Hi investors, let's talk about fake volume and its effect on the price of Bitcoin.

Bitcoin.

On Monday 24th of February 2014, Mt. Gox, at the time the most popular Bitcoin trading platform in the world, abruptly stopped all trading on the exchange, citing it would “close all transactions for the time being in order to protect the site and [its] users” against a hacking attack.

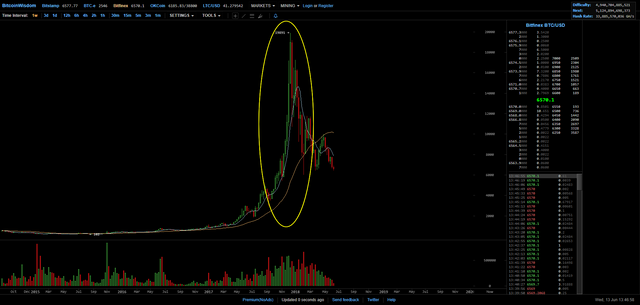

The hacking of Mt. Gox precipitated a large crash in an already overbought Bitcoin market:

...and culminated three years later in a trial during which Mt.Gox CEO, Mark Karpeles finally lifted the veil behind the shady business practices of the exchange.

As it would turn out, not only most or all of the "hacked" bitcoins had been stolen straight out of the Mt. Gox hot wallet due to serious security negligence, but Mt.Gox was also found guilty of wash trading on their own platform.

"Wash trading is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace."

It was later revealed that Mt.Gox was actually operating trading bots which were responsible for injecting fake volume on the exchange. Those bots directly contributed to the November 2013 bubble and their existence was later confirmed by Mark Karpeles during his trial.

"It needs to be recognized that, whether intentional or not (though plausible ignorance only goes so far), Mt. Gox has effectively been abusing Bitcoin to operate a Ponzi scheme for at least a year. The November “bubble” well into the $1000’s – and possibly April’s as well – was driven by hundreds of millions of dollars of fake liquidity pumped into the market out of thin air (note that this is equivalent to “with depositors’ money”). It is only natural that the Bitcoin price would deflate for around 5 months since its December peak, since there was never enough fiat coming in to support these kind of prices in the first place."

from the Willy Report.

It's been now revealed that Mt.Gox might not be the only crypto exchange dabbling in wash trading. According to a study published by Sylvain Ribes in March 2018, wash trading could be rampant across most of the cryptoverse:

"By my reckoning, over $3 billion dollars of daily volume is nonexistent. Possibly more. Yet somehow, the practice is, if not encouraged, at least thoroughly ignored by popular data aggregators and most of their users, when all anybody really has to do is have a look to figure out that something is amiss".

from Chasing fake volume: a crypto-plague by Sylvain Ribes

One can also remember the accusations against Bitfinex made by the anonymous Bitfinex'ed:

"The truth is, we will never know how much of Bitfinex’s trade volume are in fact wash trades, and if they knowingly allow wash trading, chances are logs would be sparse, or just outright fake.

They probably would not want their transaction logs leaked and everyone to figure out the scheme, like when MtGox’s transaction logs got leaked resulting everyone figuring out about Marcus and WillyBot.

Absent those transaction logs being leaked, we likely still would not know to this day what happened with MtGox".

from Wash Trading Bitcoin: How Bitfinex benefits from fraudulent trading by Bitfinex'ed

In the face of those revelations, one must now wonder how much of this move:

... was completely fabricated by trading bots across multiple unregulated exchanges all over the world.

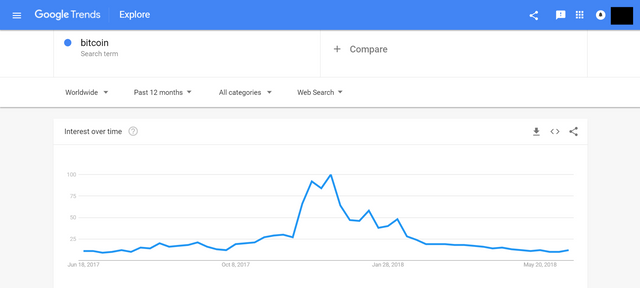

Since the bubble has burst, Bitcoin has been consistently unable to sustain its price due to a serious lack of volume. Part of this lack of volume can be attributed to Bitcoin's complete fall from grace in the eyes of retail investors.

But one has to wonder if the threat of regulations might have led multiple large exchanges to simply"unplug" their trading bots, resulting in a complete dry up of liquidity which then resulted in a complete fall of the price.

Without the support of "fake liquidity", it's likely that this market will stay bearish until it finds a floor supported by "real" volume originating from actual investors (retail or institutional).

The $112,836,784,902 USD question now being: where will this floor be?

Hi @tradealert, you have received an upvote from

tradealert. I'm the Vietnamese Community bot developed by witness @quochuy and powered by community SP delegations.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting post, thanks. The question on everyone's mind including mine..where's the bottom?!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wish I knew too :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If you want to start investing in cryptocurrency join Coinbase and get $10 Free Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit