The halvening was coming and everybody wanted a pot of money to play on the markets with.

This bit just flew over my friends heads when I tried to describe it. I tried still.

During May 2020, that award of Bitcoin was going to be halved to 6.25 Bitcoin. Which becomes the size of the new block-reward. This artificial, but hard-coded devaluing of the ‘award’ size drives up the price of Bitcoin or specifically the price of unitary Bitcoin (i.e 1 BTC) which in turn increases the demand and competition for it. The demand curve of Bitcoin follows some obscure law of economics too. It mirrors the demand curve of ostentatious goods. Typically, the more the price of such goods the more quantity demanded, which some may well deem abnormal but quite fine in the world of Bitcoin . This relates to Andreas’ motives in specifically the following way. In 2016, during the last halving (I am going to start calling it that - halvening is too geeky and a mouthful to pronounce) and for some time after that, the price of Bitcoin skyrocketed and achieved an all-time high. It dragged the prices of all the other cryptos up with it and there was such a mad scramble. Many people (including Andreas obviously) felt this was about to happen again.

And this more than anything would be responsible for the relaunch of Super.One and the lockdown conditions created by the coronavirus, ensured that people were listless and desirous enough of anything that might cure their boredom. Also at least it got them to the place where they could hear the pitches – online. This was lengthy and although I had gone to some length in explaining, nobody was listening.

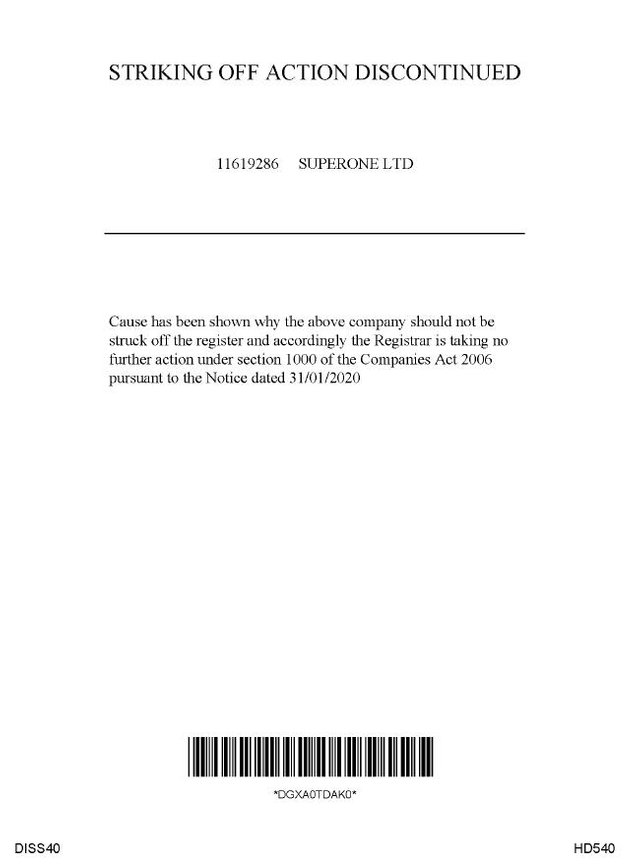

I am naturally curious so I knew that I definitely would search so off to the gov’s websites I went. I found corroborating evidence that Andreas Christensen was not only the founder of Super.One but that Super.One was going to be stricken off the register of companies as lately as January 2020. Admittedly, the company had salvaged its position in the eyes of the registrar of companies and action to be stricken off got called off. I post the cropped ‘photo’ of this notice here, following the demand curve for ostentatious goods in the study of Economics.

The fact that Super.One was nearly stricken off the books early this year was rather inconsistent with the information being given would be ‘investors’ about the standing of the company. This wasn’t a company about to launch operations. Another thing was: contrary to information provided about the existence of a team, there appeared to be no team ‘shown’ on the documents I reviewed. Super.One appeared to be someone’s solo project. There were other worrying signs. Since a majority of those who contacted me about this opportunity did so on Facebook or through Messenger, I was keen to show them the results of my digs. I made a related Facebook post the very next day.