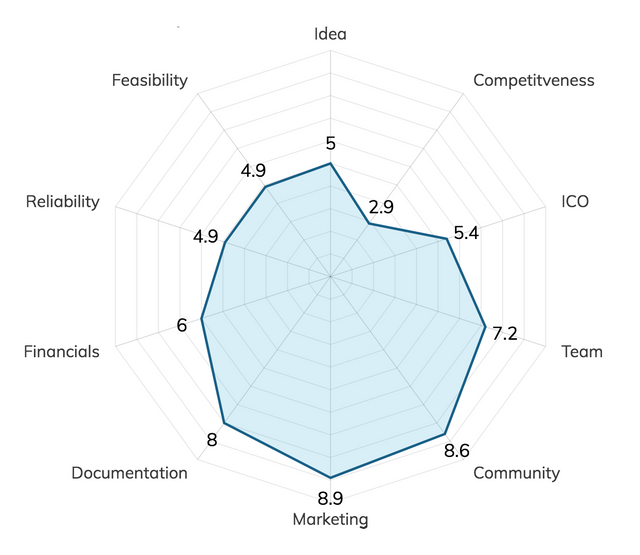

A CryptoStandard Score of 5.9 and a Negative+ outlook are assigned to Tradingene (ICO starts on 13 May 2018)

Tradingene envisions to provide trading algorithms to retail investors through establishing a marketplace. However, its room for growth is extremely limited with the greater number of established players in the market, such as Bloomberg, Quantopian, and TradeStation. Its feasibility and success depend highly on how attractive its algorithms are and how the prices are set.

Tradingene is a trading algorithm marketplace that connects algorithm creators and investors, so that algorithmic trading can be made more accessible, and creators can be rewarded at the same time.

The analysis is based on our rigorous CryptoStandard Score model which is supported by over 80 parameters. The distribution of the score and the explanation are shown below:

Idea

The idea does not seem attractive nor innovative. Quite a number of players already exist in the market, as acknowledged by the company. While the idea of a marketplace may sound ideal in promoting algorithmic trading, its scalability remains in doubt.

Competitiveness

Our team sees very little competitiveness of the company. TradeStation, TradingView and Bloomberg all allow people to develop their own algorithms, while Quantopian and Collective2 offer creators the opportunity to attract investors to their algorithms. Tradingene so far has not identified significant edges over those platforms.

ICO

Most details are published for the ICO, except for the ambiguity regarding whether the unsold tokens will be burned and whether there will be any future offerings. What is also noteworthy is that the lock-up period for founders and plans for listing on exchanges are not mentioned.

Team

The team comprises strong business and technology personnel. However, the lack of blockchain experience of the team has caught our attention. Although Sasha Ivanov, the CEO of Waves Platform, is one of the advisors, it would still be a plus if the team could incorporate talents with blockchain-related experience.

Community

Tradingene’s founding team can be reached directly on communication channels, with most questions promptly answered by its Chief Communications Officer and administrators. Nevertheless, there were concerns from some potential investors over the feasibility of the project, which have yet to be addressed fully.

Marketing

Tradingene has made itself present on most social media platforms, while also having a considerable size of community and a decent amount of press coverage, which is important in attracting more potential investors to join.

Documentation

The documentation of Tradingene is clear and sufficient for investors to understand their business. Yet, it has not disclosed or warned investors about the risks of investing into the company.

Financials

There are no past financials nor projected financials available for Tradingene.

Reliability

The company has a working product, which is appreciable but would have been if Tradingene releases more information on the number of active users. Our team also sees the need of a more detailed execution plan after the ICO.

Feasibility

There are strong and well-established trading algorithm providers currently, which hinders the project’s feasibility as investors have plenty of choices when it comes to purchasing or building algorithms. Also, given the nature of the marketplace and the limited functionality of the token, our team sees little incentive for end users or retail investors to purchase the tokens.

See their profile: https://cryptostandard.io/ico/tradingene/

#cryptostandard #crypto #cryptocurrency #ditigalcurrency #cryptonews #ico #bitcoin #btc #ethereum #eth #ripple #xrp #blockchain #review #reviewpaper #whitepaper #ratings #professional #money #binance #fintech #newcoin #coinmarketcap #initialcoinoffering #icomarketing #coinmarket #coinmarketing