Detail of Top Cryptocurrencies

Bitcoin:

The king of all cryptocurrencies; Bitcoin currently has a market capitalization (number of coins multiplied by value of each coin) of over $357 billion, or roughly 45% of the value of the whole cryptocurrency market.

Ethereum:

The Ethereum platform has enabled many companies to raise tens (or even hundreds) of millions of dollars in funding for their own Ethereum-based projects. This has further increased Ethereum’s value, reaching around half of Bitcoin’s market cap this year.

Bitcoin Cash:

Although it has only existed for a few weeks, Bitcoin Cash has already surged to top five in terms of market cap. That's because Bitcoin Cash is actually a fork of Bitcoin, supported by the biggest Bitcoin mining company as well as the manufacturer of Bitcoin mining chip

Ripple:

Ripple is a payment network that enables "secure, instant and nearly free global financial transactions of any size with no chargebacks."

Ripple is unlike most cryptocurrencies in that it doesn’t use a blockchain to establish consensus for transactions. Instead, it uses an iterative consensus process that makes it faster than the Bitcoin network, but may also leave it more exposed to attacks.

The developers of a rival network called “Stellar Lumens” that used the same consensus ledger as Ripple discovered that the system is unlikely to be safe when there is more than one node validating a transaction. However, Ripple strongly disagreed with the conclusion and claimed Stellar had incorrectly implemented the consensus mechanism and lacked some of the built-in protections that Ripple had supposedly built.

Ripple has seen some success in convincing large financial institutions, including Japan's largest banks, to test its blockchain and perhaps even implement it in the future

Bitcoin Gold:

Bitcoin Gold also implements new safety features such as replay protection (against attackers trying to repeat or delay data on the network) as well as a unique address format.

Litecoin:

it also uses a different mining algorithm, called “scrypt,” compared to Bitcoin, which uses SHA256. This gives Litecoin a mining decentralization advantage because people only need GPUs to mine Litecoin, as opposed to Bitcoin, where ASICs are required these days for any sort of mining reward.

Dash:

Dash uses a two-tier architecture for its network. The first tier consists of miners who secure the network and write transactions to the blockchain, and the second tier is made of “masternodes.” Masternodes relay Dash transactions and enable the InstantSend and PrivateSend types of transactions.

IOTA:

IOTA is a cryptocurrency technology that targets the Internet of Things (IoT) and doesn’t use a blockchain in order to reduce the computational needs of the network and eliminate transaction fees.

Ethereum Classic:

Ethereum Classic is the original version of Ethereum; the new “Ethereum” is a fork of this original version. The split happened when a decentralized autonomous organization built on top of the original Ethereum was hacked. “The DAO,” as this organization was called, acted as a venture capital fund for future distributed applications that would be built on top of Ethereum.

Monero:

Monero’s coins are also fungible, which means there won’t be any way for an exchange or for vendors to block certain Monero coins. All Monero coins will be interchangeable with others.

NEO:

NEO is a smart contract platform that enables all sorts of financial contracts and even third-party distributed applications to be developed on top of it, much like Ethereum. Unlike Ethereum, where developers can only use its own JavaScript-like “Solidity” programming language, NEO allows developers to use any coding language they like

NEM:

NEM, on the other hand, encourages owners of its coins to spend them fast and furiously in order to gain even more NEM coins.

Cordano:

Cardano is a new cryptocurrency that comes with some interesting new innovations. It was built by a team of technology-focused developers and academics from multiple universities. One of these innovations is that the code was written in Haskell, a more memory-safe programming language, which should minimize the existence of bugs on the Cardano network.

EOS:

With EOS, you can also roll back changes to fix serious bugs if a supermajority of users agree to the changes. Presumably, this is done to avoid the same situation that created Ethereum Classic and the new Ethereum fork

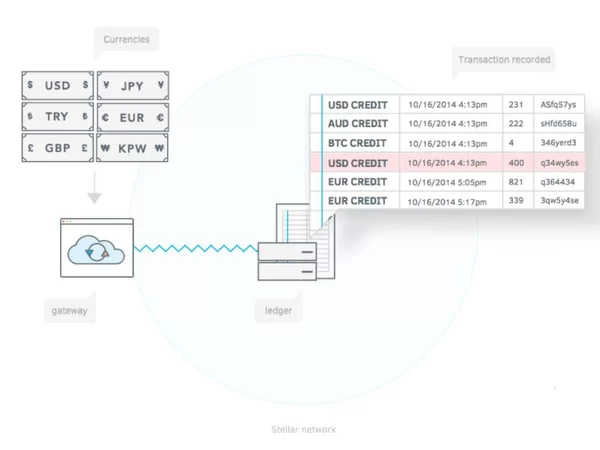

Stellar Lumens:

this coin is my favourite coin,,Stellar Lumens is a cryptocurrency similar to Ripple and aims to become the de facto cryptocurrency system used by banks and other financial institutions. The “lumens” are the currency units that exist on the Stellar network.

The developers behind the Stellar network believe that lumens could eventually be used as a “bridge” between different cryptocurrencies. However, to exchange between cryptocurrencies, you’d have to trust a third-party “anchor,” similar to how you trust a cryptocurrency exchange to convert your money from one currency to another. The main difference seems to be that these anchors will live on the Stellar network.

Recently, IBM announced a partnership with Stellar to enable banks to complete instant cross-border transactions with each other, which seems to have propelled Stellar Lumens back into the top 25 cryptocurrencies. IBM will use its own custom blockchain solution for much of the transaction clearing, but the transaction settlement will be done on the Stellar network.

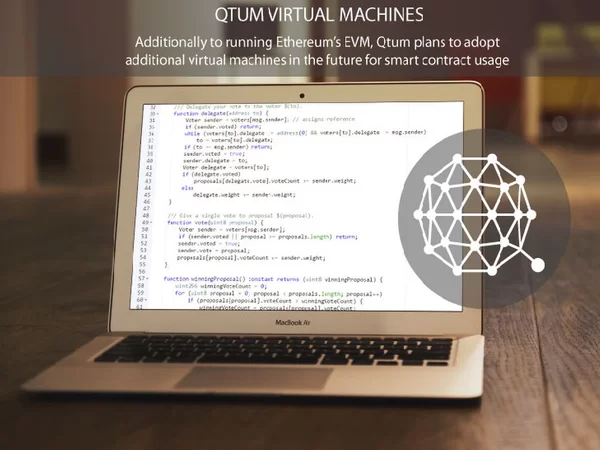

Qtum:

Qtum is a merger of Bitcoin and Ethereum’s technologies that targets business applications. It also uses an efficient PoS system to increase the efficiency of network transactions.

The underlying technology uses an “Account Abstraction Layer” that acts as a bridge between the Ethereum Virtual Machine and the Unspent Transaction Output model of Bitcoin Core. This gives the network Bitcoin’s reliability while enabling the development of smart contracts and distributed applications (DApps), similarly to how it works on the Ethereum network.

The development team believes that Qtum’s applications should be easier to develop and that they should also be more secure than those on the Ethereum network. They further believe that the industries that will benefit most from its platform will be mobile telecommunications, counterfeit protection, finance, industrial logistics (shipping, warranty, etc), and manufacturing.

Zcash:

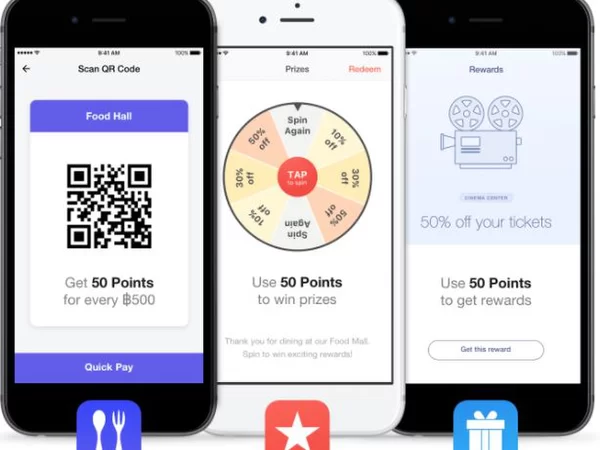

OmiseGO:

OmiseGO is a public Ethereum-based financial technology that can be used in digital wallets and enables peer-to-peer exchanges of fiat currency (USD, Euro, etc.) and cryptocurrency in real time. The goal of the project is to “unbank” users, or in other words, to disrupt the banking industry by making people realize they don’t need a bank account to use digital money.

According to the OmiseGO developers, “anyone will be able to conduct financial transactions such as payments, remittances, payroll deposit, B2B commerce, supply-chain finance, loyalty programs, asset management and trading, and other on-demand services, in a completely decentralized and inexpensive way.”

The OmiseGO decentralized exchange doesn’t treat fiat currencies any better than the cryptocurrencies on its network, which means the system is constructed so that the best currencies win.

Lisk:

Lisk aims to be the first “modular blockchain,” where each distributed app on top of it is not just a token (as in Ethereum’s case), but its own blockchain (or sidechain). The developers gave a few example for how this technology could be used:

Decentralized storage can be done on a stand-alone blockchain or on Lisk.

Anonymous transactions can be done on a stand-alone blockchain or on Lisk.

A social blogging system can be done on a stand-alone blockchain or on Lisk.

The list goes on. The sidechains are operated using the same DPoS system used by the parent Lisk blockchain, and they're secured by the top 101 delegates. These top delegates are decided based on the weight of the voting of other users in the network.

Hshare:

Hshare is the the precursor to Hcash. The Hshare token was created primarily for the Initial Coin Offering (ICO) through which the developers of the Hcash cryptocurrency raised funding. For 10 months after the ICO, Hshare owners will be able convert their Hshares into Hcash.

Tether:

The company behind Tether claims the coins are backed 1-to-1 by USD reserves and that its holdings are published daily, and frequently audited. However, the company also says it won’t, itself, convert your Tether coins to USD. You will have to exchange your tether to other currencies via online exchanges.

BitConnect:

BitConnect is a blockchain-based lending platform where users can purchase BitConnect coins with Bitcoin and then lend those Bitconnect coins to others for a profit. According to the developers, BitConnect lenders can expect to gain a profit of up to 40% per month, which sounds quite incredible, and perhaps too good to be true. This has led some to believe that BitConnect may be a scam.

Waves:

The Waves platform enables its own decentralized exchange, so owners of any Waves digital asset can directly exchange their coins/assets with any other owner of a Waves token straight from the Waves platform

Stratis:

Stratis is a Blockchain-as-a-Service (BaaS) platform that aims to provide solutions for corporations in the financial sector by allowing these companies to build their own private blockchains on top of the Stratis platform. Not all companies may want to have their transactions out in the open for anyone to track, especially if the cryptocurrency platforms they have to use lack private transactions features. This is where a platform such as Stratis can be helpful.

Stratis also uses C#, one of the most popular programming languages in the enterprise sector, which could give it a leg up over other similar platforms. Stratis also allows companies to implement features seen on other platforms such as Ethereum or Waves on their own private blockchains.

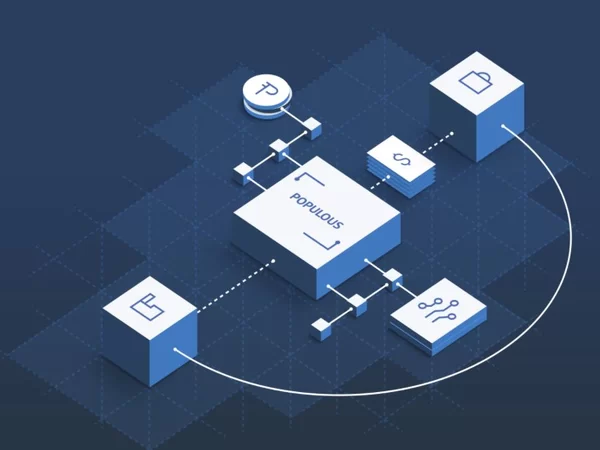

Populous:

Populous’ aim is to create a global trading environment for investors and sellers to trade invoices from around the world. One idea is that Populous could help companies better manage their cash flows by presenting them with investors who are willing to buy their invoices and give them the cash they need immediately, instead of having to wait 45-90 days to receive the money from their own customers. This way, companies that are strapped for cash have an alternative to increasing their cash flow without getting a loan from a bank.

i post here about cryptocurrency top list, hope all lover of blockchain will love it,,

lololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololololol

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

:D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.tomshardware.com/picturestory/778-biggest-cryptocurrencies.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great report! I love how you used all of the pictures accordingly and left out the boring graphs. Great work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks dear,, it is your respect,,to me @runicar , need your suport if you like to upvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh you just copy pasted this from somewhere? Ain't gonna get anything for that.....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post says bitcoin has market cap of $57 billion, it has market cap of $300 bil as per coinmarketcap

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

may be typing error

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

has been correct 357,, is

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Super post..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks owais

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks @shajj

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/family/@engesraa/alaaelh-family

upvote plz :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yeah sure dear @engesraa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks ! <3

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

mostwelcome dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i did dear

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

great post, as usual!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks dear @

[-]five34a4b

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit