubble-frenzy-6996d1251e83

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit