INTRODUCTION

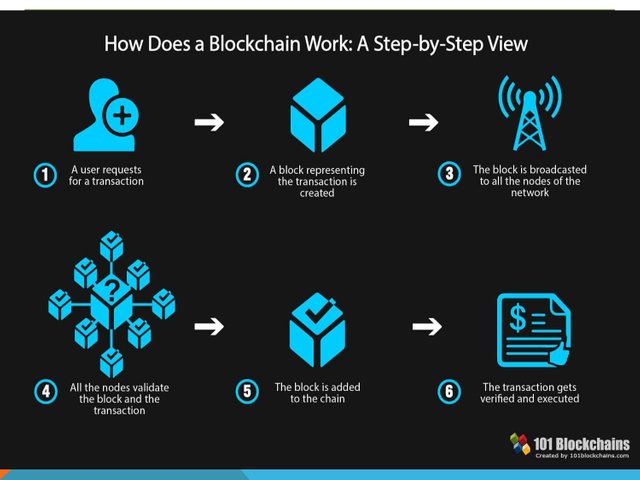

What is Blockchain

A blockchain is a growing list of records, called blocks, that are linked using cryptography. Each block contains a cryptographic hash of the previous block, a time-stamp, and transaction data. By design, a blockchain is resistant to modification of the data. It is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. For use as a distributed ledger, Blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for inter-node communication and validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without alteration of all subsequent blocks, which requires consensus of the network majority.

Decentralized Computing

Decentralized computing is the allocation of resources, both hardware and software, to each individual workstation, or office location. In contrast, centralized computing exists when the majority of functions are carried out, or obtained from a remote centralized location.

Decentralized computing is a trend in modern-day business environments. This is the opposite of centralized computing, which was prevalent during the early days of computers. A decentralized computer system has many benefits over a conventional centralized network. Desktop have advanced so rapidly, that their potential performance far exceeds the requirements of most business applications. This results in most desktop computers remaining idle (in relation to their full potential). A decentralized system can use the potential of these systems to maximize efficiency. However, it is debatable whether these networks increase overall effectiveness.

OIKOS as a Decentralized Asset

Oikos is a decentralised synthetic asset issuance protocol built on Tron. These synthetic assets are collateralized by the Oikos Network Token (OKS) which when locked in the contract enables the issuance of synthetic assets (Synths). These Synthetic assets (Synths) are backed by Oikos Network Tokens (OKS) locked into a smart contract as collateral. Synths track the prices of various assets, allowing crypto-native and unbanked users to trade P2C (peer-to-contract) on Oikos Exchange without liquidity limitations.

Oikos owns its OKS tokens and follows the blockchain ideology, so these tokens have to be blocked to create synthetic assets. The device is over-collateralized to keep away from risking the price of sure black swans and the gadget together with liquidity.

Oikos Exchange

Trading on Oikos.exchange has an edge over centralised exchanges and order book based DEX’s. The lack of an order book means all trades are executed against the contract, known as P2C (peer-to-contract) trading. Assets are assigned an exchange rate through price feeds.

No counterparty is required to exchange, as the system converts the debt from one Synth to another. Hence no order books or order matching is required, resulting in infinite liquidity between Synths. No debt change is required to be recorded against the debt pool either, as the same value is burned from the source Synth and minted from the destination Synth.

Characteristics of the Oikos Exchange

The oikos exchange is of great importance and is only limited to those who are users of the platform. With the oikos platform, assets are basically assigned an exchange rate through the price feeds supplied by an oracle and as such can be converted using the oikos.exchange dApps and it provides an infinite liquidity up to the total amount of collateral in the system, and the platform also oversees zero slippage and permissionless on-chain tradings.

Additionally, Oikos Swap pools for all intents and purposes on the exchanges. Anybody can make contributions by means of including or losing liquidity to get commissions via exchanging costs, simply as prices paid by way of the OKS token.

Trustless Token Exchange

Oikos Swap is a Tron port of Uniswap, a trustless decentralized exchange that allows users to trade any Tron-based token without any deposits or withdrawals to a centralized order book. Better yet, Oikos Swap liquidity pools have little to no slippage for the vast majority of transactions. Anyone can contribute by adding or removing liquidity to gain commissions in the form of exchange fees as well as rewards paid in OKS token.

Conclusion

I strongly believe this project and its trading platform to be very promising since it’s delivered one of the most complex and useful protocols built on Tron to date. Many investors and traders have long waited for a similar platform like Oikos. Even it has promised further improvements to the mechanism as well as functional upgrades and new Synths, which will vastly increase the utility of the platform. To be more informed and familiarized with the OIKOS system, use the links below:

Website: https://oikos.cash/

Oikos trade: https://oikos.exchange

Lightpaper: https://docs.oikos.cash/litepaper

Github: https://github.com/organizations/oikos-money

Twitter: https://twitter.com/oikos_cash

Discord: https://discord.gg/qjuqy6X

Telegram : https://t.me/oikoscash

Author: todas61

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1315169

Wallet Address: TGp83skVJk25jF4FVjN5iqjTkwk3pZ39NU

great content

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit