CryptoDime is a startup, founded by a talented group of traders from the ForexDime company. It aims to combine the technologies of traditional market management with fast-growing crypto assets. CryptoDime allows people earning money on modern hedge funds strategies with minimal investment.

Crypto fund will buy the main cryptocurrencies for the money, invested in it during the ICO. Herewith investors won’t pay any commissions and will be able to track the movement of their funds at any time.

The main advantages of the project

**1. Instant diversification**

As everybody knows, it is necessary to offset the risks. Now there are many cryptocurrencies for this aim, but not all of them can be bought and stored in one place. CryptoDime let purchase plenty of crypto assets with just a few mouse clicks.

2. 24/7 trading

A user can exchange his tokens at any time.

3. Transparency

It doesn't take much to check, where tokens are and what their value is.

4. High effectiveness

The fund proposes to monitor increasing costs of cryptocurrency pool using one asset. It means that instead of constant counting every coin of the profit and further calculating the results, the investor orients to the Growth Index Portfolio.

*5. The minimum amount of investment

In order to begin investing in ForexDime, you need to have $1000. At the same time, CryptoDime requires 0,1 ETH (as at April 2018 it’s equal to $55).

6. High security level

The security of transactions is ensured by using cryptography, created by NSA.

How does it work?

Step one

To join the fund. Now joining the fund is possible by means of sending bitcoins or Ethereum to company’s wallet for the purchase of tokens. In the future, it is planned to implement the payment acceptance in fiat currencies.

Step two

After sending BTC or ETH a user gets tokens at a current price of the fund.

Step three

Getting profit. Received money is invested in crypto assets according to the accepted strategy.

Investment portfolio

The team made a hub of 18 cryptocurrencies in the following ratio:

● Bitcoin 10,5%

● Ethereum 10,5%

● Monero 4,7%

● Ripple 15,1%

● KIN 6,3%

● IOTA 4,1%

● Stellar 2,9%

● NEO 3,3%

● EOS 3,2%

● Dash 5,9%

● Bitcoin Cash 7,8%

● Steem 4,4%

● ICON 4,1%

● Cardano 3,9%

● Litecoin 4,2%

● Lisk 2,8%

● Tron 2,7%

● Qtum 3,6%

Investment strategy

Company’s strategy consists of 3 elements:

70% of funds are invested in 18 over-mentioned coins. The cost increase of cryptocurrencies ensures income with the minimum risks.

15% of funds are actively sold on the stock exchange.

15% will be invested in ICO and tokens purchase at the stage of Pre-ICO.

If the level of volatility is high, the strategy will change. In particular, the managers offer to hedge positions in order to avoid excessive fluctuations in the value of NAV.

Dividend payments

The company undertakes to pay the funds to the investors every quarter and at year-end. Money can be sent on Ethereum wallet, Neteller (USD) and Skrill (USD). However, now bank transfers are available only for private investors. According to the data given on the website the amount of payments varies from 3% to 11% per quarter.

Purchase of tokens

Token of the system is called CDM. It’s an Ethereum token of ER20 standard. ICO was canceled as HardCap was successfully collected during the presale (at a price of 600 CDM for 1 ETH). The registration of users for Airdrop is also closed. But you can buy coins on decentralized exchange https://bluedex.github.io.

In total, 10 billion tokens were issued. They were supposed to be distributed as follows:

● 70% - to sell to investors;

● 15% - reserved for Airdrop;

● 15% - remuneration for founders.

It worth mentioning that the users, who bought tokens during Airdrop, have no right to receive dividends.

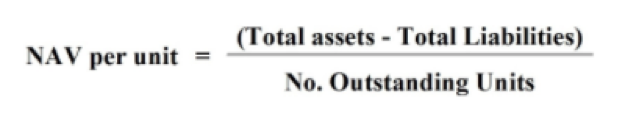

The CDM price is calculated as a net asset value (NAV). In fact, this shows the real value of our fund's assets, minus liabilities. The NAV stock index depends on the behavior of its underlying components. Calculation formula of NAV:

Development of the project

The team is planning to develop the environment for CDM tokens usage in three directions:

● Online-casino.

It is proposed to improve the existing games by introducing blockchain technology in them. It will allow increasing the transparency and giving users the possibility to play honestly. The casino will accept more than a thousand altcoins and provide the CDMA owners with the priority access.

● Decentralized exchange.

It’s planned to create the own DEX, on which more than 1000 cryptocurrency will be traded. The crucial feature of the exchanger is that secret keys won’t be stored on a centralized server of the company.

● Social network.

The special platform for traders’ communication.

Team

The founders of the startup are ForexDime management companies:

● Joserh Roy is a founder, a manager of the fund, and a manager of the project ecosystem development;

● A Abhishek is a co-founder, managing the fund;

● Gabriel Barton is a co-founder, managing the fund;

**Summary **

The idea of cryptocurrency index is rather new, but it is based on traditional financial technologies. Together with the low entry threshold, it is exactly what ensured the collection of HardCap at the presale stage. The CryptoDime rate will be also growing after the growth of basic assets value. In addition to this, you can receive dividends.

Website | Telegram | Facebook | Twitter

Author: https://bitcointalk.org/index.php?action=profile;u=1152502