Summary

- Never day trade

- Never invest money you cannot afford to loose

- Diversify

- Buy low, sell high

- Do your research

Introduction

I know my bogs can be stuffed with information, so I will keep this one short.

If you are new, and looking to get into a free market (shares or cryptocurrencies), then these are some tips you might like to follow/remember.

1. Never day trade

Day trading makes you loose sight of the bigger picture, its general trend and leaves you exposed to a lot of emotions. It is akin to gambling given it's fluctuation at a daily movement level. If you see a huge jump in price, or a quick fall in a cryptocurrency, emotions to buy and sell will always be involved. In Figure 1, shows you a volatile graph of day to day trading for Microsoft's share prices, where you may have no idea when something will go down or go up.

Note, for all graphs, X-axis is time, Y-axis is price per share.

Figure 1

.png)

Tool: Macrotrends.net, from 8 February 1996 to 1 March 1996.

However in Figure 2, this shows you the share price of Microsoft from 13 March 1986 until 1 July 2017. In the bigger picture Microsoft was able to succeed.

Figure 2

.png)

Tool: Macrotrends.net, from 13 March 1986 until 1 July 2017

2. Never invest money that you cannot afford to loose

If you have $10,000 in your bank account, do not invest all $10,000. For example only invest $5,000 and leave the other $5,000 in your bank account. You want to invest enough where even if all of your investments were to crash and burn, you would have enough money to live and start over.

Note, when a recession hits, it is often those people who have a lot of cash on hand that tend to do very well (i.e. a lot on the bank).

3. Diversify

Investing 101. This is drilled into you during university, but there are too many people to count that have not followed it and lost it all. Diversifying into other shares or assets (eg. retail shares, mining shares, property and your bank account) is a good way to spread your risk. Even if one industry crashes, you have three more investments in other industries that are growing.

Note, there are people around the world that have gotten rich very quickly. But most wealthy people have gained their wealth overtime by growing it progressively and slowly. A lot of one hit wonders will fall as fast as they grew.

4. Buy low, sell high

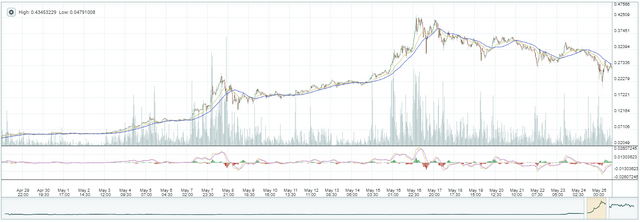

Sometime, you wonder if people were born knowing this phrase. Another Investing 101 that people often say to follow but do not. This comes down to emotions. People will buy when they see a positive trend, but sell when they see a negative trend. You want to do the opposite. You want to pre-empt the trend, and this comes with experience. For example, in Figure 3, a lot of people bought into the bull market of Ripple, around May 15th. Now the share price is close to where it was before the hype.

Tool: Poloniex, Ripple price history

People should have bought low when the price dipped around the 9th of May, then sold when they felt they had made sufficient gains. It is always hard to judge the direction of the market, but the more you are informed and understand the stock or the cryptocoin, the better you can pre-empt the market.

Note, a lot of the share market and concurrency comes down to emotion. Be greedy when others are fearful, be fearful when others are greedy. Right now, in my opinion, people are being greedy.

5. Do your research

Do not buy an asset simply because one of your friends has told you that it is a good asset. Research it, understand it, see how it works. This involves looking at news, company reports, analysis, charts, financial reports, mission statements, direction. A list of general factors are below for researching shares.

- Geo-political factors

- National factors

- Economic factors

- Industry factors

- Company Factors

- Financial factors

- Social factors

When it comes to stocks, with all your research, you should be asking one important question. Would you be comfortable buying the company outright? If the answer is no, then you should not invest in it or do more research.

With cryptocurrencies as well, you should be looking at what would the coin be used for? Does the project have a future? What problem does the project solve? How good is the management of that project? Is the block chain able to scale with a heavy increase in the demand to meet expectations if it goes mainstream?

With cryptocurrencies, with all your research, you should still be asking the same question. Would you be comfortable buying the project outright? If the answer is no, then you should not invest in it or do more research.

Tools