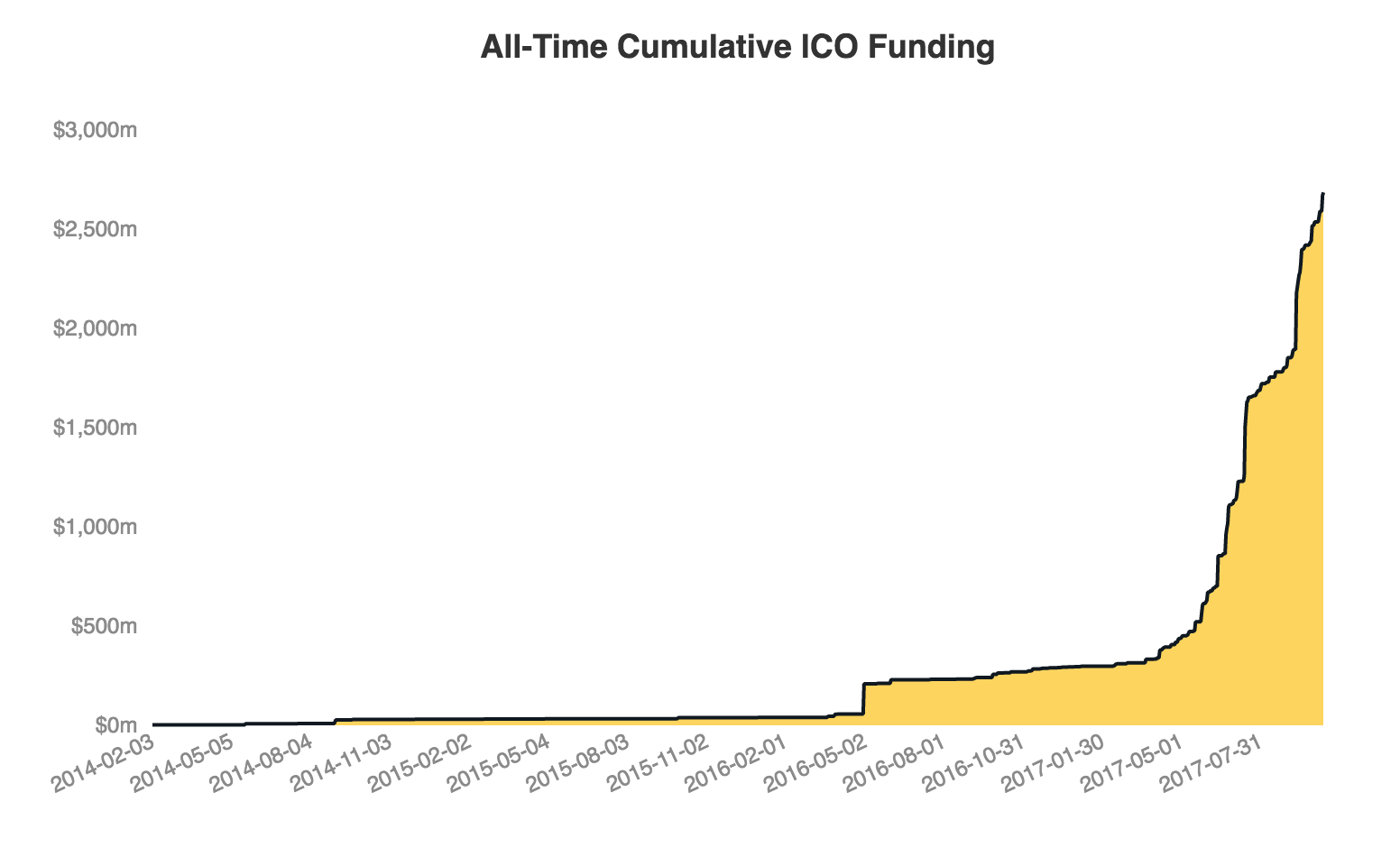

ICO’s, or initial coin offerings, have taken the finance world by storm in 2017 and are fundamentally attempting to rewrite the rules of finance. ICO’s are a method for raising funds that often bypass the regulated and exploitative capital-raising process dominated by venture capitalists and investment banks. If anyone out there claims to understand what is going on or predict what is going to happen: they are full of it.

The truth is 95% of “crypto experts” have been in the space for less than a year. There is a gold rush for guidance and wisdom surrounding ICO’s and what has emerged has been nothing short of pure unadulterated chaos, greed, scams, and flat out lies.

Venture capitalists are scrambling to get in on this revolutionary new financing mechanism as their startup funding bubble looks to be bursting. A utility token sale that can be used to raise hundreds of millions of dollars for no equity is the wet dream of any venture capitalist. In their greed-driven haste, these venture capitalists spent months hyping up the Tezos project.

Tezos is attempting to create a blockchain-based platform that enables automatic upgrades. They mostly have an idea on paper. This idea, pumped by the institutional elite of Silicon Valley investors for months, went on to raise a record-setting $232m ICO in July.

All of the top “trusted” names in Silicon Valley got behind the project and their overambitious hype led to a meltdown of blockbuster proportion. Tezos co-founders Arthur and Kathleen Breitman have accused Johann Gevers, President of the Tezos foundation, of inappropriate actions. This internal drama and chaos has left investors with little to no recourse of action and has potentially invited the SEC to investigate.

Tim Draper, the billionaire Silicon Valley VC and investor in Tezos, is actively calling for US Securities and Exchange Commission (SEC) to exempt certain initial coin offering (ICO) projects from the repercussions. You can’t make this stuff up. These people know what they are doing is wrong and likely illegal, but their greed and ego pushes them to new levels of stupidity and dishonesty in the wild west world of ICO’s.

What did ICO participants get from Tezos in return for their $232m? Not equity. Not a security. In fact Tezos likely doesn’t consider them to be investors at all, but rather a large group of people collectively making a “non-refundable donation” in the amount of $232m. Co-Founder Katheleen Brietman compared the Tezos ICO to receiving a “tote bag” for contributing to public television.

Let’s take a look to see if the Tezos sale of tokens is or not a sale of securities:

The Tezos token was sold for money. Both Bitcoin and Ether are considered assets and taxed by the IRS as such. This is monetary value.

The Tezos Foundation is a common enterprise. It is managed by three trustees.

The people who purchased the Tezos token had an expectation of profit because they were not purchasing these tokens to use them as a service, which is not yet available, but instead to resell the coins, hopefully at a higher price.

The people who purchased Tezos are not building the company or involved as employees so they are benefiting from the effort of others including the three trustees who run the foundation.

To sweeten the sauce, the holders of the tokens have voting rights, and have input in how the common enterprise is governed (voting rights).

So how did DLS get away with this? They probably hired some very sophisticated lawyers who were able to help them build the Tezos Foundation and attempt to shield them from any securities fraud concerns. DLS also received a commission from the Foundation for promoting the ICO.

If the Tezos is found by the SEC to be a security, then the Foundation had an obligation to register these securities in order to sell them to U.S. citizens, and the officers of DLS needed to be licensed by the SEC and FINRA in order to be able to receive compensation for promoting a sale. Source

In light of this dumpster fires of risk and problems, Gab has been exploring the road less traveled with ICO’s: regulation and SEC compliance. We recently announced our intentions to be the very first to launch a Reg A+ SEC-approved ICO. Gab seeks to build for the longterm future, not pump and dump on a get-rich-quick scheme or provide some sort of liquidity for Venture Capitalists and their LP’s.

Gab is a community of creators working together to build a new decentralized internet where people, free expression, and individual liberty come first. Our goal is to empower and incentivize people to defend free speech and expression on the internet at all costs.

Gab has been 100% supported by our community since we launched in August 2016. We opened our first funding round to our users instead of venture capitalists and raised over $1m in under 40 days. We are planning to make history and trail blaze a path for legal, SEC-compliant ICO’s. We are a mission-oriented company with a big vision: decentralize and incentivize the communication of free and open information and ideas on the internet.

Enjoy your tote bag, Tezos donors.

Will Gab be using the STEEM blockchain to launch the token?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm thinking that GAB is attempting to make there own token for its platform. At least that's what I gathered from the aforementioned post by @torba.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Why make these posts on Steemit then? Especially when an SMT would be the perfect technology to use for a site like Gab.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's simply informational and maybe GAB is looking for some blockchain developers for its own infrastructure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @torba! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @torba! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit