This is a rather lengthy read, so if you just want the short scoop, it's a story in which the hero, a crypto-newbie learns to find crypto-jewels in the mud but initially drops them due to lack of experience and almost falls into depression. But he quickly recovers, then hones his newly acquired skills and finds a bigger crypto-jewel in even deeper mud. He takes it to the market but fails to profit from it. Upon closer examination he realizes that his crypto-jewel is more of a goose that lays golden eggs, having a much greater potential than he initially thought. While looking at it from multiple vantage points and getting to know it better, he falls hopelessly in love with it and takes it home for the long term.

So, you want to know the name of this "goose" he found? Well, then you don't just want the short scoop, so keep on reading.

…

Finding A Crypto-Jewel In The Mud

Like many others who were active on the crypto markets in 2017, I first heard about Bitcoin and cryptocurrencies a few years ago from a friend. In 2012 he was mining Bitcoin and tried to get me on board. His crypto experience was mainly in mining which required a hefty investment and I had no money to spare. But he did end up educating me on what Bitcoin was and in the next months I followed up on it and how he was doing. Unfortunately the steep rise in the price of Bitcoin to almost $1200 at the end of 2013 and then its deep decline into the spring of 2014 caught my friend with his guard down and pretty much killed his operations.

In the next couple of years I didn't pay much attention to Bitcoin. Then, from 2015 on I began to hear more and more about it but it was of no use I thought, as I didn't have any money available to invest anyway.

By the end of 2016 however, my outlook on crypto had changed. I already had probably hundreds of hours invested in reading and listening to or watching Youtube videos about Bitcoin and the Blockchain technology, enough to start grasping that not only is this not going to go away, but eventually all of society will be deeply changed by this trustless technology revolution. I finally understood that any amount of money I manage to "put into this thing" will definitely grow, unless I act grossly stupid.

So 2017 found me with a thirsty appetite for all market related crypto information. I was not totally clueless in regard to trading, but I didn't have much experience either. However I had a lot of energy and enthusiasm built up by the research up to that point so, sometime in March I decided it's time I got in with any amount I could afford.

After having entered with a little money in BTC at a price of $1300 (mid-April), I started to follow crypto-news and cryptocurrency technical analysis videos with renewed vigor and emotional attachment this time. I played with a few trades, won a little on some and lost it with others, but on average I was lucky to be breaking even in dollar value well into the beginning of May, mostly due to Bitcoin’s increasing price.

The small losses I was taking have helped me very much in my crypto trading education. Since then I tell everyone that no lesson is more valuable than losing money - that gets your whole attention and focus and you start to look at things from multiple perspectives when making decisions.

Along my research I started to run into fundamental analysis of coins, technical analysis videos and ICO presentations, which got me to start looking at coins in more depth and actually read their whitepapers or at least glance over their technical specifications and activity on the bitcointalk.org forum.

Seeing how the price of Ripple (XRP) had increased more than 10 times since the beginning of March and the prices of other coins blooming as well, I decided to do my own research and then put all my crypto funds into one coin that will make it big.

I researched thoroughly from as many points of view as I knew at that time and came up with a single coin: Digibyte (DGB).

It was dirt cheap at 100 Satoshi and from what I got to read, see and hear, it made sense to me that the price of DGB could easily reach 5000 Satoshi levels. So I bought into DGB at 100 Satoshi with all of my crypto funds. Given DGB’s low price, I had what looked like a lot of coins. I was thinking of how much this would mean if it actually went to 5000 and it got me all giggly - my puny investment would turn into something significant for me.

A few days past and my investment was looking good as the price of DGB was over 100 Satoshi. But then it started to turn around so I sold between 102 and 101. It fell below 85 but then it turned around so I bought in again at 96 Satoshi. The price went up to 105 but then it fell below 100. I was ok with it as long as my funds were more than what I started with. But in a few days the price dropped below 85 Satoshi and I was starting to panic. However, it didn’t linger there too long and in another few days I was back in profit as the price was over 110 satoshi.

The price dipped to around 100 again, but I thought that’s just a small correction on our way to the moon. However, the price dropped below 90 and I didn’t sell.

I remember seeing the price below 75 Satoshi and wishing I had sold higher (but at a loss from 96) only to be able to buy back at this price. It was the first time I was feeling the drawbacks of not using a stop loss order (automatic selling when the price drops below a certain price). But it was still ok overall as I was expecting DGB to moon really soon and I was already seeing it go back up.

But it only went up to 95 satoshi and then started to drop.

I was holding on to my DGB bought at 96 Satoshi, but the market was valuing it at below 90 Satoshi and I was losing patience while seeing many other coins grow. This let emotions creep in deep and roam free of my immaturely projected control, causing internal havoc, panic and doubt. And this is how all my previous research, plans, ideas and determination went down the drain.

The price then dropped further, all the way down to 60 satoshi. By this time I had lost all trust in DGB and all I wanted to do was get out of it at break even so that I could invest in some of those other coins that actually moved, while this "hog" was playing everdeeper in the mud.

I got so reckless that the moment DGB's price went to 94 Satoshi I sold it all, happy that I could walk away from DGB with my initial money intact, losing the little profit I've made since I started trading Crypto and vowing to keep away from this tactic from then on.

So I gave up on the risky “single coin portfolio” approach and went back to buying multiple coins, desperate to see my portfolio go up in value as soon as possible. During the next couple of days while my portfolio started to rise at a timid rate (just a few percentage points), I was seeing DGB go over 130, then drop below 90 Satoshi, rise again past 145, then back around 90. While it attracted my attention, I was determined to not let it play with my mind. And during the following days, as the price corrected to below 100 Satoshi levels I was starting to feel peace of mind that I’ve made the right decision.

But then, after only 7 days from its previous high of 116 Satoshi DGB’s price skyrocketed more than 400% to 460 Satoshi while my portfolio was only registering 4%-5% profits. I felt like I lost an important opportunity and I didn’t even consider jumping back on-board with DGB. As I was seeing the price correct to below 300 Satoshi I thought that there was no use in chasing DGB now as it’s already falling after a pump.

All that I’ve learned up to that point was completely clouded by disappointment and disillusion. My initial research into DGB and my belief in it meant nothing at this point as I was looking for anything to prove to myself that there was nothing wrong with my approach from a mature trader’s point of view (which I clearly wasn’t) and it was only a pump and dump that I’ve missed. Yes, I’d heard of Fibonacci retracements and had seen Elliott Wave Analysis videos, but there was no place for rational thinking in my mind at that time. Everything useful was forgotten as I was only looking for a psychological stick to help me carry my emotional weight and I found it in the reasoning that it was a pump and dump scheme.

But then, in just one day the price jumped back and above the previous high of 460 Satoshi and it kept going. Was this actually not a pump and dump scheme? Was I right in the beginning after all? Hm, maybe it was too early to tell, but it was definitely too late to buy. I had learned not to “buy high” so going in at these all time high levels was not a good idea. And so I watched the price go up to 950 Satoshi, more than twice its previous all time high from just five days prior.

Seeing this and the fact that my portfolio’s profitability was under 10% got disappointment and disillusion back in full force, with a hint of depression starting to creep in. Sure, the price corrected again, it even went back to just above 450 Satoshi levels, but by this time I was emotionally defeated and saw too big of a risk in buying at that time, after such big increases in the last couple of weeks and then what looked like a massive and abrupt drop.

However, it turned out I was dead wrong this time as well, as less than a week later, on June 3rd 2017 at about 6 p.m. I get a call from a crypto-brother asking me if I’ve seen the price of DGB lately.

When I opened my Blockfolio app and saw the price of DGB on Poloniex at 2550 Satoshi and rising my jaw dropped and I felt like 10 tons of bricks have fallen on me all at once. I felt not only depressed, but like a squashed bug on the windshield of a speeding car on the highway in mid-summer.

Finding The Goose That Lays Golden Eggs

It looked like the biggest profit opportunity of my life has just passed me by, after I’d actually held it in my hands and then let it go by my own will and against my previous plans. It hit me real hard at first and I took it out on myself and my family. Don’t imagine anything too drastic, but I did manage to ruin what otherwise would have been a wonderful sunny evening in the park with my wife and our daughter.

But Crypto-world is faster than Formula 1 on steroids, so I metabolized this experience rather quickly. As I tried to make sense of it all, I started to understand that I had actually hit a winner. Although I did not practice what my mind had preached to me and did not profit from it, I at least got the confirmation that my method of finding “crypto-jewels in the mud” actually works.

To support this confirmation, in the days prior to DGB’s all time high my portfolio had also started to climb nicely due to some other dirt cheap coins I found and got into (such as Reddcoin, Myriad and Dogecoin).

Along with finding the above mentioned three coins (RDD, XMY & DOGE) I had also been scouring the deeper mud (coins selling close to or at 1 Satoshi) trying to find some cool unexpected coin that will get me some nice 10x or more profits.

So, what initially seemed to be a humiliating and punishing nightmare turned into a very insightful, inspiring and overall enlightening experience. Sure, it had a cost attached, but having paid it I was now able to surf the crypto waves free of deep emotional attachment.

Taking this newfound knowledge and experience along with the profits from the last good trades, I started to buy some of those minimally cheap coins. Among them on the Yobbit exchange, where I usually found most of those dirty, outcast, dumped by everyone coins was one called Htmlcoin (HTML5 at that moment). It had just been through a 51% attack and people were getting rid of it. I knew that when there’s “blood on the streets it’s time to buy”, so I read up on all I could find about it. The developer seemed honest and dedicated, not wanting to let this coin die, so I followed Htmlcoin closely on Bitcointalk and put some of my funds into it at 1 Satoshi.

Later, when I got to read about a few of the specifics for the new HTMLCOIN blockchain I got a little excited, but I wasn’t sure if “Bitcoin/Ethereum Hybrid” was a phrase that sounded good only to me, or to others as well, since I wasn’t seeing very much positive social engagement at that time.

But in the last days of June an announcement came from HTMLCOIN on Bitcointalk saying they are looking for a developer and I believe this caused a wave of volunteers, not necessarily developers, to approach Amando and offer their help.

In a matter of days, an enthusiastic community of volunteers from all over the world emerged on Skype around Amando Boncales and the new HTMLCOIN team started to grow from there.

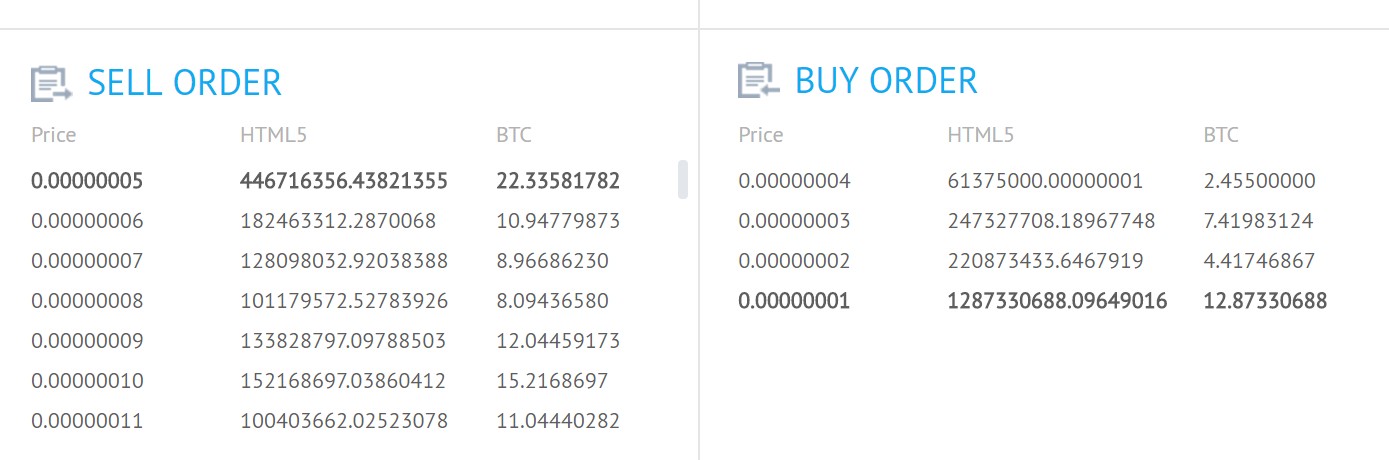

At first not much seemed to be happening, as it’s probably not easy to manage volunteers with limited time and resources in multiple time zones while making sure everyone’s on the same page. But then things started to pick up and by the end of August the price of HTML5 went up to 5 Satoshi right before the launch of the new HTMLCOIN website.

I was ready to sell at that price, but the buying stopped just short of reaching my sell order for part of my coins. I had them spread out meaning to sell about half at 5 satoshi, and the rest gradually in really small orders up to 10 Satoshi. When I saw support dropping for 5 satoshi I could have sold at 4 or 3, but I wasn’t really expecting the price to drop below 3 satoshi since we were all waiting for a new website and a coin swap to a brand new blockchain.

But fear, uncertainty and doubt along with BTC volatility and small buy support did their thing and after a little while the price dropped back down to 1 Satoshi. I was a little annoyed at this point for missing the opportunity to sell at 4 or at least at 3 to then buy back at 1, but I was starting to believe in this coin and I took this opportunity to buy more HTML5 with the plan this time to only sell part of it, by putting the first sell order at 8 satoshi and then many miniscule orders thrown about somewhat randomly up to about 33 satoshi.

September didn’t bring much action on the HTML5 market, but in October the price rose to 5 satoshi again as people were expecting the initially announced automatic swap to take place. But this didn’t work out precisely as expected and the “bears ruled again” taking the price slowly back to 1 satoshi again.

But then in November, after many tribulations the swap had finally started. Not on all exchanges though.

While Bleutrade went through the swap in a fast and graceful manner, with CoinGather following suit, Yobit chose to completely ignore repeated messages from the HTMLCOIN devs. This after having agreed to the swap date and having requested and received (in escrow) 5 BTC as a premium for executing the swap - a hefty amount to be asked of a foundation with volunteers working on an 100% open source platform with a coin priced close to the minimum possible in BTC. Nevertheless, the HTMLCOIN team was ready to part with that amount and even offered training, help and direct supervision for the swap process. But it all fell on deaf ears and Yobit didn’t even bother to reply.

Now how would I know all of this? Well, if you check out the main communication channels (Telegram, Twitter, Facebook) you’ll come to appreciate that the HTMLCOIN team is extremely open and transparent and they understand the value of the community and take the time to interact with it constantly in all matters. And with this Yobit “non-swap” situation, as the community was getting restless, they decided to put it all out for the members to see, while also suggesting diplomacy and proper behavior towards Yobit, regardless of Yobit’s actions or lack thereof.

But understanding and diplomacy have nothing on raw human emotion and so, along with the news that the CoinGather exchange closed down and owners apparently fled with people’s coins, many of which were HTMLCOIN, the price went back down to 1 Satoshi and this time with a vengeance. On Yobit the sell orders volume at 1 satoshi was building up quite a bit and HTML5 was being bought up with DOGE and ETH for less than 0.2 satoshi in small amounts while pretty significant amounts of HTML5 were trying to get sold at around 0.6-0.7 satoshi.

During all this I added to my HTMLCOIN bag, first at 2 satoshi but then also at 0.3 satoshi and even as low as 0.15 satoshi (via the DOGE/HTML5 market), although not as much as I wanted - at that moment I would’ve done anything to be able to buy all HTML5 that was being sold below 1 satoshi, but I had no additional funds. Still, I was very happy, as I had no doubt that the swap will finally happen somehow as the devs clearly stated on all channels that there’ll be no one left behind. We also knew that most devs had their coins on Yobit as well, so that brought some peace of mind to those within the community.

While the automatic swap never actually took place on Yobit, by the end of November at least they started allowing coin withdrawal and people were now able to manually swap their coins by using a form on htmlcoin.com.

The price jumped back to 5 satoshi, but it didn’t have the energy to keep that level (because people fled from alts into Bitcoin) and so the price dropped once again to 1 Satoshi in what would be my final chance to get into HTMLCOIN at this price. But this time I didn’t take much advantage of it, since my portfolio was already more than 50% into HTMLCOIN and some small voice inside my head kept nagging me that I’ve already put too much into it.

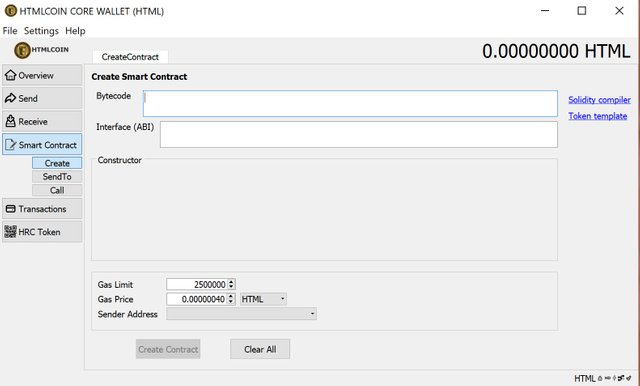

By December I had studied the HTMLCOIN whitepaper thoroughly and had my first real interaction with a full cryptocurrency wallet as I sent all of my HTMLCOIN bought on Bleutrade to my wallet. And I was very surprised to see the coins in my wallet in no more than a few seconds.

I don’t think I could have found a better coin to really “get started” in crypto with. It’s got CPU mining capability right from within the wallet (and it’s really simple too), the ability to run multiple wallets (with a little DIY) and also the possibility of staking your coins (in essence creating new coin by keeping HTMLCOIN in your wallet), independent of the mining process. This got me started on mining as well as staking and trying out different configurations with multiple wallets on multiple laptops to see what works best in terms of mining and staking. I also noticed the ability to create tokens and launch smart contracts right from within the wallet and while that seemed too much for me at the moment, this did get some seeds planted into my brain.

All in all, it was clear to me: I was no longer (actually I’ve never been) a trader of HTMLCOIN, but an avid investor... after having missed at least three selling opportunities I no longer cared to place any sell orders. I was contempt with holding on to what I had, buying more when I could and otherwise not wanting to risk any of it, especially given my not so inspired course of action until then.

As the official HTMLCOIN Telegram channel was constantly buzzing with inquiries and discussions it became clear to me that my feelings towards HTMLCOIN were shared by many others as well.

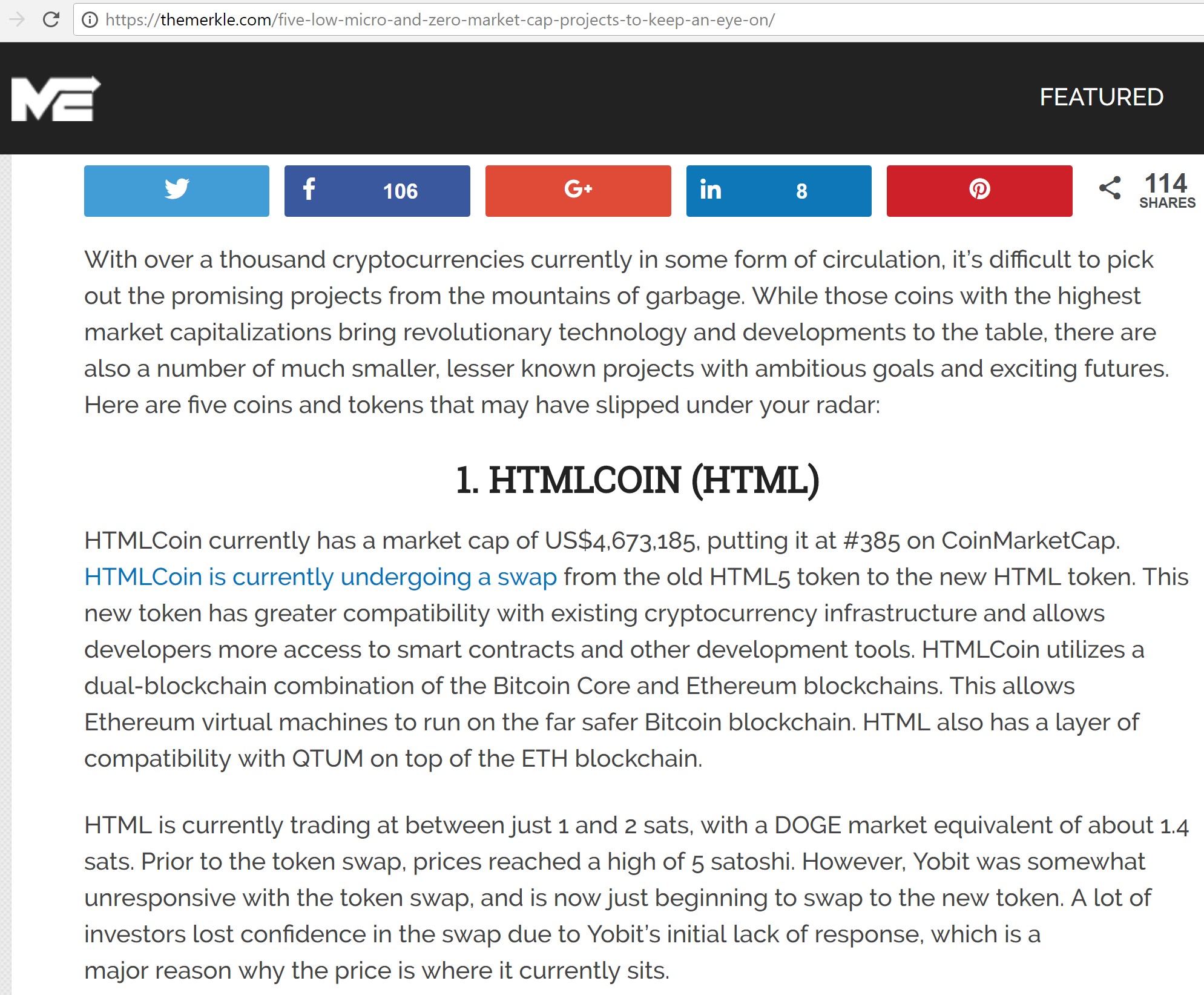

Mainstream media was also starting to notice HTMLCOIN more and more and themerkle.com posted a very positive article placing HTMLCOIN at the top of the top 5 coins to watch for in 2018.

HTMLCOIN article on Merkle.com

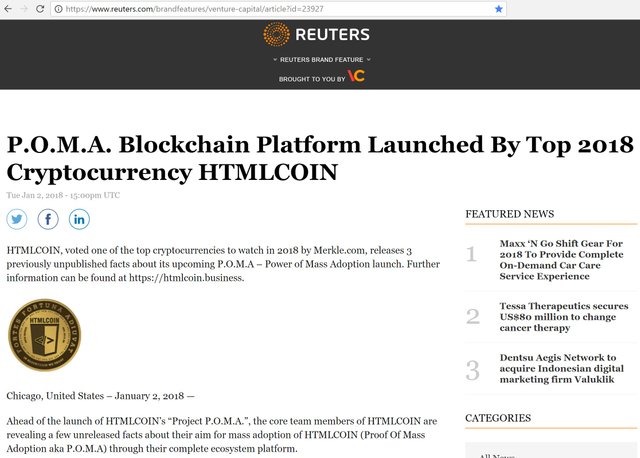

This article was noticed and picked up by Reuters.com and Nasdaq.com on January 2nd.

HTMLCOIN article on Reuters.com

HTMLCOIN article on Nasdaq.com

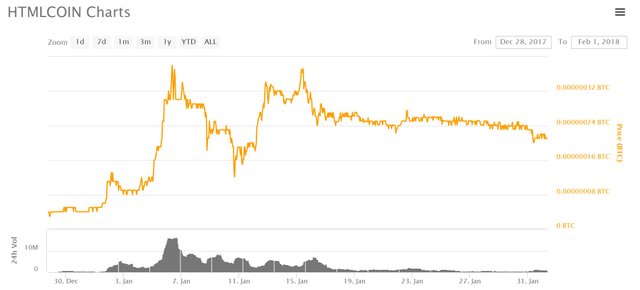

As a result the price of HTMLCOIN exploded:

first it jumped to 14 satoshi and took a 50% correction to 7 satoshi, but then in only 3 days it jumped all the way to 38 satoshi;

in another three days the price took another deep dive to below its previous all time high, but then, three days later it was back to 38 satoshi levels;

this time the correction only took the price down to 20 satoshi levels and now at the end of January the price has been consolidating between 22 and 27 with what seems to be strong support building up below 23 satoshi.

All of this hoopla in 2018 has really supercharged the HTMLCOIN community. We are now just shy of 10k members on Telegram, while having only one exchange where HTMLCOIN can be traded in somewhat decent volumes (this being Bleutrade).

The official marketing team is working hard to get HTMLCOIN listed on as many exchanges as possible (now with the help of TBIS’ Michael Stollaire as well), but the community is definitely doing its part and seems to do an evermore efficient job of it.

Htmlcoiners understand that by helping others we are really helping ourselves and we are doing that constantly, most actively on the Telegram channel.

Any newcomer is welcome (except those who spam and get instantly banned) and every question is usually finding its answer pretty quick, either directly from a developer or a channel admin or from the community itself.

But community support in HTMLCOIN goes way beyond answering questions and being nice to each other. Many of our members are actually donating their own funds for community projects such as premium voting for listing on new exchanges. The vote on the Kucoin exchange was a very good example as many community members set up Reddit posts offering people the necessary funds to vote for their favorite coin once registered on Kucoin.

And this made quite a difference, HTMLCOIN being able to beat TRON in a direct voting match, also with the help of our friends in the Titanium (TBIS) community, a recent partner of HTMLCOIN in the Blockchain Alliance and possible client in the near future.

I will not be surprised if the HTMLCOIN community ends up as an example to all other online communities, not only crypto related, as the dynamics developing within this group are amazing. We will see how this community holds up in time and how it will be affected by quick growth and then unfavorable market context, but if it does pull through, I see us capable of things on a global scale that now seem nothing short of magical or purely wishful thinking.

But seeing how people within the community begin to understand the amazing opportunities brought forth by this HTMLCOIN package (blockchain, dev team, community), I could see the community itself growing healthy and constantly and staying strong and united during difficult times. While soon we may split into different discussion groups based on interests such as trading, marketing, project building or other aspects of the HTMLcoin ecosystem, overall we will still all be Htmlcoiners and here to help ourselves by helping each other within and outside the ecosystem.

I love crypto!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Htmlcoin is still a child, but ambitious))) Titanium HTML needs more than his Titan... Titan should be blockcahin technologies...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @clasic! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @clasic! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit