In the dynamic realm of digital finance, cryptocurrencies have emerged as a groundbreaking innovation, disrupting traditional financial systems and offering users a decentralized and borderless alternative. This article serves as a comprehensive guide to the basics of cryptocurrencies, with a focus on the most prominent players in the market—Bitcoin, Ethereum, and various altcoins.

Understanding the Foundation: What Are Cryptocurrencies?

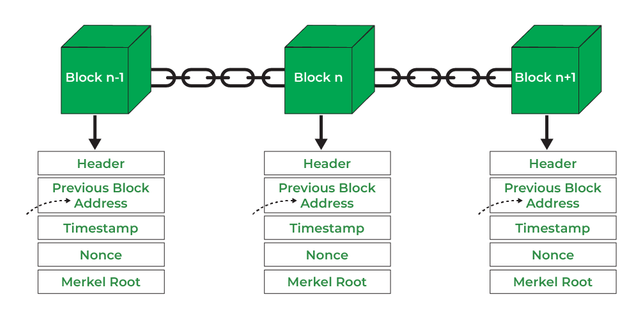

At its core, a cryptocurrency is a form of digital or virtual currency that employs cryptography for secure financial transactions. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This groundbreaking technology ensures transparency, security, and immutability of transaction records.

Bitcoin (BTC): The Pioneer

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, stands as the pioneer of cryptocurrencies. Often referred to as digital gold, Bitcoin operates on a peer-to-peer network, allowing users to send and receive value without the need for intermediaries like banks. The finite supply of 21 million coins contributes to its scarcity, a key factor influencing its value.Ethereum (ETH): Beyond Currency

While Bitcoin primarily serves as a digital currency, Ethereum extends the capabilities of blockchain technology. Launched in 2015 by Vitalik Buterin, Ethereum introduces smart contracts—self-executing contracts with coded terms. This opens up a world of decentralized applications (DApps) and programmable transactions, expanding the use cases beyond simple peer-to-peer transactions.Altcoins: Diversifying the Crypto Landscape

Altcoins, or alternative coins, refer to any digital currency other than Bitcoin. These coins aim to address perceived limitations or offer unique features. Notable altcoins include Ripple (XRP) for cross-border payments, Litecoin (LTC) for faster transaction confirmation, and Cardano (ADA) for its focus on scalability and sustainability. Each altcoin brings its own value proposition and use case to the crypto ecosystem.

How Cryptocurrencies Work: A Brief Overview

Cryptocurrencies leverage blockchain technology to validate and record transactions. In a nutshell, a blockchain is a decentralized ledger that chronologically records all transactions across a network of computers. This ledger ensures transparency, security, and immutability by requiring consensus among network participants.

Mining and Consensus Mechanisms

Bitcoin, and many other cryptocurrencies, rely on a process called mining to validate transactions and secure the network. Miners use powerful computers to solve complex mathematical puzzles, and in return, they are rewarded with newly minted coins. Other consensus mechanisms, such as proof-of-stake (PoS) and delegated proof-of-stake (DPoS), offer alternative approaches to validating transactions without the resource-intensive nature of mining.

Investing in Cryptocurrencies: Opportunities and Risks

As the popularity of cryptocurrencies grows, so does interest in investing in these digital assets. Before diving into the market, it's crucial to understand the opportunities and risks involved.

Opportunities:

Potential for High Returns: Cryptocurrencies have shown the potential for substantial returns on investment.

Diversification: Including cryptocurrencies in a diversified investment portfolio can reduce overall risk.

Risks:

Volatility: Cryptocurrency prices can be highly volatile, leading to both rapid gains and losses.

Regulatory Risks: Regulatory developments can significantly impact the value and legality of certain cryptocurrencies.

Conclusion: Navigating the Crypto Landscape

In conclusion, cryptocurrencies have evolved from a niche concept to a global financial phenomenon. Understanding the basics of Bitcoin, Ethereum, and altcoins provides a solid foundation for navigating the crypto landscape. Whether you are a curious newcomer or an experienced investor, staying informed about the ever-changing crypto space is key to making sound decisions in this exciting and dynamic market.