Implementing cryptocurrency payments into your business seems like a normal thing to do recording the present marketing trend.

Me, for instance, I own a travel agency in Greece, a villa rental and sailing holidays, to be accurate, and I would love to open up a window for the virtual money, as we consider it will be the next step, in the future.

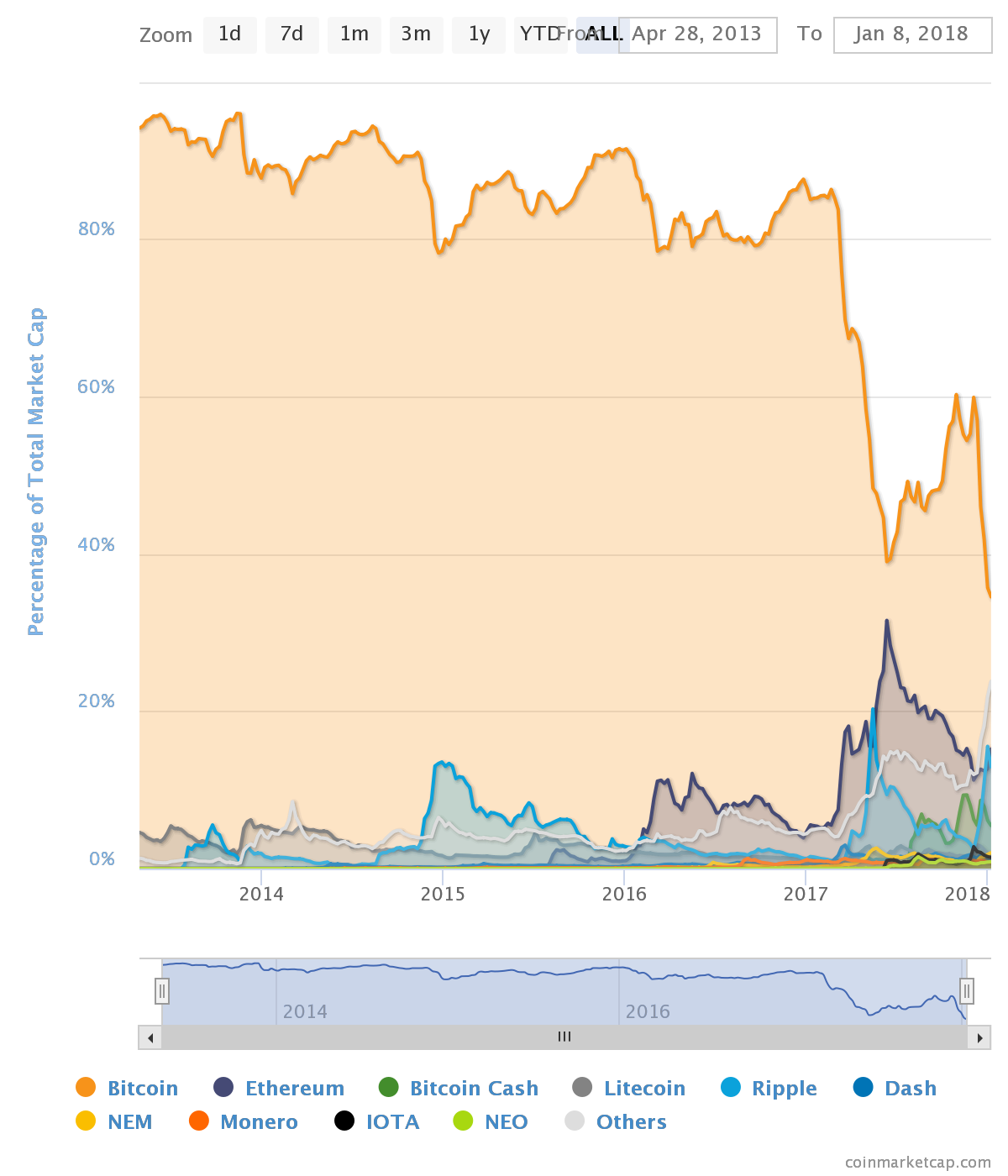

Unfortunately, the cryptocurrency market is still very volatile, the cryptocoins following a chaotic, but most of the time, ascendant course, as you can see on the chart bellow.

For instance, if a customer would buy a holiday villa package, worth 0,25 BTC, that would be around $ 3.963. If the next day, the currency depreciates about 5%, then the agency would be losing around $ 198.

With this kind of value fluctuations, businesses would close within a week from launching.

So, for now, it would be more like a gambling, bad business idea. But, hopefully, soon, there will be found a solution to keep the cryptocurrencies values on a normal flow, with more stabile values.

Hopefully, soon, the banks will accept virtual coins, that being the point of start for a solid and stabile virtual cryptocurrency market.

The Steem Dollar (SBD) was supposed to help with that, but I guess it's not easy maintaining a currency peg yet, and it is currently worth around $8 USD instead of $1. I think this will come though in time, like you say.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My opinion is that a virtual central bank is mandatory in this case, in order to pump virtual coins, when needed, and keep it away from speculations. For instance, if I have 5 millions of dollars, I buy ethereum and bitcoin, the price goes crazy high, as the cryptocurrency is limited and sell it in a week, getting the maximum profit of it. But, this way, the market gets high and crashes after a short while.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I can't easily explain the mechanics, but Steem has a nice way of preventing SBDs from dropping below $1, but no equivalent function for preventing speculative pumping. Resolving this problem seems a bit difficult partly because a policy response would require consensus among the witnesses, or blockchain software changes that are difficult to agree on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit