Thursday. July 20th 2017 - BTC was trading above $2,500 testing resistance at the top of the daily down-trend channel.

A possible upside of $2,800 could be within range if the move continues momentum, on a continued weakened US Dollar.

RSI is touching 51 at time of writing. If above 55 can be held, along with a channel breakout - a bullish stance will be taken in BTC. A crossing day of 21/22 July for this is worth monitoring as it would signal a break from the downwards RSI trend of the past weeks.

On the contrary a channel reversal back to touching the 100 DMA, and possibly lower to $2,200 figures could be a potential short cover.

Levels to watch:

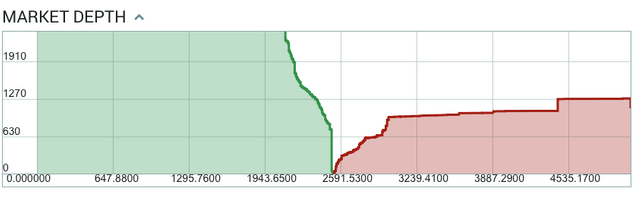

Massive buy order volume waiting at $2,500 at Poloniex exchange.

Profit taking around $2,700 - $3,000 in high order.

Base support / Channel Mean: $1,800~$1,900

Channel Resistance: $2,400

Good analysis!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@lakov thanks! I will be sharing my analysis more often here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit