No coin no matter what they promise will give you everlasting profits. Unless we one day live in a complete utopia where crypto prices endlessly moon and everyone’s a millionaire, there will always be pain when trading.

Due to the recent talks about the end of the recent crypto bull market, it might be a good time to prepare for what may happen next. I am not necessarily saying the bull market is over by the way. It’s still up in the air if we’ll still see the major gains crypto coins have made thus far this year.

What I am saying is that it’s never too late to begin preparing for the unexpected.

When the big bear comes to town

Knowing when your crypto investments may start taking a turn for the worse is something new crypto traders often struggle with. Analyzing trend charts and making price action predictions isn’t always the easiest thing to do. Most pro traders have taken several years to hone their skills to do this.

Certain things seasoned traders look at to determine the future price of a crypto include:

-Upcoming market conditions (pump & dumps, major sell-offs, market trends)

-External conditions (government regulations, lawsuits, competition)

-Company news (issues with development, company growth, progress made)

-Hype and discussions (influencers, forms, communities, & social media talking about it)

There are many things to research when determining whether you should hold, sell, or buy a specific crypto coin/token. While a project may still be doing everything right, the crypto market as a whole can still tank and cause major losses for all.

This is the case many have eventually witnessed regardless of the crypto they’ve invested in. When the bear market comes knocking all cryptos can take a plunge. It’s these cases that surprise many and cause those worried about their finances to sell at the wrong time.

What can you do about it?

So how can you prepare yourselves when the big bear comes to swipe down your gains? One potential solution is to use crypto trading bots.

If you’re a seasoned trader or a complete newbie to crypto, trading bots can provide a shield to your portfolio. Once trading bots sense a major decline in the market they’ll immediately trade you out, preventing a worse loss from occuring.

Bots also don’t have emotions so they won’t even think twice about selling at a bad time due to FUD or FOMO. They’ll always follow the linear rules set and use split-second market analysis to make the best trade possible.

Other than being used to help earn profits, crypto trading bots are a great way to maintain and protect your portfolio during market downturns. Don’t fret if trading bots sound on the “expensive” side, because UpBots has an innovative solution.

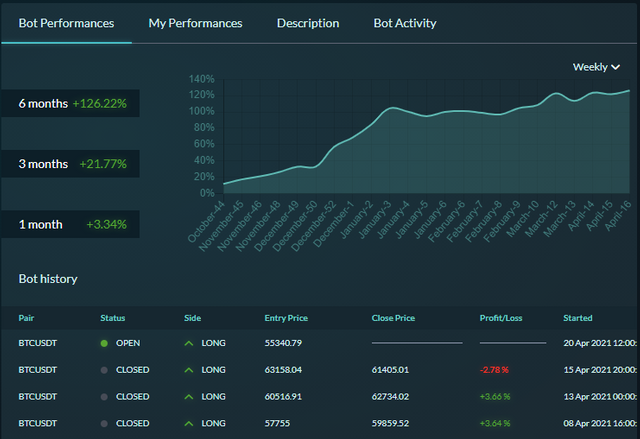

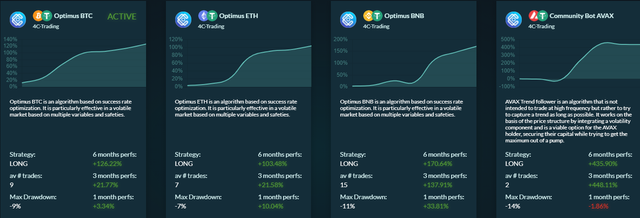

UpBots offers a line of crypto trading bots that you can get started using completely free. There are BTC, ETH, BNB, and AVAX bots available with more on their way. You can get started right now on their MVP demo platform.

When the market gets tough it’s good to have some backup in your corner.