ORCA is breaking in the European banking market worth trillions of dollars to deliver a large-scale Open Banking platform and be at the forefront of financial innovation. It was never been done before, because it was simply not possible. Until now.

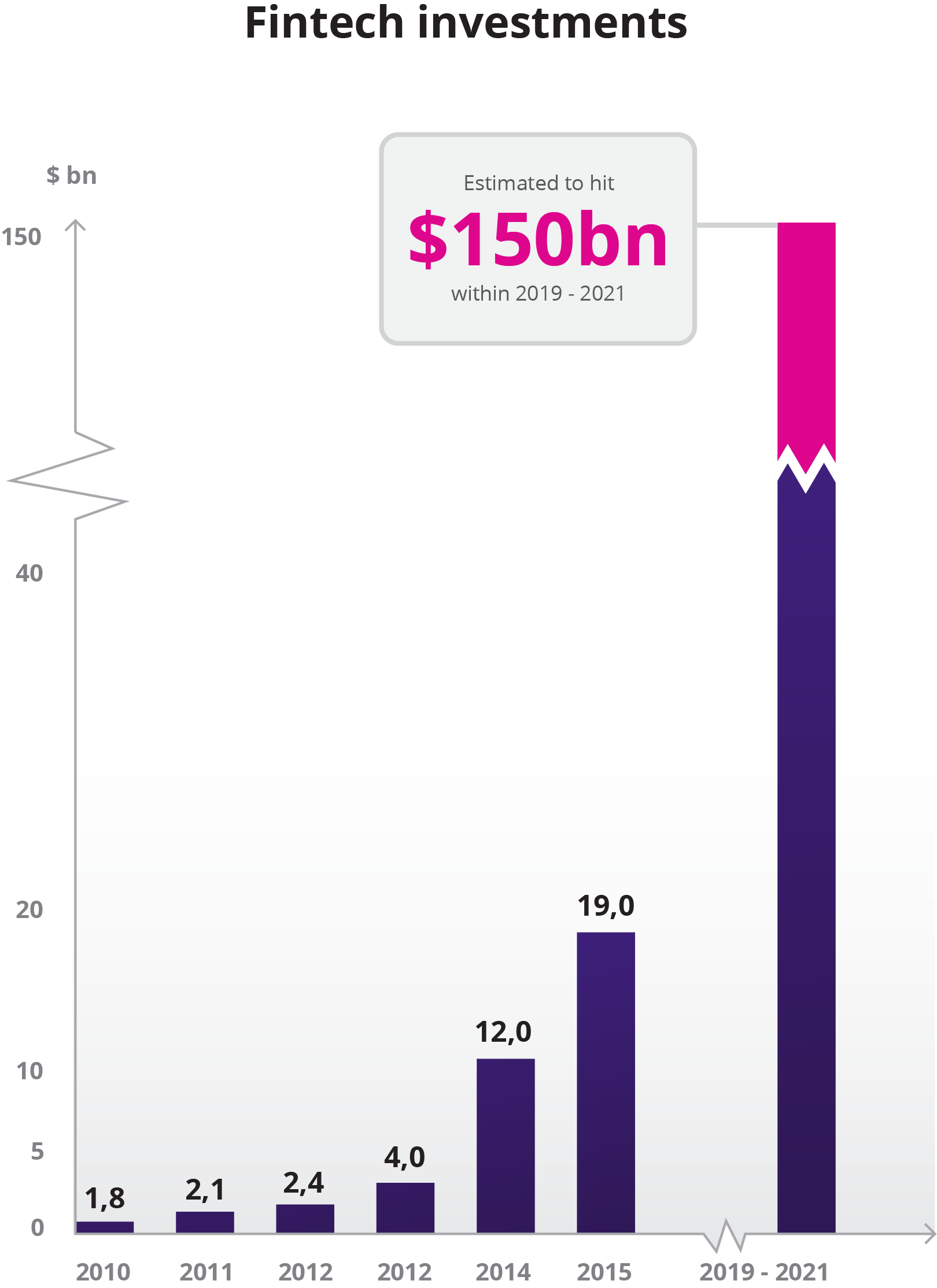

The industry of financial technology aka Fintech has been getting a substantial amount of public attention over the last months. We see payment-processing start-ups joining the space every day while the world of digital currencies is getting media coverage and awareness from all over the place. What is more, new regulation in Europe is transforming the financial landscape in ways never applied before. One thing is for sure, we’re on the brink of a shift. It is estimated that investments into Fintech projects will reach 150 billion dollars per annum by 2021. Institutional funds, venture capitalists, and angel investors are paying more and more attention to an industry which was somewhat lacking in innovation over the last decade.

ORCA Alliance is approaching its token sale rapidly so we decided to interview our strategic backers to find out why they are putting money in ORCA and why they think it’s a good investment.

“Timing is everything. With PSD2 taking effect in January, the possibilities of Open Banking just spurred inside the market. European banking sector is worth trillions of dollars and we think now is the perfect time to step in. There’s going to be a lot of competition and ORCA is bringing a competitive advantage — including decentralized services into their Open Banking platform to deliver for the quickly growing demand” — Darius Rugevičius.

“Other factors that we looked into considerably include the business model and the road to implementation. We liked the idea of using an aggregation platform similar to Google Store or Spotify. There’s a proven track record of these kinds of service aggregation platforms as successful businesses. The question then stands, whether these services can technically be put on the platform, whether the concept is not only feasible but implementable as well. And from what we found out, it actually is. ORCA is already working on establishing API connections to the banks themselves and largest digital currency exchanges. Their proof-of-concept is public and programming code is available on Github.

Some banks are actually eager to have ventures like ORCA approaching them because they have not prepared well for the PSD2 enforcement and have limited knowledge on how to become compliant. In this case, cooperation provides a win-win for both parties.“

It is refreshing to see ORCA on a mission to make the banking experience less frustrating for everyone. Recent regulatory developments in Europe positions the ORCA project at the most opportune time to bridge the gap between cryptocurrencies and conventional banking. What’s important for us and we think brings a lot benefit for investors is the two-fold potential of the project to bring in users. Route A is Open Banking, which will attract Europeans looking for more freedom when making everyday financial decisions. Route B is the decentralized economy and digital currencies that are gaining public awareness and support every day. When these two routes converge, they will turn into a positive feedback loop. — said Sishir Varghese.

„What I really like about ORCA — the founders know each other and have been working together for quite a few years building different digital products. What is more, you’re here from the start, you’re driving and pushing the change. Not waiting for the banks to approach you but approaching them yourselves. Together with PSD2, ORCA is forming how Open Banking should work.– M. Samami

Barriers to success

In order to give a more accurate representation of the overall environment, we asked our backers to name the biggest challenges ORCA faces for successful platform delivery based on their perspective. Both dimensions, Open Banking and decentralized currencies/services are relatively new concepts globally. There are a lot of questions left unaddressed or unanswered. We believe in being prepared rather than being naive. Below we provide a couple of attention points deemed to be the most critical by our backers:

Data Security. Client information is an important topic, especially after recent well-known controversies regarding data leaks. It is essential to guarantee that user data is transmitted in a way that prevents any breaches of protocol. Financial information is even more sensitive. Close cooperation with Rivetz, a cybersecurity firm, will be essential when building ORCA’s security infrastructure. What is more, the GDPR regulation is coming into enforcement in Europe and aims to give users more control of their shared information. Even though ORCA platform will only act an information gateway without storing client data, the responsibility of integrating trusted pathways from the platform’s side is a top priority.

Effective partnerships. Creation of an Open Banking platform includes numerous working parts combined in unison along an instantiated timeline. The need for effective partnerships to lighten up a load of development is apparent. When the funding of the project is achieved, orientation will have to shift towards integrating services, securing API connections to existing banks and service providers, and expanding the base of early adopters. Securing a network of partners in the field is a clear strategy to implement aforementioned tasks while saving resources at the same time.

Flexiblity and on-the-go evolution. Open banking is a novel idea. There is no manual on best practices and rules how the banking industry will transform itself. The same goes for decentralized digital currencies. Downward pressures may come from new regulation, competitors, and rate of user adoption. The key to success in market conditions like this is agile management. When market standards begin to manifest, ORCA will have to be alert and quick to adopt them. The challenge lies in effective communication within the core team, advisors, partners and the community behind the project.

.png)

Congratulations @vizier! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit