Over 75% Return on Equity from just one short trade!

Where can I short Bitcoin?

...now that's a question I've been asked a lot recently, and it’s simply because many of us see our portfolio shrinking and red candles everywhere. DON'T PANIC!

Markets can’t go up forever and you would be right in trying to capitalize on the 'bad' days. Assuming you know what shorting is - (if you don’t, read up on it here: https://www.investopedia.com/terms/s/short.asp) - lets dive into the first question, Where?

BitMex

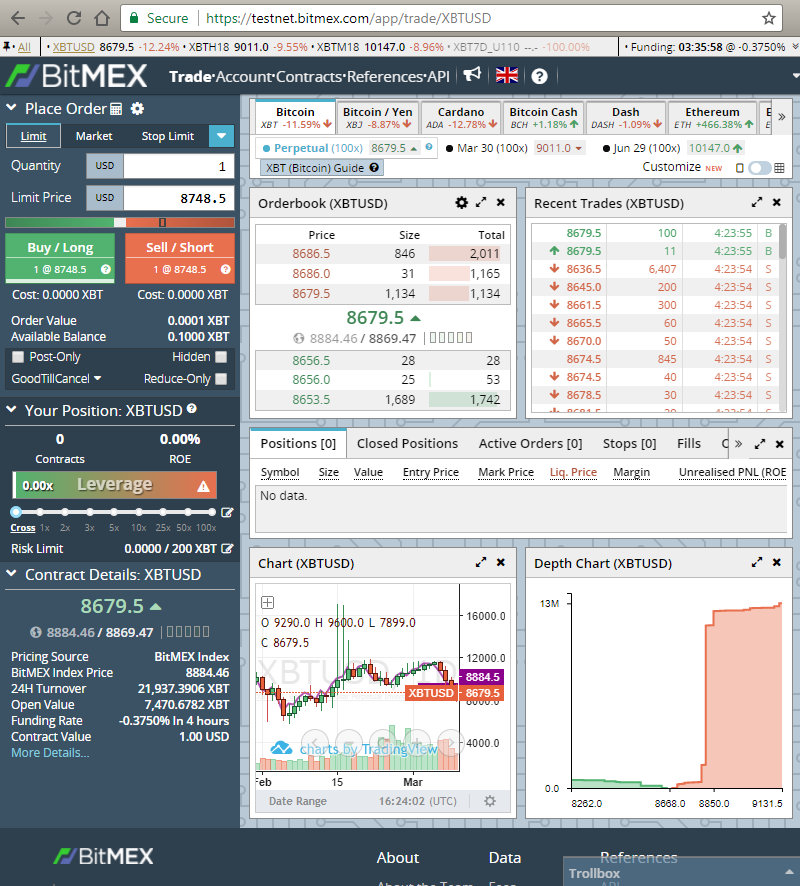

BitMex is a trading platform for cryptocurrencies which offers margin trading, i.e. trading with leverage. Unlike many other trading exchanges, BitMex only accepts deposits of Bitcoin. You can trade against other cryptocurrencies but you don’t not actually own them, only the Bitcoin value of them. You will need to register for an account and for the purposes of this guide, I'd recommend using http://testnet.bitmex.com.

It's a good sandbox version of BitMex expect you get .1 BTC to play with (it's paper money btw, so 100% safe as you can't deposit or withdraw real Bitcoins in the sandbox version).

How can I short Bitcoin?

Above is the main interface you are met with. Don't worry if your interface doesn't look exactly the same, you can drag-n-drop all the window box to suit you. Most crypto investors get scared off by the complicated layout but it's actually pretty simple and most stock traders would actually be more familiar with this than other exchanges. By the end of this guide you should start to feel at home on BitMex and begin to reap the rewards of both the Bull and Bear runs!

The Sidebar

The most important section of this webpage is the sidebar on the left. From here you can buy, sell, add leverage, set orders, glance at your ROE% (Return on Equity) and much more.

Now this works vice-versa, but since you are here to learn how to short, we will focus on that perspective. Firstly, you need to decide on the sell order you want to execute. You can pick an order type within the red highlighted box above.

Order Types for Shorting

- Limit - I want to sell when price hits a higher value (Limit Price) than it is currently at. If you specify a lower value, it will act like the Market Order below.

- Market - I want to sell NOW! At the best possible price in the orderbook (the biggest green number in the orderbook window).

- Stop Limit - I want to set a Limit Order automatically once the price falls below a lower value (Spot Price) than it is currently at. Only specify a higher Spot Price to set a Buy Stop.

- Stop Market - I want to sell when price falls below Stop Price. For a sell, Stop Price has to be lower than current price for a sell order.

- Trailing Stop - I want to sell if the current price falls more than the Trail Value (has to be a negative number for a sell).

- Take Profit Limit - I want to set a Limit Order automatically once the price rises above a higher value (Trigger Price) than it is currently at. Similar but opposite set conditions to a Stop Limit Order.

- Take Profit Market - I want to sell when price crosses a higher value (Trigger Price) than it is currently at.

Confused?! For simplicity sake, take a look at this example:

I want to short Bitcoin at $9,999 because I believe it will fall further. Current price is $10,100. I set a Stop Market Sell Order for 9999.0 as the Stop Price and leave it for now. Over the next few hours, the price falls and at $9,999 my order was filled. I have successfully shorted Bitcoin.

You could have also used a Market order if it wanted to short immediately if you were certain the price would fall further.

As well as, you could have caught Bitcoin at $9,980 and knew it would bounce back to $9,999 before continuing falling, so you set yourself a Limit Sell Order at 9999 as the Limit Price.

Either way you now are riding a Bear Run! But how much did you invest? Where is your expected profit or loss?

Margin Trading with Leveraging

The Quantity field is how many 'contracts' you are willing to trade. Each contract is a Dollar worth of Bitcoin in your Account Balance. Your overall Order Value is:

Order Value = Quantity x executions price

Without any Leverage applied, Order Value shall not exceed your Available Balance.

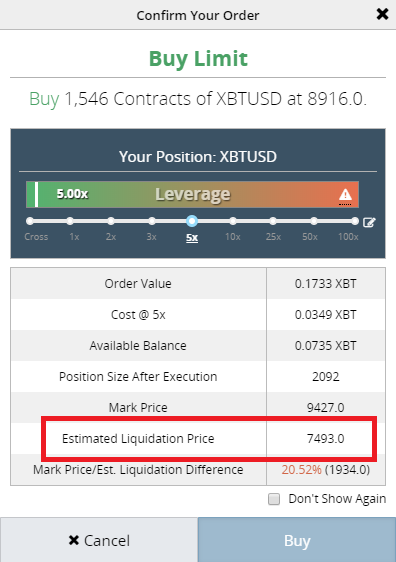

Now under the 'Your Position' tab, you will find the Leverage controls, spanning from 0(Cross) to 100x. There are many risks involved with Leverage and if you happen to lose your heavily leveraged positions, you will be put on blast for all to see. Check out https://twitter.com/BitmexRekt which announces liquidated trades in realtime! Depending on how much Leverage you pick, your Maximum Order Value will increase over the Available Balance you have.

Available Balance > Order Value / Leverage

For Example: you want to 5x Leverage a trade, slide the control to 5x and confirm, then enter a Quantity that will get you just under 5 times more Order Value than your Available Balance.

Once you are ready to initiate the trade, a confirmation box will pop up and display your Estimated Liquidation Price. If the price of Bitcoin ever crosses that number, your trade will be closed automatically and the losses deducted.

To see your current PNL (Profit'n'Loss) on a Position, hover over the Unrealized PNL. This will show the current PNL if you exited using a Market Order i.e. at the current price excluding costs associated with opening the trade.

Taking Profits

There are two ways to close a position:

- Close using either a Limit Order and setting the Limit Price in the window provided in the Position[x] tab and clicking on Close or Market closing for immediate termination and receiving current the PNL by clicking on Market.

- For a more advanced method of Taking Profits/setting Stop Losses, use the Place Order sidebar and much sure the Quantity field reflects the number of Contracts you want to terminate. This is a highly customisable method and offer loads of options to double down, reduce risks by selling only a fraction or increase rewards further by adding to the position.

Picking up on our earlier example, we shorted Bitcoin at $9,999 and the current price in now at $8,500. To take profits at $8,000, all we need to do it set a Take Profit Market Order at a Trigger Price of 8000. To terminate the entire position instantly, we could use Close Position and click on Market.

To mitigate Risk as every successful trader should strive to do, we can set a Stop Loss Order. It good practise to set this immediately after acquiring a position. In our example, we could say that if the price goes up to $10,500, we want to terminate the position and take the loss because we believe that the price we carry on going up and losing us money. To set this, we use Stop Market Order and set a Stop Price for 10500.

BEWARE!: Always make sure that if an order no longer applies in the current situation, delete it! As unfilled orders can still be filled when the trigger conditions apply again and you may not want that to happen. For example, taking profit and leaving your stop losses still unfilled. If you take profit, delete your stop losses and vice versa. Find unfilled orders in Active Orders.

Go Forth and Maximise Profits!

BitMex offers a lot more than just shorting Bitcoin, but the principles mentioned above apply to the other trading pairs offered and vice versa for longing assets too. Also to remember, BitMex deals in only Bitcoins account side, therefore you can only hold Bitcoin and Profit/Loss is applied to the value of Bitcoin you hold.

Above^^ bonus example of Longing Bitcoin on BitMEX Testnet with Stop Loss and Take Profit set.

Informative guide. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @whaleofcoinbase! You received a personal award!

Click here to view your Board of Honor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @whaleofcoinbase! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit