The second half of 2017 saw a huge rise in cryptocurrency market cap with the market cap of all cryptocurrencies growing from about US$16 billion at the start to 2017 to about US$600 billion at the end of the year.

Although this rise was publicized in the media as a boom in bitcoin, towards the end of 2017, bitcoin's price fell from a peak of US$20k to about US$13k now. Other crypto such as ripple, bitcoin cash, cardano, iota, and litecoin are catching up.

One of the main misconceptions with cryptocurrency is that it is a decentralized system that is unregulated and free from government control. Given that some governments have indicated plans to create national cryptocurrencies (e.g. Russia's cryptoruble and Venezuela's oil-backed petro cryptocurrency) it is clear that cryptocurrency does not necessarily need to subvert government. The ripple cryptocurrency is compliant with banking regulations and is designed to enable quick, fast, and cheap transfer of funds between banks.

Cryptocurrency is merely a means of using cryptography to denote ownership of financial assets over the internet. The competition among the different ways of scaling, blockchain vs tangle, and centralization vs decentralization will all play out in the crypto market place in the same way that Google, Facebook, Microsoft, etc all compete to provide the best services for customers in the web market.

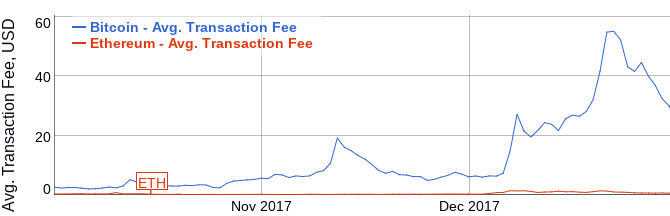

Bitcoin transaction fees are falling

According to bitinfocharts.com bitcoin transaction fees seem to be dropping from their highs a few weeks ago. Nevertheless, the average bitcoin transaction fee is still a whopping US$30 on average compared to ethereum's US$0.60.

As bitcoin dominance starts to fade, many other cryptos are catching up, and many of these altcoins have significantly lower fees and innovative scaling techniques. That being said, bitcoin's promised "lightning network" may provide the solution to high transaction fees all while maintaining a decentralized system. Whether lightning network works as planned is yet to be seen, but personally I am holding (or "hodling") my bitcoins.

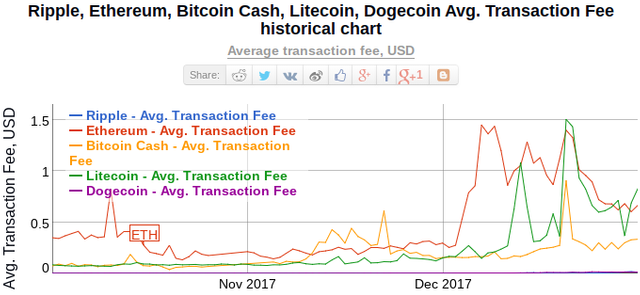

Litecoin fees are starting to rise

Removing bitcoin from the transaction cost chart, it becomes much easier to see the differences in fees among the altcoins. What is interesting is that litecoin is often seen as the "silver to bitcoin's gold." This is due to lower transaction fees.

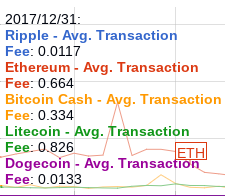

However, recently litecoin's transaction fees have risen to around 80 cents while fees of bitcoin cash and the ethereum are lower. Bitcoin cash, with an average of 30 cents per transaction, is the lowest fee crypto on Coinbase, making it a suitable "vessel coin" to buy at Coinbase for the sole purpose of moving it to an exchange for conversion. Transaction fees for ether were above US$1 for some period of time likely due to the cryptokitty craze, but ether fees are starting to fall such that litecoin fees are now higher than ether's.

Dogecoin and ripple have the lowest fees by far with each transaction only costing one cent.

do not let go of bitcoin .not yet at least.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit