Welcome friends to one of my infrequent market/economics posts. While my passion today is the many historic sites I have first hand knowledge of in The American southwest and my native Northeast, and oh yes, baseball, my profession was "the markets". I study and understand what moves them. I'm more concerned with where we are and where we're headed longer term. I never lose site of the fact that there are several factors that work in concert:

Fundamentals: Dow Jones at 27,000 produced a "Price/earnings ratio" of 32! (times underlying earnings of the DOW 30); Same for S & P. Meaning? Historically a top. Bottoms more like a PE of 10. Always, swings are well over priced, or well underpriced.

Market Sentiment: "fear drives Market"....and can be measured. a.) put/call ratios b. public shorting of stocks. But one must understand and interpret the numbers. NOW? we have lots of negative sentiment, thus I see at 24,400 DOW fear indicators very positive. Look for downside containment and possible suprise move upwards trying to approach the old highs. BUT, beyond? Negative. see below.

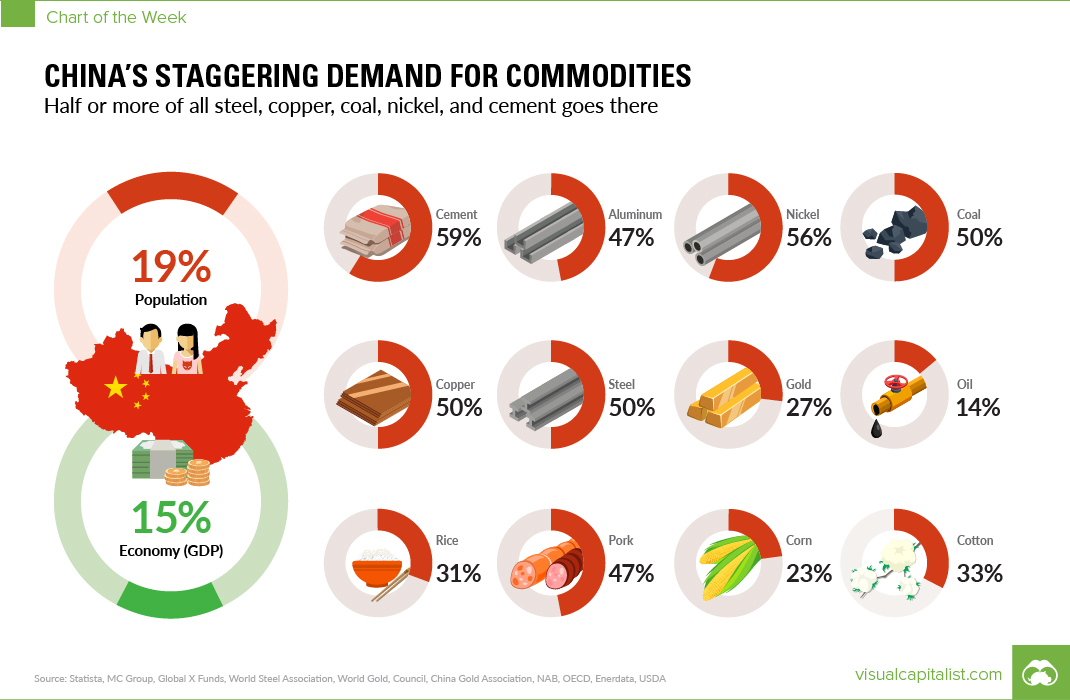

See above the chart on CHINA's thirst for commodities. (compliments Visual capitalist).

World economic circumstances:

China last year completed 77 of the world's 144 tallest buildings. All a minimum of 656 feet. Their demand for commodities is literally off the charts. Furthermore China will be demanded a gold backed currency and does not wish to be holding our debt nor supporting it any longer. The dollar is in decline (except for reflex rallies). the chart is bad and will drop probably 20 percent more at a minimum. The debt of Japan, China and other industrialized nations is even a greater pct. of GDP than the US! So interest rates continue to rise. Help for the dollar? perhaps. But not so much if interest rates rise worldwide.

Where to be? Sell the rally I said should happen in the US markets. Continue to buy silver first, gold second. Coincidentally the commercials are now coverring short positions in the metals. Serious strenght is coming rather soon in both.

The cryptos: I said weeks ago, sell Bitcoin at 15,000, hold at 10,000, BUY at 8000 (and below). I'd not accumulate here, but hold. 13,000-14,000 likely...then let's take a look. I wish I had a better handle on the real long term.

For the metals, the long term is dramatically higher prices over the next several years.

Great post. You should really make your way over to @steemsilvergold. Many silver stackers there!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you...and will do!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

much appreciated!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Proof that China is coming up in the world - "China last year completed 77 of the world's 144 tallest buildings. All a minimum of 656 feet."

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

that is just one example, and a major one..there are far more..look at balance of trade. look where wealth is transferred.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. Great analysis. Great detail. It's simply GREAT! Thank you for sharing your knowledge on the subject. -Dan "World Travel Pro!"

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

you are awefully kind, travel-pro!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lovely post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit