Over the years, Switzerland have grown to be regarded as the banking hub of the world. It unique understanding of financial instruments and array of experts in the field has made it an attractive point for bankers and investors around the globe. Also, It has a lot of historic features which opens it to the decentralised view of blockchain technology. Its own political system is based on a citizen-controlled ethos and boasts century’s old culture of individual rights. Coupled with Swiss neutrality, business-friendly environment and privacy-friendly financial and legal infrastructures, and now it is very successfully marketing itself as a blokchain hub for crypto friendly companies.

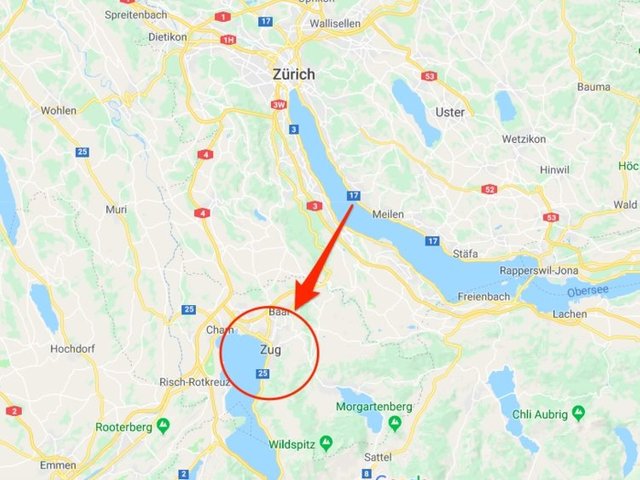

Blockchain technology and cryptocurrencies are mostly famed for their decentralized nature which tends to create new business opportunities and ultimately eliminate middleman barriers. However, despite its decentralizing drive, development of the technology has tended to cluster around certain locations: Silicon Valley, New York, Malta, Gibraltar, Singapore, most recently ireland and now Zug Switzerland are all key hubs. Switzerland is home to "Crypto Valley," a cluster of companies and foundations in the small town of Zug just outside of Zurich. Read more Here

Brief Overview Of Zug

Located just south of Zurich with a population of 120,000, Zug is one of the smallest of Switzerland's 26 cantons and it has one of the country's lowest tax rates, introduced in the 1940s as a way to lift itself out of poverty.

Zug is a small town about an hour outside of Zurich with a population of around 30,000. The city traditionally centred around agriculture and heavy industry but more recently has become a hotspot for pharmaceutical and medical companies. Shire, AstraZeneca, and Johnson & Johnson all have offices here.

Zug, named for its fishing rights is both a town and canton in Switzerland and home to a little under 30,000 residents. It is an affluent area, a low tax region and a base for several multinational companies

Many multinationals are attracted by Zug's low tax. The region - or "Canton" as it's known in Swiss parlance - charges just 14% corporation tax. It's one of the region's many business-friendly policies.

Zug itself carried on as a leading light for crypto companies. Ethereum incorporated in Zug in 2014 and the first bitcoin ATMs were installed. In 2015, Shapeshift located in Zug and in the same year the Swiss Federal council issued a report that bitcoins were regarded as a virtual currency and no further regulations were required.

Why Zug Was So Early To Embrace Crypto.

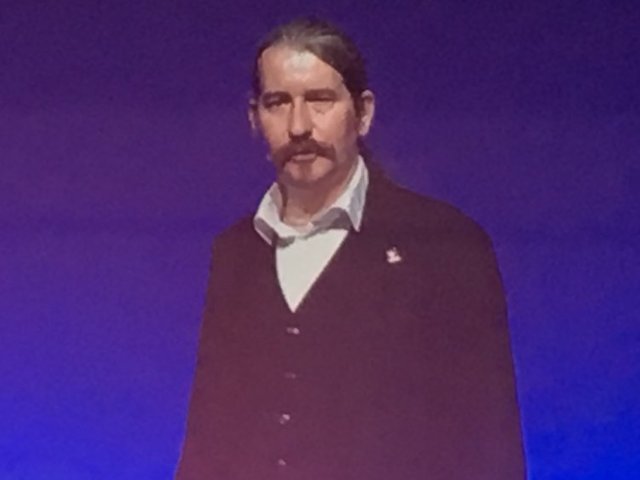

Many are aware of the rise of Zug as a crypto hub, but only few know how it came about. It was largely because of one man: Nikolas Nikolajsen. Danish-born developer Nikolajsen worked at Credit Suisse in Switzerland before leaving to set up crypto services company Bitcoin Suisse in 2013.

There were a lot of conversations between the founder [of Bitcoin Suisse] and the government - what is this, what is that?" Bitcoin Suisse CEO Arthur Vayloyan told me. "He was very active in consulting and educating. Many knowledgeable people today know their thing because they were privileged to have [Niklas] as an initiator.

The Breakthrough: The Emergence of Crypto Valley

After discussions with Nikolajsen and others, Zug put in place clear guidance as to how it would treat cryptocurrency companies and those that dealt with the assets.

The new rules helped attract the team behind ethereum, the second biggest cryptocurrency by value, to Zug. The Ethereum Foundation, which promotes and supports the cryptocurrency, is based in Zug and Bitcoin Suisse helped advise the group on its initial coin offering (ICO) in 2014.

About the influx of crypto startups, the whole starting point was the Ethereum Foundation said Oliver Bussmann, president of the Crypto Valley Association as quoted by Business Insider. They decided to set up the foundation in Zug and that triggered the set up of a new ecosystem - law firms, tax, accounting, smart contract evolvement firms, startups, universities.

The Crypto Valley Association was set up at the beginning of 2017 to coordinate all these interested parties with over 500 companies registered till date.

CHALLENGES

Skeptism About Finma Regulations

According to Reuters, Swiss banks are urging the authorities to give them more clarity on the rules that apply to cryptocurrency projects before providing services to the market, and at least two important players have withdrawn for now. Read more

Bank Uncertainty

Zuercher Kantonalbank (ZKB), the fourth largest Swiss bank and one of the few big banks in the world to welcome issuers of cryptocurrencies, has closed the accounts of more than 20 companies in the last year. Only a handful of Switzerland's 250 banks ever allowed companies to deposit the cash equivalent of cryptocurrencies raised in ICOs. At least two still do, Reuters has established.

Due to this Myriads of issues, It is difficult for crypto-projects to use the funds they raise through ICOs if they are locked out of the banking system because funds from ICOs are often originally raised in cryptocurrencies bitcoin and ether, which have limited use as a means of payment in the broader economy.

Competition

The influx of crypto companies in ZuG has created a massive wave of competitions (however healthy), this may pose a challenge of inferiority complex to budding startups that may wish to join the league of these giants.

FINMA REGULATORY INTERVENTION

Following the continous tussle between crypto start ups and banks, Swiss Finacial Regulator FINMA decided to wave in. FINMA issued separate guidelines to spell out how Swiss AML rules and securities regulations apply to various ICOs. But securities rules are less stringent in Switzerland than in the United States, where the Securities and Exchange Commission has toughened its stance on ICOs. This makes it more risky for banks in Switzerland to be involved with ICO projects (If they are fraudulent) which may have raised money from U.S. contributors and could fall under the purview of the SEC. Read more on FINMA Regulation and Whitepaper HERE

The Benefits OF CITING A CRYPTO PROJECT IN ZUG

For now Swiss authorities and industry are behind Zug's push into crypto finance, believing it will allow the financial sector to diversify as the demise of banking secrecy looms. "If we don't take part at the front of 'fintech', we don't deserve our title as a global financial center," said Martin Hess of the Swiss Banking Association. The advantages of citing a crypto firm in Zug ouweighs the opposite. Several other reasons are attracting crypto projects to Zug, some of which are:

•Wide spread nationwide acceptance with physical presence of bitcoin ATMs, Bitcoin accepting shops and blockchain labs. Unlike other countries, politicians express concern about the cryptocurrency craze, citing worries about security, regulation, volatility and a speculative bubble. Not so in Switzerland.

.jpeg)

•An astonishing 14% tax evaluation for corporate bodies as well as blockchain startup companies is by far the cheapest by far in the industry.

•A serene environment overseeing a beautiful lake, surrounded by a secured location within a valley and an array of multinational companies with proven track record of huge success- from Ethereum foundation, Shapeshift and more.

•A one-stop ecosystem to find advisors helping with value proposition and token economy, seasoned legal experts, tax experts, accounting experts, people specialized in global marketing and global communications PR, secure ICO launch platforms, independent audit firms, smart contract audits, KYC, AML utilities and a community of investors looking to support the product and ultimately launch succesful token sales.

The land is green in Zug, beyond the challenges, blockchain is here is to stay, thinking of a Perfect blockchain start up location? crypto valley in Zug is the place to be.

OUR OFFICIAL LINKS

Website