Hi traders, I am still hedged in cash on most exchanges. Not buying back into BTC just yet.

Here's why...

- The price has gone parabolic and a correction is overdue, at some point the big players will take some profit which could trigger a wave of dumps and panic-selling; remember: most of the new money in the market (people who entered at $4000 and above) have never experienced a Bitcoin bear market and will be the first to panic-sell in case we start to break down;

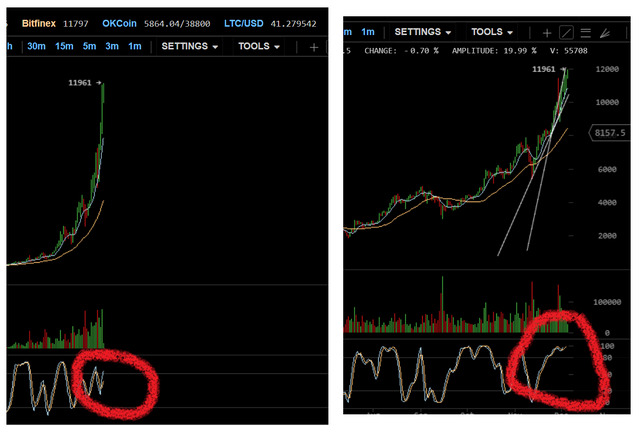

- The Stochastic RSI has crossed over the "oversold" line (faint grey-ish line at the top) on both the weekly (left) and daily (right) charts which usually signals an exhaustion of the bulls;

- To add to that, although the price is creeping back to $12,000, the volume looks weak;

- Finally, we could have a potential "sell on the news" event before December 18th when the CME Bitcoin futures go live.

HOWEVER,

If the bulls take control of the market yet again and we start making new highs, then the following scenario could play out:

- We push to the next fib levels north: $12,500 then $15,000 where you can expect more selling.

What I'd like to warn you about is not to over-trade and to keep some $$ firepower on exchanges in case we get a dump so you'll be able to buy a dip, possibly around the $8000 area. At these very high levels, it's better to wait for the market to make a clear move before getting into a trade and right now, a case could be made that both scenarios are 50/50, although I personally lean towards a correction.

For the love of God, be careful, manage your position-size and don't use leverage so you don't get wiped out.

Where do you think Bitcoin is going?

If you liked this analysis, please consider supporting the blog by up-voting this post and feel-free to follow me for more trading analysis and commentaries (rants).

Cheers,

good hint.

it's about patience these days.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think so too...

You're holding a lot of Bitcoin @joshbreslauer?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dan, Good article and video. upvoted followed and resteemed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @traderdad, how's trading going?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

While folks went shopping on the Friday after thanksgiving, I put a few hedges on that paid off the last 3 trading days. Looking at 1/2 dozen events over the next two weeks that should make premium selling in options work through 12/15. In the crypto space, thinking about dumping my bitcoin and etherium and switching to futures. Just want see how the details on futures before jumping in bitcoin futures. Just got my daughter using Nicehash for mining cryptos, hoping she gets the bug for this space. Her Day Jobs is disking out ice cream in winter. want her to try a bit more and get a little cashflow in her life..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awsome, where do you think Bitcoin is going short term? I see a massive correction coming, price action looks very unsustainable.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agree with you on correction.. Bitcoin has been almost mechanical on the pull backs to 50% or 68% fib retracements. However, when Bitcoin blew threw all the Short Sellers at $10,000 on GDAX in two days, I knew the institutional investors had finally arrived. On Sunday, I quitely dumped at $9,990 to avoid the in mass sell orders that Monday/Tuesday. I remember 2008 an panic selling. So while I want to dump the rest, thinking they will run this rocket ship through the 12-18 opening of CME futures at least. Remember both CME and CBOE must deliver real bitcoins when contracts expire. So guess it really buying in preparation for futures. Markets in general try to punish the most people, so with 99% of investor being long expect a catastrophic drop at any time. As a retail investor, I can not hedge my bitcoin now, so I am playing it small. When the futures and options are here, will probably split my Gold portfolio to be half Gold - half Bitcoin/Etherium. But I expect to 20% a week on future/options bitcoin trading....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting opinion, I was under the impression that the CME futures would be settled in cash, did I read that wrong??

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not sure, I trade futures daily. Actually like doing the options on futures contracd on /ES, /RTY,/CL. Got away from trading /GC gold after banksters were caught colluding a few years ago.Going to paper trade the bitcoin stuff through end of year to get the details. if they settle to cash should be easier on CME and CBOE to bring their markets online. CBOE has teamed with the Winklevoss twins who probably own 1% of outstanding bitcoins today. Nevertheless, /Bitcoin should have a calming effect on bitcoin price movement and country arbitrage

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hopefully it can reduce volatility a bit and gives altcoins some room to breathe.

By the way, I've checked the bitcoin contract specs, will be settled in cash:

http://www.cmegroup.com/trading/equity-index/us-index/bitcoin_contract_specifications.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @tradealert. Nice video! Thanks on the advice :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My pleasure :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great advice. Thanks. Anyway, I followed your recommendation to buy decentraland and it has paid off. MANA has gone parabolic. I am not sure what to do at this stage, should I dump now or hold? I guess I have to check the reason for the skyrocketing price and take it from there. I look forward to your next altcoin call. Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hey @getrichfast, I suggest you take profit now, sell 60% of your position, let the rest ride in case it goes higher, lock your gains in cash/USDT not in Bitcoin, the market could correct very soon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sound advice in this market regarding Bitcoin... I am not in Bitcoin at the moment. Also, not really feeling the urge to be. With Bitcoin I am concerned about transaction per second scale-ability, majority Chinese miners, and last but not least - price. I also feel that tech like IOTA's tangle could displace block chain in the long haul. Reasons: Fee-less to use and TPS scale-able. At the moment I have chosen to invest in IOTA over Bitcoin for these reasons. Thoughts?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @nateinsav I am not too familiar with IOTA tbo, as far as investment, it's possible MIOTA is just a glorified tech demo for the underlining technology (tangle) just like Zcash is a tech demo coin for znarks. What I can tell for sure is that BTC is way overvalued right now and primed for a correction which will affect the $ value of all crypto so if you've made some good money on IOTA I would definitely lock some profit in fiat right now :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I noticed it was interesting that IOTA moved counter to most other "block chain" coins during it's last move up. This recent Bitcoin pump sucked the life out of every alt coin - including IOTA's move. I think the smart money has figured out the IOTA's tangle is uniquely different from "block chain" and has the potential to be "block chain's" replacement. IOTA is first to market and has many legitimate business partnerships that any "me too" tangle coin in the future will have a hard time selling to those same partners. True believer here - holding my IOTA.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

IOTA definitely has some good momentum going for it, will be interesting to see how the technology develops in the future

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit