Which is faster to settle credit card payment via merchant, creditor and bank or cryptocurrency payment via P2P (peer-to-peer)?

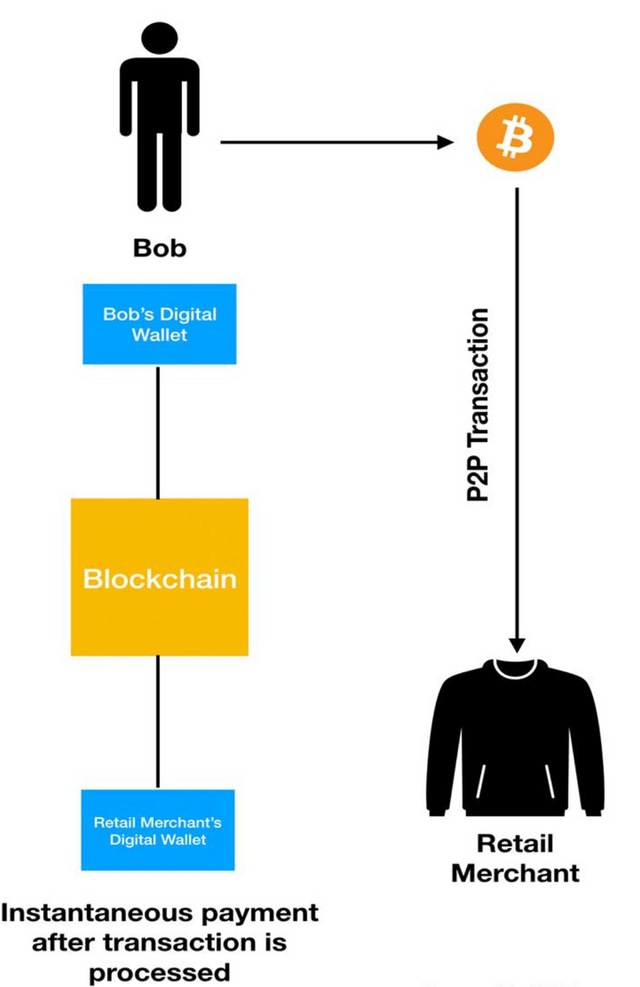

P2P is faster. Instant payments with no waiting or clearing between banks and merchants. The merchant who retails gets paid right away and it does not involve a middleman (banks and credit companies).

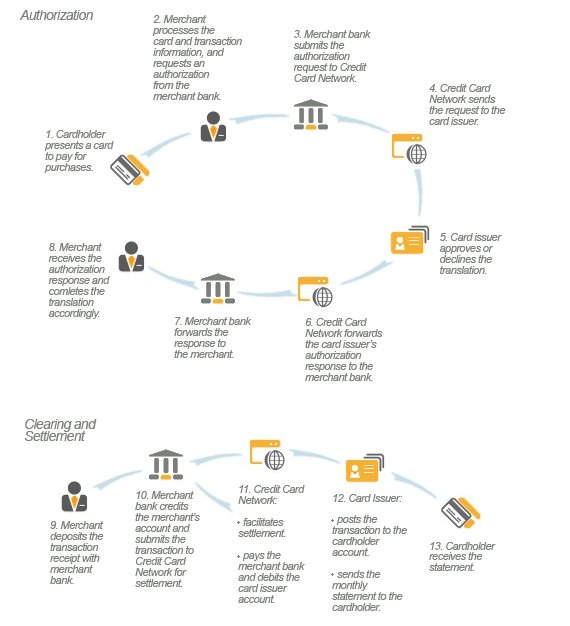

Due to the clearing and settlement process, it take a total of 13 steps for a transaction to update. That can take anywhere from 24 hours to a few days or weeks. This is because banks batch process transaction records taken from creditors. So the merchant gathers up all the transactions at the end of the day and it is batch processed with the credit details that the banks then pay after they have batch processed their transactions. It is also prone to inconsistencies and large transaction fees from creditors.

P2P is faster. It can be processed from as fast as a few seconds to just a few hours (depending on the token network used). There is also no middleman (banks or credit card companies). The transaction is conducted only between the buyer and the merchant retailer. No interest fees to pay credit and transaction fee to the banks, etc.

Advantages of P2P:

1- No middleman or broker, it is direct between buyer and seller

2- Faster settlement of a transaction

3- No interest fees like credit cards, zero debt

4- Immutable on a public ledger

5- Transparent for all to see, less prone to fraudulence

Speaking of credit cards, I recently had an interesting experience with my Tractor Supply Company credit card. I needed to make a payment but was having trouble accessing my account online. After some frustration, I decided to search for a solution and came across click here. Their article on Tractor Supply Company credit card payments was a lifesaver, providing step-by-step instructions on how to make a payment over the phone.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit