WHAT LENDING IS?

In general, Lending (also known as "financing") in its most general sense is the temporary giving of money or property to another person with the expectation that it will be repaid. In a business and financial context, lending includes many different types of commercial loans.

In businesses or financial institutions, Lenders are referred to people that lend money, with the expectation that it will be paid back in due time. On the other hand, Credit money is any future monetary claim against an individual that can be used to buy goods and services. Over the years, it has been seen that the world in general operate traditional method in terms of having Access to Credit (Money). Most people rely heavily on the traditional lenders such as Banks (either Micro finance or Commercial), Peer to Peer platforms, Funding raising contribution. All these platform listed earlier do not in any form addresses the progressive needs of customers in the future. Researched have it that Global lending has an expected growth rate of 14% and in the next five years it would have increase in digital ecosystem technology disruption which makes the lending platform to rise to over two billion in reality. The adoption of digital assets usage have increase tremendously, something as simple as getting access to credits (money) still remain a problem in the modern age for many borrowers. Therefore, there is need to addressed this for customers and bring an end to the traditional methods of lending. Additionally, even with breakthrough technologies like blockchain, traditional financing is still channel, product and geographic specific with onerous processes that result in long cycle times and increased cost of capital. These issues not only limit efficient flow of assets, but also ignore a large segment of the market that is under-served by banks.

WHAT IS LIBRA CREDIT?

Libra Credit is an innovation created, built and developed by Libra Foundation, a platform whose mission is to create Credit for the Real World in a Global way. Libra Credit is an ethereum blockchain decentralized ecosystem built to make patronizers have an easy access for lending. In other words, making lending platform easy. The Libra Credit team has its records tracked in digital credit services across the Globe, especially Asia.

The Libra Credit will be launched and released in July, 2018 with crypto-to-crypto and crypto-to-fiat lending.

MODE OF OPERATIONS OF THE LIBRA LENDING PLATFORM

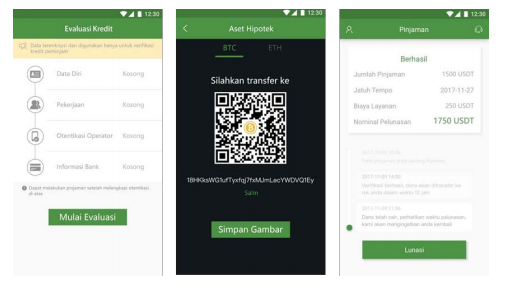

The mode of operations of the Libra Lending Platform is a front end user interface that allows token holders to have access to the network through the mobile application. A developed and built mobile application is already in testing and in progress to facilitate and aid the crypto-to-crypto loans.

WHAT MAKES LIBRA CREDIT UNIQUE?

The Libra Credit has its unique nature due to the fact that it can integrate with 0x-protocol-based decentralized exchanges (DEX) to approve access to standard ERC-20 collateral token, with token symbol LBA. An illustration of how the integration works in sequence to the 0x-based DEX (e.g. Radar Relay and DDEX) is represented below:

The following operations below can be done with the Libra Credit and 0x-based DEX:

- With LBA borrower can create a loan request with ERC20 collateral token for stable token at agreed terms

- The LBA allows the borrower to sends loan request to Libra Credit and makes an ERC20 collateral deposit

- Upon confirmation and approval of the loan request, Libra Credit will forward this request in the form of a 0x exchange order to DEX Taker

- The DEX Taker approves the request and accesses its balance of stable token

- The DEX Taker then submits the Libra-signed order to DEX partners such as Radar Relay and DDEX

- The DEX partners will also authenticates the Libra signature, verifies that the order has not expired, verified that the order has not already been filled, and then transfers the collateral token into stable token

- The DEX partners send stable token to Libra Credit

- Finally, the Libra Credit disburses the stable token to borrower

BENEFITS OF USING THE LIBRA CREDIT LENDING PLATFORM

- It helps Crypto-to-fiat loan possible by allowing collateralization of cryptocurrencies to spend fiat without sacrificing their current crypto position

- It also helps Crypto-to-stablecoin loans possible by enabling borrowers to hedge price volatilities without exiting the market

- Its aids Crypto-to-crypto lending, by allowing borrowers to pledge other alternate tokens for more mainstream crypto currencies (i.e. BTC / ETH) with better liquidity.

- It brings lending t its simplest form.

- It helps to eradicate the traditional lending method which have a higher percentage attached to it.

CONCLUSION

The Libra Credit is a decentralized ERC 20 compatible blockchain technology built to help facilitate users easy access to credit. The token symbol is LBA and it will be launched July 2018. The token sale have ended presently and the crytocurrency space expects this to be the new revolution.

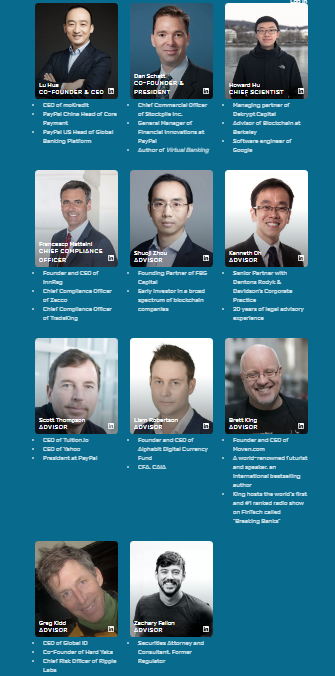

THE LIBRA CREDIT TEAM AND ADVISORS

THE LIBRA CREDIT INVESTORS

FOR MORE INFORMATION:

https://www.libracredit.io/

https://medium.com/libracredit

https://twitter.com/LibraCredit

https://t.me/libraofficial

https://www.linkedin.com/company/libracredit/

Whitepaper Link: https://www.libracredit.io/page/Libra_Credit_Whitepaper.pdf

AUTHOR'S DETAILS: CAPABLEUWA

Interesting article

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it is, thanks. Libra credit is a great platform. Hope you have gotten some token?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What's the minimum investment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry, token sale have ended

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit