On June 25, Japan's Minister of Finance, representative Fujimaki recommended that the present assessment rate for crypto exchanges in the nation, which goes up to a greatest of 55 percent, could be swapped with a 20 percent level duty like stocks or forex exchanges.

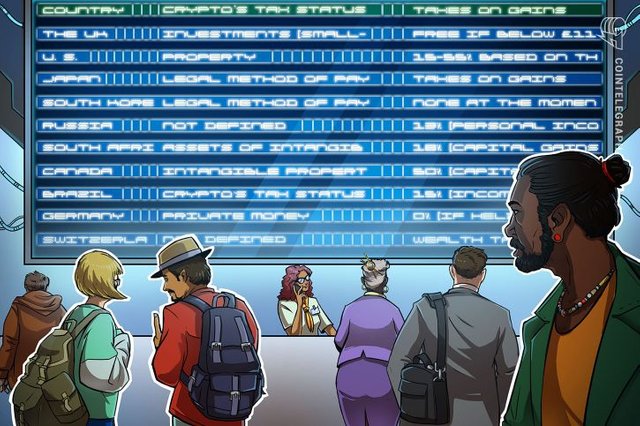

While Japan is uncertain if the present duty structure ought to lose its dynamic scale — saying "impose reasonableness" as one of the contentions for staying with the old model — some significant markets don't have clear rules for how Bitcoin and altcoins are exhausted by any stretch of the imagination. Here's the means by which digital forms of money are at present exacted from the U.S. to Switzerland.

The U.K.

Crypto’s tax status: Investments (small-scale holding); working capital (if used regularly)

Taxes on gains: Free, if below £11,850, then up to 45 percent

Her Majesty's Revenue and Customs (HMRC), an organization in charge of gathering charges in the U.K., presented its guide on the tax assessment of Bitcoin and different coins in 2014. Hence, salary got — and charges identified with exercises including crypto — are liable to company assess, pay expense or capital additions impose, contingent upon the specifics. As a HMRC delegate disclosed to British media outlet Alphr, "regardless of whether any benefit or pick up is chargeable or any misfortune is suitable will be taken a gander at on a case-by-case premise."

All things considered, digital forms of money regularly fall into the capital increases assess class for easygoing clients in the U.K., being thought about speculations. Be that as it may, a few merchants may be at risk to salary charge, contingent upon how frequently they exchange and the volume of those tasks. As indicated by HMRC:

Where an advantage (counting Bitcoin) is held as a venture — instead of being working capital in an exchanging action — the assumption is that any benefit or pick up on its transfer will be charged to Capital Gains Tax."

So also, crypto-to-crypto exchanges are assessable occasions too. Be that as it may, as the HMRC brings up, each circumstance may fluctuate, contingent upon the conditions.

Vitally, there's a tax-exempt stipend for each U.K. national of working age. For the 2018/2019 assessment year, for example, it constitutes £11,850 per individual. In the event that the citizen surpasses that sum, he or she is subject to pay 20 percent charge on anything earned amongst £11,851 and £46,350, 40 percent on income of £46,351-£150,000 and 45 percent on increases above £150,000.

The U.S.

Crypto’s tax status: Property

Assessments on increases: Calculated in light of the coin's an incentive as of the date it was exchanged

The Internal Revenue Service (IRS), a U.S. government organization that gathers charges and upholds impose laws, sees digital currencies as properties. In this way, on the off chance that you offer your coins for a benefit you will be obligated to pay a capital additions charge.

In 2014, the organization issued general direction on how cryptos are saddled. As indicated by Notice 2014-21, got or mined digital currencies must be incorporated into registering gross pay with honest estimation of the virtual money as of the date it was gotten. The duties are figured in light of that esteem. Thus, endowments, mining and crypto-to-crypto swaps are for the most part assessable occasions, evaluated by the estimation of the coins on the day those occasions occured.

Significantly, crypto-representatives are not required to issue 1099 divulgence shapes — the ones utilized by the IRS to report wage other than wages, pay rates and tips — which makes the way toward detailing acquires troublesome for crypto clients. In any case, U.S.- based crypto trade and wallet benefit Coinbase has apparently sent the frame to a portion of its clients.

The IRS has demonstrated huge enthusiasm for digital currencies as a wellspring of income in the course of recent years. For example, in February 2018, Coinbase sent an official notice to roughly 13,000 of its clients, educating them that their information is being given over to the IRS per their demand. Also, the IRS purportedly utilizes programming for following purposes and reminds crypto holders to pay their expenses through updates, featuring the "inalienably pseudo-mysterious viewpoint" of cryptographic money exchanges.

Japan

Crypto’s tax status: Legal method of payment

Assessments on picks up: 15-55 percent, in light of the volume

As of now, increases profited — which are named a lawful technique for installment — in Japan are delegated "random pay," concurring the Japanese National Tax Agency, the nation's central assessment office.

Basically, that implies that Japanese crypto holders need to pay in the vicinity of 15 and 55 percent on their benefits pronounced on their yearly assessment filings. The best sum applies to individuals who procure in excess of 40 million yen ($365,000) yearly.

As indicated by Bloomberg, such direction incited some crypto financial specialists to move to nations where no capital additions assess on long haul interests in virtual cash is charged, for example, Singapore. The media outlet likewise talked with Hiroyuki Komiya, who runs a blockchain counseling firm in Tokyo, who said that he figured out how to diminish his assessable pay by "a couple of million yen" through utilizing a "general normal" instead of a "moving normal" to do his estimations. Komiya clarified that he's as yet indeterminate about a few subtleties regarding pronouncing crypto picks up, as there are no unmistakable authority rules on the issue:

The government hasn’t clarified certain details, so you’re left unsure whether you’ve got it right or not.”

Nonetheless, the assessment laws for crypto clients in Japan may change later on. On June 25, Japan's Minister of Finance examined the possibility of changing the dynamic expense rate. Representative Fujimaki asked Japan's Deputy Prime Minister Taro Aso if crypto exchanges ought to be saddled by means of a "different settlement tax assessment," rather than their present grouping. That implies that the present tax assessment system would be swapped with a 20 percent level duty like stocks or forex exchanges. All things considered, Aso communicated his incredulity that people in general would respond emphatically to the change, refering to "charge decency."

The present assessment rate for crypto exchanges has a most extreme of 55 percent, and changing its class would convey it to the 20 percent level duty connected to stocks or forex exchanges.

Nonetheless, the assessment laws for crypto clients in Japan may change later on. On June 25, Japan's Minister of Finance examined the possibility of changing the dynamic expense rate. Representative Fujimaki asked Japan's Deputy Prime Minister Taro Aso if crypto exchanges ought to be saddled by means of a "different settlement tax assessment," rather than their present grouping. That implies that the present tax assessment system would be swapped with a 20 percent level duty like stocks or forex exchanges. All things considered, Aso communicated his incredulity that people in general would respond emphatically to the change, refering to "charge decency."

The present assessment rate for crypto exchanges has a most extreme of 55 percent, and changing its class would convey it to the 20 percent level duty connected to stocks or forex exchanges.

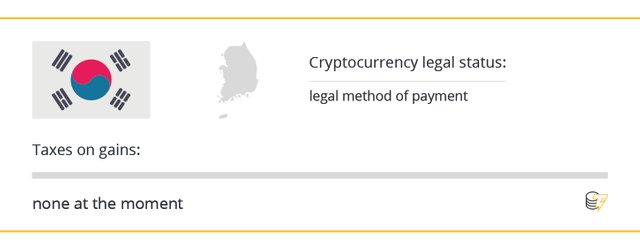

South Korea

Crypto’s status: Legal method of payment

Duties on increases: None right now

As of now, there's no assessment structure for crypto financial specialists in South Korea, and no data from nearby government organizations expressly expressing that increases from crypto exchanging ought to be accounted for impose purposes now, in spite of the fact that there's a 24.2 percent charge for cryptographic money trades in the nation.

Notwithstanding, in April the Fuji News Network (FNN) detailed that South Korea's Ministry of Strategy and Finance declared that a general tax collection system for cryptographic forms of money will be distributed before the finish of June. Consequently, as per the FNN, the South Korean government's crypto impose team has proposed an "exchange pay charge that duties assesses on benefits" produced using crypto deals. Furthermore, "if pay from virtual cash exchanges is viewed as brief and unpredictable, other wage expenses might be forced."

While the organization still hasn't made any official declarations with respect to the arrangement, nearby news outlet Chosun wrote about June 22 that a capital additions duty of 10 percent would have been presented later on. Be that as it may, this was before long discredited by the Ministry of Strategy and Finance itself.

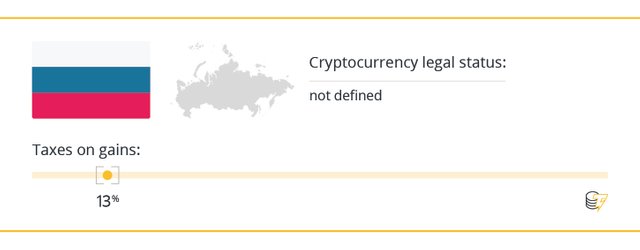

Russia

Crypto’s status: Not defined

Taxes on gains: 13 percent (personal income tax)

Now, there's no clear assessment structure for digital forms of money in Russia, albeit different general crypto bills have been presented for the current year at the state level.

By the by, on May 17, the Ministry of Finance distributed an archive expressing that subjects should evaluate and pronounce capital increases charge on digital forms of money "freely" before an authority administrative structure for the crypto showcase is presented. Individual pay assess in Russia is demanded at 13 percent.

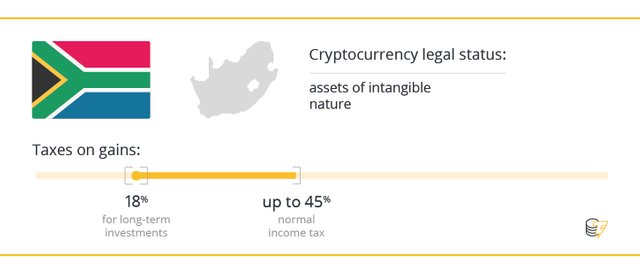

South Africa

Crypto’s status: Assets of intangible nature

Taxes on gains: 18 percent (capital gains tax); 18-45 percent (normal income tax)

The South African Revenue Service (SARS) — the nation's assessment guard dog — sees cryptographic forms of money as resources of an immaterial nature. Toward the beginning of April 2018, the SARS announced it will "keep on applying typical salary impose guidelines to crypto." Essentially, the office foresees South African crypto clients to proclaim their additions or misfortunes as part yearly assessable wage, including virtual monetary standards gained through mining.

In the update, SARS also noticed that, while there's no administrative structure for digital currencies right now and Bitcoin isn't lawful delicate, "there is a current expense system that can direct SARS and influenced citizens on the assessment ramifications of cryptographic forms of money, influencing a different Interpretation To note pointless for the time being."

In this way, as per Ettiene Retief, Chairman of the National Tax and SARS Committee at SAIPA, general crypto picks up for the most part fall into "typical pay assess," while long haul ventures are ordinarily slapped with a capital additions impose. The last constitutes 18 percent in 2018 and 2019, while ordinary salary assess is liquid and relies upon the wage.