Hello,

Guys I have something special for you!!

Cryptocurrency has been dividing people since its inception. Some believe in it religiously, some are convinced it’s a sham, still others hate crypto but love blockchain. The number of different groups of opinions is infinite. But a group of people whose opinions should count for something, even in the decentralized and seemingly anarchistic crypto world, are economists. More precisely, economists who have received the Nobel Memorial Prize for their work.

Economics is not one of the original Nobel Prizes created by Alfred Nobel's will, but the nomination process, selection criteria, and awards presentation of it are performed similarly to those of the Nobel Prizes. It is actually a memorial prize, established by the Swedish National Bank, but it is referred to along with the other Nobel Prizes by the Nobel Foundation. It is generally regarded as the most prestigious award for that field.

Here is what Nobel laureate economists have to say about crypto:

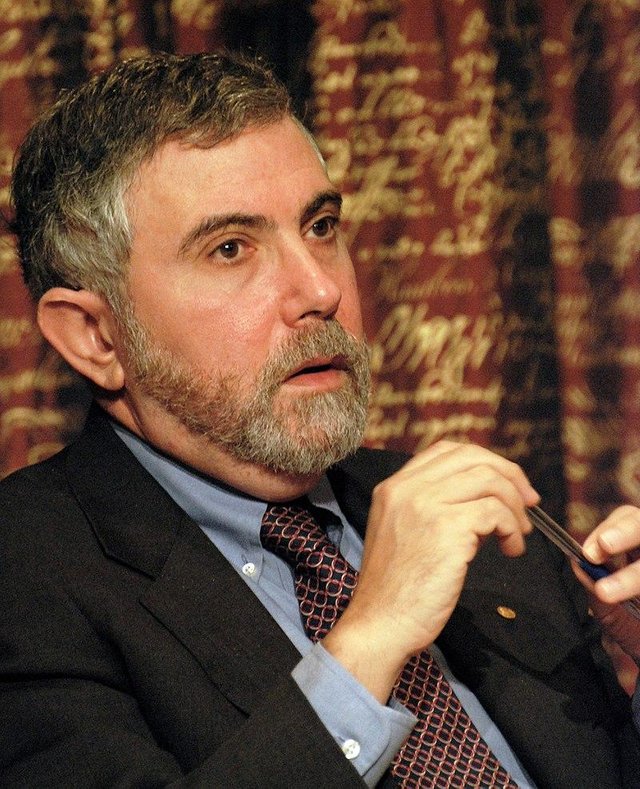

Richard Thaler, Paul Krugman: Bitcoin is a bubble

Loudly proclaiming Bitcoin is a bubble likely to collapse sooner or later are laureates Richard Thaler and Paul Krugman.

Richard Thaler is the Charles R. Walgreen Distinguished Service Professor of Behavioral Science and Economics at the University of Chicago Booth School of Business. In 2015, he was president of the American Economic Association. He was awarded the Nobel prize in 2017 for his contributions to behavioral economics.

In his opinion, “the market that to me most looks like a bubble is that of Bitcoin and its sisters.” This was stated in an interview with Portuguese publication ECO this January. As an example, he pointed to Long Island Iced Tea’s shares surging over 300% following a blockchain rebrand to Long Blockchain Corp. “Companies are adding ‘blockchain’ to their name and their value goes up,” he said. “It doesn’t make sense that it keeps going like this.”

Paul Krugman, Nobel laureate of 2008, is currently a Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for The New York Times. He even published an opinion piece on crypto, titled “Bubble, Bubble, Fraud and Trouble” in which he lets us know exactly what he thinks: “So is Bitcoin a giant bubble that will end in grief? Yes. But it’s a bubble wrapped in techno-mysticism inside a cocoon of libertarian ideology.” He compares crypto to USD 100 bills, where shops often don’t take them, but drug dealers and tax evaders love them.

And he’s been quite clear about it too: in an interview with Business Insider last December, he said he considers Bitcoin to be “a more obvious bubble than housing was.”

Eugene Fama: No adoption for Bitcoin because of volatility

Eugene Fama received his Nobel Memorial Prize in 2013, and he is best known for his empirical work on portfolio theory, asset pricing and the ‘Efficient Market hypothesis’, which states that markets are efficient and that their information is broadcast in their current price.

In a Bitcoin Uncensored podcast Professor Fama said his part about crypto. His opinion on Bitcoin adoption and future is simple: “People won’t use it because basically it’s very difficult to know how much you need to settle [...] As if it doesn’t have a stable value it’s probably not going to survive as a unit of account. What that means is that its value is likely to go to zero at some point.”

He joins the ever-growing group of people who like to say that crypto is a thing only beneficial to drug dealers and criminals. Also, in his opinion, crypto has no clear advantages over fiat money.

Bengt Holmström: Central banks issuing cryptocurrency is a bad idea

Bengt Holmström is a Finnish economist who is currently Paul A. Samuelson Professor of Economics at the Massachusetts Institute of Technology. He received the Nobel Memorial Prize in 2016 along with Oliver Hart.

While he has remained tight-lipped about crypto in general, he did say that centralized, bank-regulated cryptocurrencies would be a bad idea in the event of a crisis. In his opinion, the crisis would see money rushing out of the banks and flooding the central bank, which would suddenly find itself in the position of taking the role of market intermediary, though bereft of much of the information that banks possess. The central bank would then need to resolve the conundrum of how to inject the money back into the banking system.

“That’s an example of where you think you’re doing something good, you’re creating a lot of safety, but the consequences are actually potentially catastrophic [...] The bigger the calamity, the more safety there was initially,” Bloomberg quoted him as saying this January.

Notably, his and Oliver Hart’s work on contract theory significantly influenced smart contracts.

Conclusion

One would be quite hard-pressed to find a positive thing that well-distinguished economists had to say about crypto. However, it could be argued that, since crypto is an attack on traditional economics - the field most of them devoted their lives to - they feel there is nothing that crypto, and by extension Bitcoin, can bring to the table.

This is not a new thing, though: most great inventions were brought into the world while old people were complaining that it was all better in their day. And while the opinions of Nobel Prize awardees should count for something - who was ever stopped by that?

post from cryptonews

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptonews.com/exclusives/what-six-nobel-laureate-economists-have-to-say-about-crypto-1402.htm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit