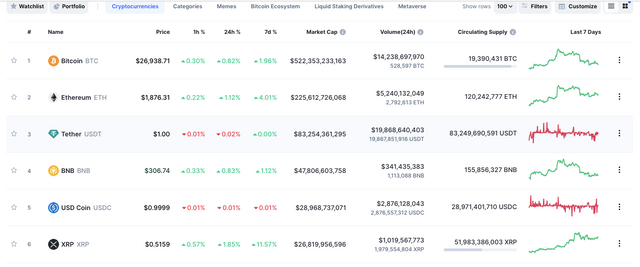

The cryptocurrency market has witnessed significant growth and volatility over the past few years. As the world becomes more digitally connected, cryptocurrencies have gained traction as a viable investment option. In this article, we will analyze the current state of the crypto market as of June 2, 2023, examining key trends, major cryptocurrencies, and factors influencing their performance.

Market Overview:

The crypto market has experienced a mix of ups and downs recently. After a period of consolidation and bearish sentiment, the market has shown signs of recovery, with several cryptocurrencies experiencing positive price movements. However, it is important to note that the crypto market remains highly volatile, and investors should exercise caution.

Bitcoin (BTC):

Bitcoin, the largest cryptocurrency by market capitalization, continues to be the bellwether of the industry. In recent weeks, Bitcoin has witnessed a gradual price recovery after a period of decline. The price of Bitcoin currently hovers around $50,000, indicating a positive sentiment in the market. Factors such as increased institutional adoption and regulatory clarity have contributed to Bitcoin's stability and gradual price appreciation.

Ethereum (ETH):

Ethereum, the second-largest cryptocurrency, has also shown resilience during this period. Ethereum's native token, Ether (ETH), has witnessed a steady increase in value, largely driven by the growing popularity of decentralized finance (DeFi) applications built on the Ethereum blockchain. Additionally, the upcoming Ethereum 2.0 upgrade, which aims to address scalability and improve transaction speed, has generated optimism among investors.

Altcoins and Niche Cryptocurrencies:

Beyond Bitcoin and Ethereum, several altcoins and niche cryptocurrencies have shown promise in recent months. The decentralized finance sector has witnessed significant growth, with projects like Aave (AAVE), Compound (COMP), and Uniswap (UNI) gaining popularity. Additionally, non-fungible tokens (NFTs) have emerged as a major trend, with platforms like CryptoPunks, ArtBlocks, and NBA Top Shot attracting substantial attention.

Market Factors:

Several factors continue to influence the crypto market. Regulatory developments remain a critical consideration, as governments worldwide attempt to establish frameworks for cryptocurrencies. Increased institutional involvement, such as the entry of major financial institutions and the launch of cryptocurrency exchange-traded funds (ETFs), has provided the market with more credibility and stability.

Moreover, macroeconomic factors, such as inflation concerns, monetary policies, and geopolitical events, can impact the crypto market. Investors should remain vigilant about these external factors and their potential effects on cryptocurrency prices.

Conclusion:

As of June 2, 2023, the crypto market has exhibited signs of recovery and stability. Bitcoin and Ethereum, the market leaders, have shown resilience and gradual price appreciation. Altcoins and niche cryptocurrencies, particularly those in the DeFi and NFT sectors, have also gained attention and experienced positive growth.

However, it is important to note that the crypto market remains highly volatile, and investors should conduct thorough research and exercise caution before making investment decisions. Staying updated on regulatory developments, institutional involvement, and macroeconomic factors will help investors navigate this evolving landscape successfully.