Since we've perceived how well known Bitcoin (BTC) has turned out to be over the previous year, there is likely one inquiry that relatively every astute financial specialist is currently asking: Is bitcoin worth the speculation now?

The basic response to that — obviously — relies upon one's experience, goals, and riches.

Yet, an intriguing suggestion that has been tossed around of late rotates around bitcoin turning into a topical venture that could even opponent gold. Could bitcoin work similarly as gold? Might it be able to likewise be a store of significant worth?

Fortuitously, the two resources have generally comparable per-unit esteems right now. So now is a decent time to make these inquiries. To give the appropriate responses, we should take a gander at some of bitcoin's key qualities that make it appealing to financial specialists.

Constrained Supply

It is very much recorded that the bitcoin virtual cash has a constrained supply — 21 million to be correct. As of late, reports turned out educating the market that 80% of the world's BTC has been mined, with roughly 4.2 million as yet staying out there. In examination, the supply of gold is said to increment by 1% to 2% every year.

Just by utilizing the law of free market activity, we can extrapolate that bitcoin's esteem pivots generally on its request. A superbly inelastic supply — when the sum total of what coins have been mined — implies that any development in bitcoin's request would straightforwardly influence its cost with no piece of the supply bend counterbalancing the request instigated value development. This is one conceivable clarification (utilizing market elements in financial matters) for bitcoin's unpredictable; it is super delicate to request shifts.

Since its supply is set at a specific sum, there is a decent possibility bitcoin will turn out to be progressively important as request keeps on going up as it improved the situation the previous year. Keep in mind, the worldwide populace is additionally developing, so the quantity of bitcoin buyers can just ascent.

Virtual Money

Since it is a virtual money, bitcoin is greatly helpful to purchase and simple to bear. This has the two its upsides and downsides.

On the splendid side, each exchange including bitcoin happens rapidly, especially those including substantial entireties of cash, and its clients can profit by the obscurity of proprietorship, to such an extent that bitcoin can be utilized as a part of a wide range of buys. This makes bitcoin particularly significant operating at a profit advertise.

On the drawback, since it's virtual, bitcoin is more powerless against interruptions to its framework (i.e. hacks), subsequently possibly losing all its esteem. Besides, bitcoin's advantages must be acknowledged by a select gathering of individuals in the general public — the individuals who are technically knowledgeable. For the more established ages, even the idea driving bitcoin evades them, isolating them from the universe of cryptographic money.

Absence of Regulation

Generally, bitcoin is viewed as a decentralized element not subject to any administration directions. Once more, this is both great and terrible.

While decentralization permits all individuals from the bitcoin group to participate in the mining and check process, it creates issues that must be alleviated by administering experts. For instance, without control, exchanges operating at a profit showcase, and illegal tax avoidance utilizing bitcoin, would be left uncontrolled.

Keep in mind the story in 2015 about the capture of the proprietor of the Silk Road site and how bitcoin was associated with that trial? This is the reason a few locales are pushing for digital money laws to handle these issues.

Bitcoin Compared to Gold

Without a doubt, bitcoin offers our general public another decision of money that is both secure and simple to use with the possibility to acknowledge, yet does that make it a decent store of significant worth contrasted with gold? For this, we should consider how their qualities would look a long time not far off.

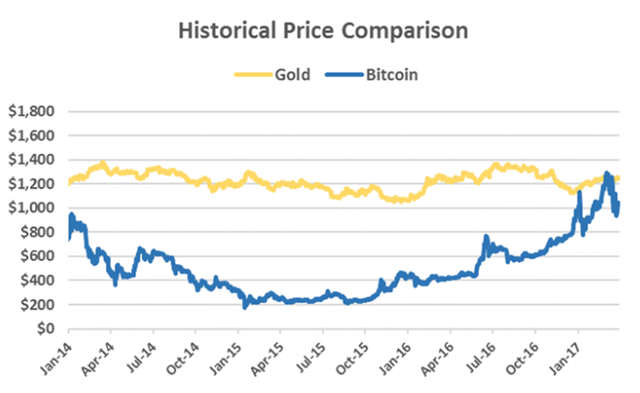

Source: https://www.coindesk.com/charts-bitcoins-golden-price-streak-comes-close/

Taking a gander at their chronicled costs, there's a recounting story: Bitcoin has a substantially higher variety in the course of recent years than gold, yet general it is slanting upwards, while gold remained moderately level.

This says a considerable measure in regards to the dangers required with these benefits. Clearly, Bitcoin has a higher hazard, however its esteem could keep going up particularly as it is even rarer than gold. Additionally, the issue some have with bitcoin isn't about its unpredictability, yet how the instability would block its way towards ending up genuine cash.

Then again, gold can be viewed as a generally more secure venture, particularly as it has been around for a great many years — nothing will hurt its status as the #1 valuable metal.

Here and now versus Long haul

As a speculator, you need to know your venture skyline when making a judgment. As observed in the course of recent months, bitcoin fluctuates. Thus, those putting resources into the here and now would have a higher possibility of benefitting from bitcoin.

"For over 5,000 years gold and silver have been attempted and-genuine cash. They've kept going essentially the term of composed development," said Dave Kranzler of Investment Research Dynamics.

Over the long haul, the two resources would likely go up yet for various reasons. For bitcoin, its restricted supply and the rising notoriety of computerized money at this moment would absolutely help its esteem. Concerning gold, speculators would dependably see it as a decent fence against swelling and the share trading system, which was generally its most normal utilize.

Previous PayPal president David Marcus once gave his own view on bitcoin :

"I extremely like bitcoin. I possess bitcoins. It's a store of significant worth, a dispersed record. It's an awesome place to put resources, particularly in places like Argentina with 40% expansion, where $1 today is worth 60 pennies in a year, and an administration's cash does not hold esteem. It's additionally a decent venture vehicle in the event that you have a hunger for chance. Yet, it won't be a money until the point when instability backs off."

Dangers With Bitcoin

The security ruptures in the virtual world could be viewed as the greatest dread factor for those purchasing bitcoin. Nobody can change the way that bitcoin is a man-made substance, and anything made by people has its own verifiable vulnerabilities. Some additionally contend that bitcoin is "anything but difficult to get in yet difficult to get out".

Also, impedance by administrative experts has dependably caused fears in the cryptographic money space. An administration crackdown could hit bitcoin's esteem contingent upon the nature and extent of progress forced.

Dangers With Gold

In the event that one's searching for a protected and solid speculation, gold would effectively be one of the perfect competitors. The main real issue speculators have is that it isn't as transferable as fiat cash, and unquestionably substantially more troublesome when contrasted with bitcoin.

Envision you have to make an arrangement including several kilograms of gold, somebody would need to exchange that. In addition, there's a probability that it could get stolen on its way. So the speed in which gold can be utilized as a medium of trade isn't ideal as a rule.

Bitcoin and Gold Can Co-exist

Whatever what your venture objectives are, both bitcoin and gold are resources that have an incentive later on. Truth be told, as said, gold can be a support against numerous things, and digital money might be one of those.

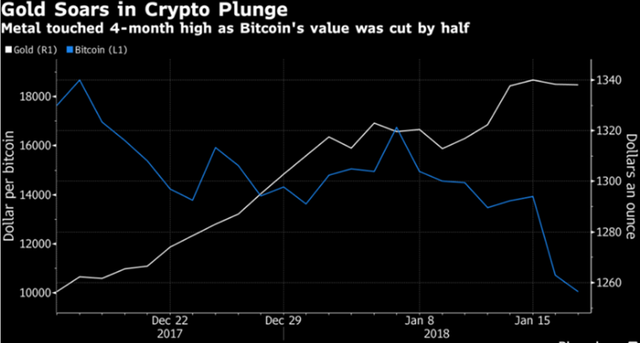

This week, the market saw a convergence of cash filling gold buys, with 30,000 kilograms sold on January 17, because of the digital currency showcase (counting bitcoin) being down for back to back days.

Source: Bloomberg

Along these lines, one approach to respect the "bitcoin versus gold" contention is to consider them to be supplements that enhance one's portfolio.

On one hand, putting exclusively in bitcoin presents a "high-hazard, high-remunerate" situation, while putting all eggs in the gold container is significantly more secure yet has a lower development roof. This is equivalent to picking between value in a rising segment and bonds.

At last, the venture choice and distribution truly rely upon how forceful a financial specialist needs to be.

All in on Bitcoin right now!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit