If you're even a little familiar with investing, you've probably heard of exchange traded funds (ETFs). They have become a popular tool in recent years for investors looking to invest in certain sectors, commodities, asset classes, and other specific things.

What are ETF's?

An ETF is a fund that owns an underlying asset. These assets can come in the form of stock, bonds, gold, futures, foreign currencies, or a collection of companies. Like index funds and mutual funds, they track the performance of a specific asset class.

However, unlike mutual funds, which have their net asset value (NAV) calculated at the end of the day, ETFs trade much like stocks and their value changes throughout a given day. They also tend to have higher daily liquidity, no lockup periods, and much lower fees.

For many retail investors, they provide a reasonable amount of exposure to things that would be otherwise difficult for them to invest in.

How are ETFs Created?

The process to create an ETF isn't overly complicated, but it may sound strange if you aren’t familiar with investing in general.

Here is a basic rundown of how it works:

- An ETF company creates a new product and wants to bring it to market. This specific ETF will track the performance of semiconductor companies in an effort to profit off of the crypto craze.

- An authorized participant (AP), typically market makers, a specialist, or a large financial firm (any source with a lot of buying power) will accept the fund and purchase their assets.

- In this scenario, the AP will purchase the specific assets that the ETF has requested to hold. For the sake of simplicity, the ETF wants to hold shared of Nvidia, Micron Technologies, Intel, Taiwan Semiconductor, Qualcomm, and Broadcom.

- The AP will deliver those shares to the ETF in exchange for a block of ETF shares. These blocks typically come in denominations of around 50,000 shares (called creation units). This exchange is completed at a 1-for-1 value, providing the exact value of the original shares in shares of the new ETF. This process can also be reversed if an AP wants to destroy a creation unit and redeem it in the underlying assets.

- The transaction is mutually beneficial as it allows the ETF to form its new product, while the AP will be able to sell the ETF shares on the market for a profit.

It is the creation and redemption process that keeps the value of an ETF in line with its assets. Because this process exists, there is always opportunity for arbitrage, which helps keep the price close to the value of the underlying assets. Without this process, prices would be sporadic and ETFs would be extremely volatile.

The Problems with ETFs Today

Like anything in the world of traditional investing, there are immense barriers that make it difficult for someone to quickly invest in ETFs. Creating an account with a major brokerage is a cumbersome process that can quickly run into delays if even the smallest detail is missed on an application.

There are many things to consider:

- You have to have legitimate documentation to sign up. In many cases, this means having a social security number, valid IDs, and other traditional methods of validation.

- A long application will need to be filled out. Missing the smallest detail will delay your application and can even lead to it being rejected.

- Depositing funds into your account takes time and can hinder your ability to invest.

- Depending on your brokerage, you will have to pay trading fees for each trade you make.

- Your funds can take several days to settle, trapping your money in cash-only, non-margin accounts.

Introducing Tiberius Coin – A New Solution to ETFs

The team behind Tiberius Coin has developed a solution to the inefficiencies that exist in ETFs. Tiberius Coin is a new asset-backed utility token that is directly redeemable for a basket of underlying metals.

This exciting new token is designed to democratize investing and other financial tools that are currently dominated by large financial institutions that actively gate retail investors. By reducing the barrier of entry, retail investors will be able to engage in commodity trading in a safe and secure environment that requires much less upfront capital.

One gold futures contract currently controls 100 troy ounces of gold. At the time of writing, one troy ounce is worth approximately $1,324, meaning one gold futures contract is worth $132,400. For most retail investors, the capital requirements to trade these futures contracts is unrealistic.

Tiberius Coin is working to change this by making commodities trading more approachable and secure through the implementation of blockchain technology.

Here's what you need to know:

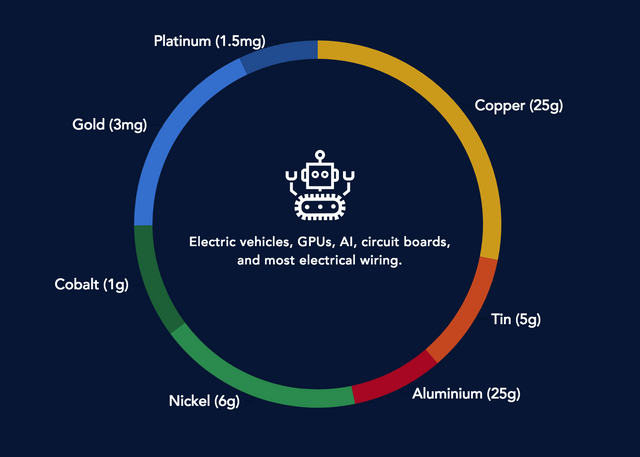

- Each Tiberius Coin can be redeemed for a predetermined amount of tin, copper, nickel, aluminum, cobalt, gold, and platinum.

- Trading fees are extremely low.

- Transactions are instantaneous, secure, and completely transparent thanks to blockchain technology.

- Each token can be traded like an ETF or redeemed for physical metal which can be delivered to a location of your choosing. Redeemed tokens are destroyed, meaning they can never be traded twice. Blockchain technology all but guarantees that this will be a smooth and seamless process.

- Tiberius Coin provides a reliable store of value that can be used for commodities investing, position hedging, or as a tool to protect you against market downturns (given that gold is often seen as the ultimate hedge in bear markets).

- New tokens can be created, but they will be worth the same amount of metals as any other token.

- The Tiberius Coin team is pro-regulation and is actively working with Swiss regulators in an effort to provide a transparent investing solution for retail investors, crypto enthusiasts, and anyone who wants to engage in commodities trading in a safe environment.

Tiberius Coin is the Simple Choice

If you are ready to simplify your investing, Tiberius Coin is the right choice for you. Thanks to blockchain technology, traditional markets like commodities are seeing a renaissance. Inefficient trading methods are quickly falling by the wayside in favor of technologically superior methods.

Physical trades that used to take weeks to complete due to all of the paperwork required to finalize a sale are now completable within a single day due to the security provided by the blockchain.

Whether you want to engage in commodities trading, invest in cryptocurrencies, or invest in something that is tied to one of the oldest commodities in the world, Tiberius Coin makes it all possible with their solution to the ETF.

Stay up to date with the latest information about Tiberius Coin. Join the official Telegram discussion and today! Stay tuned for our IS ( Initial Sale) which will start on October 1st 2018.

Join our Telegram Community!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.tiberiuscoin.com/2018/07/11/etf-like/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit