Bitcoin is in it's 3rd day of consolidation with no clear sign of where it'll go next. Unlike some other popular analysts, I've been telling you for weeks that this market is nearly impossible to predict at the moment. The contradicting, mixed signals are unlike anything I've seen to date. In this update, I'm going to point out a few of the many mixed signals, as well as focus on big picture support and resistance lines you should be watching.

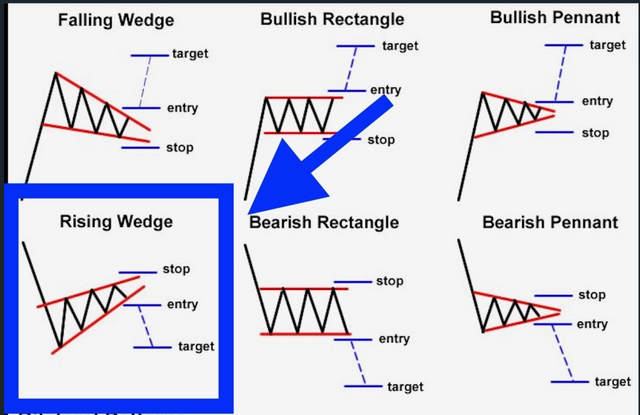

First, looking at the 4hour chart, there's a bearish rising wedge that's formed.

This rising wedge pattern, followed by a drop, has been repeating itself over and over for the last 4 weeks. While this is obviously bearish...if this pattern breaks, it'd be a bullish indication of a possible trend reversal.

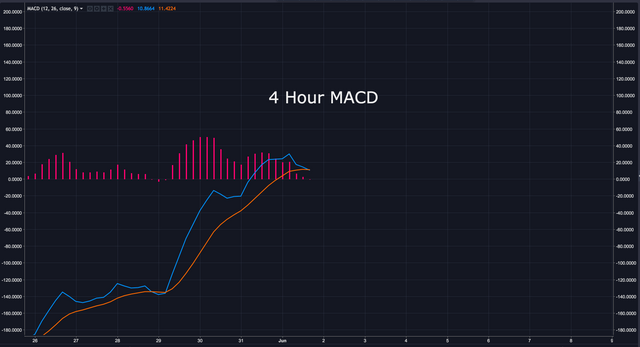

The 4 hour MACD looks like it's just crossing over to the bearish side...also lending validity to a possible upcoming drop.

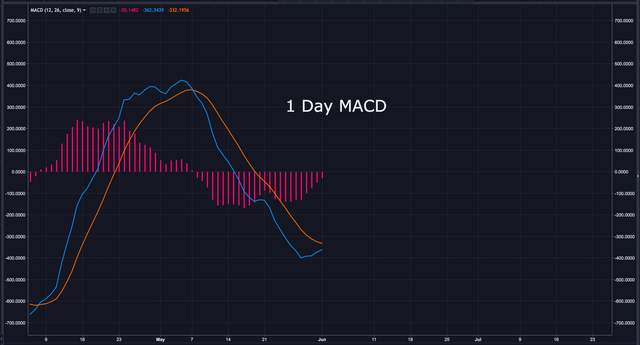

However, zooming out to the 1 day MACD, we can see it's looking rather over sold and possibly ready to cross back over to the bullish side.

The 1 day Stoch RSI has been consolidating in the oversold region for a few weeks. This usually shakes out many sellers, building energy for a bullish breakout.

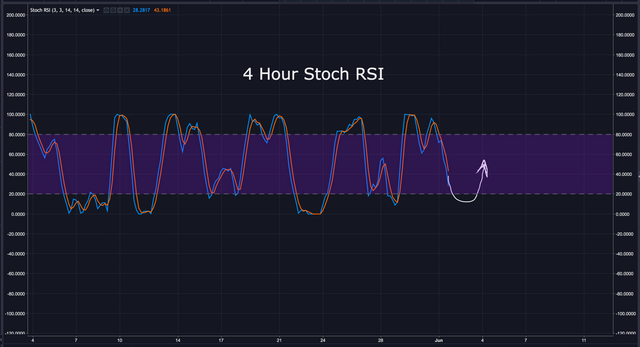

The 4 hour Stoch RSI Looks like it's got some room to drop, however, not much. We may see a temporary drop followed by buyers swooping in to push it right back up.

The 1 day MACD is showing clear bullish divergence. This could also indicate a possible bullish breakout is coming, and completely contradicts the bearish rising wedge pattern.

Looking at the 4 hour chart, we can see bitcoin briefly penetrated the 55 day EMA, but was quickly pushed back down. This will be a key area to watch. If bitcoin can decisively break above the 55 day EMA, it'd be an extremely bullish indication.

Another indicator to watch is the 4 hour RSI. An ascending support line has formed. Let's see if this support can hold.

The 4 hour MACD has also remained within the wedge I've been pointing out these past few weeks. We're nearly at the apex, which means bitcoin may be ready to breakout in one direction or the other.

Now that we've discussed some of the mixed signals, let's look at the actual chart.

Looking at the big picture, there are 4 major descending resistance lines bitcoin needs to break through before it can truly start the bull run we've all been waiting for. At each one of these points, we should expect a possible drop.

If/when bitcoin breaks above one of these resistance lines, it may be a good time to enter a temporary position. I'd put a sell order just prior to the next resistance point, and make sure I had a tight stop-loss.

There's also a strong ascending support line I've highlighted in orange. Should bitcoin drop below this support, it may be a good time to enter a short position. The next major area of support is $6,815. Planning to exit your short just prior to $6,815 would be logical.

WARNING: This is NOT financial advice, it's simply my opinion.

Finally, zooming in, we can see bitcoin has been trending down within a channel. We're reaching a critical point where it's going to either breakout above this channel, or break below the ascending support line.

The next 48 hours should be very interesting. Unless you're a skilled trader, I'd probably sit on the sidelines until there's more confirmation on which direction bitcoin will take. That said, each to their own. Only you know how much risk you're comfortable taking.

BIAS:

Short Term: Neutral

Longterm: Very Bullish

I hope this has been helpful. I’d be happy to answer any questions in the comment section below. Thanks for stopping by.

If you found this post informative, please:

Disclaimer: I am NOT a financial advisor and this is NOT financial advice. Please always do your own research and invest responsibly. Technical analysis is simply a guide. It doesn’t predict the future. Anyone that claims they know exactly what’s going to happen is foolish, lying or both. Technical Analysis should only be used as a tool to help make better decisions. If you enter a trade, I recommend having a stop loss and sticking to it. You will loose at times. The key is to have more wins than losses. With that in mind, I wish you great success.

If you don’t have an account on Binance, I STRONGLY recommend getting one. They’re usually the first to get reputable coins, have excellent security and second to none customer service. You can sign up here free of charge: https://www.binance.com/?ref=16878853

FYI…I just started a twitter page where I’ll post analysis, along with other relevant crypto data from myself and others. If you’d like to be notified as soon as updates reach Steemit, the twitter handle is @Workin2005

Excellent, in depth and easy to understand analysis. You’ve got a real gift. Thank you for helping us navigate this crazy market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you think alts could boost bitcoin in price. i think looking only at the feelings inside the market we have a much more positive attitude in the crypto sphere in the last days compared to the week before. Big altcoin announcements this month (eos/iota) might get the whole market go up again. Do you think this might have an impact on Bitcoins bull?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If the EOS rollout goes smoothly, yes, we could see renewed interest in the market.

Right now, most alcoins are tied to bitcoin. As many altcoins start to implement their vision, we may see them start to rise and fall on their own merit.

In my opinion, the main thing that's preventing a bull run is lack of regulatory clarity. As soon as the SEC comes out and clarifies it's position, we'll most likely see a flood of new money enter the market. I believe many people are interested in buying, they just want to know the rules before playing the game.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit