We all know that the cryptocurrency market is not for all types of profiles. For those starting in this universe, and even for those with more experience, before investing it is necessary to ensure that some performance indicators are known so that our decisions can be supported on some numerical basis. Today, I would like to talk about 3 of these indicators. So let's get down to business.

1 Fear and Greed Index

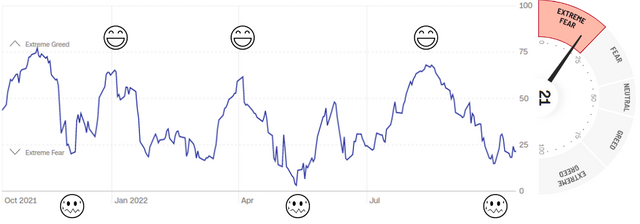

This is an index that measures the investor's psychological factor at a given time, ranging from Extreme Fear to Extreme Greed. In the figure below (FIGURE 1), we can see a time series showing the evolution of this index from August 2022 to October 2022. In the right corner of the time series, we have a panel indicating the value 21 for October 15, 2022 (the day of this publication).

FIGURE 1 - Fear and Greed Index time series, adapted from CNN BUSINESS

In general, it is interesting that purchases are made during Extreme Fear periods, acquiring assets at more advantageous prices, and possible sales should be made in opposite periods, that is, Extreme Greed.

2 Mayer Multiple Indicator

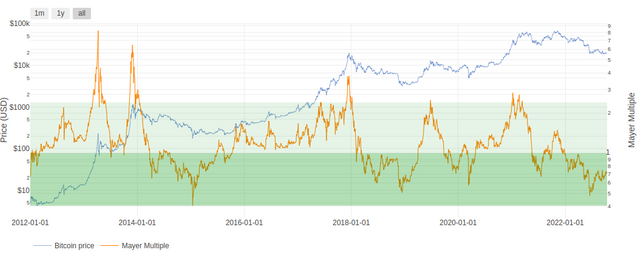

This index is nothing more than the price of bitcoin on a day D divided by the average of the last 200 days (from D-200 to D). If we do this calculation for each day, we will have a time series of Mayer Multiples (MM). The following figure (FIGURE 2) gives us an idea of this Indicator over time.

FIGURE 2 - Mayer Multiple Indicator over time, extracted from BITCOINITION

FIGURE 2 - Mayer Multiple Indicator over time, extracted from BITCOINITION

Roughly speaking, if this number is below 1 (MM < 1) then it would be a good time to buy bitcoin. If it is between 1 and 2.4 (1 ≤ MM < 2.4), we enter a zone of caution. Above 2.4 (MM ≥ 2.4) it would be interesting not to buy and perhaps even think about selling a percentage of your portfolio.

Today, this indicator is at 0.72, therefore falling in the category of a good time to buy.

3 Market Value to Realized Value

This indicator, also known as MVRV, is the relationship between the market value of a crypto asset and its realized value. This relationship can be used to help assess Bitcoin market tops and bottoms, as well as provide insights into buying and selling behavior of traders.

So in practice, if this value is above 1 (MVRV > 1), then bitcoin is overvalued. If it is below 1 (MVRV < 1), its consequent undervaluation occurs.

FIGURE 3 - MVRV over time, extracted from COINMETRICS

What is interesting here is that when MVRV < 1(where we are currently), given that the value of the currency is very undervalued, holders tend not to sell their crypto waiting for better days. On the other hand, buyers start investing more in these coins as it is affordable to buy. Therefore, the decrease in supply associated with the increase in demand tends to drive up crypto prices.

Conclusions

- As we have seen, these three indicators, read together, can give us a good general idea of how the cryptocurrency market is going at a given moment in time, providing, albeit in a rudimentary way, a numerical basis for our decisions.

- In addition, we have also seen that, currently, these three indicators are pointing in the same direction, that is, with

Fear & Greed at 21,MM at 0.72, andMVRV < 1, apparently, we are in a great time to invest in cryptocurrencies. Never forgetting, of course, that determinism never applies to the dynamics of this market. Therefore, the numbers presented here only indicate potential trends.