Talking Points:

EUR/USD hits initial head & shoulder's target of 1.1554 as outlined on October 6.

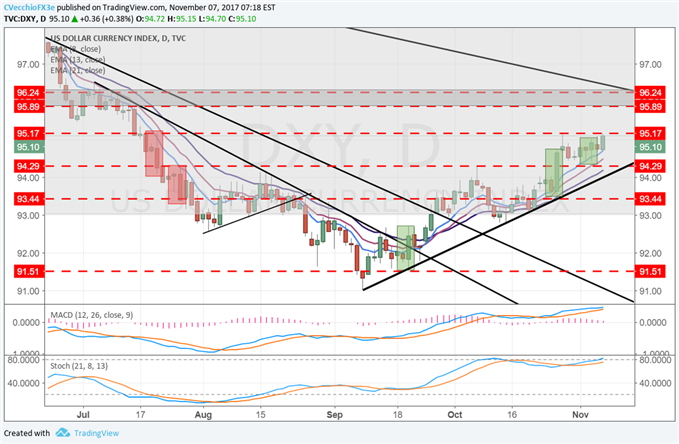

DXY Index trading just below 95.17, the July 20 bearish outside engulfing bar that helped define the greenback's mid-year swoon.

Retail trader sentiment continues to shift in a way that suggest USD-pairs may still turn higher.

Upcoming Webinars for Week of October 29 to November 3, 2017

Wednesday at 6:00 EST/11:00 GMT: Mid-Week Trading Q&A

Thursday at 7:30 EST/12:30 GMT: Central Bank Weekly

Chart 1: DXY Index Daily Timeframe (June to November 2017)

Elsewhere, both USD/CHF and USD/JPY retain bullish technical structures thanks to US yields staying elevated (particularly the 2-year yield, which the Bank of International Settlements - the central bank of central banks - has identified as the most influential interest rate along the yield curve in terms of determining currency exchange rates).

In both pairs, price is above the 8-, 13-, and 21-EMA envelope, while MACD and Stochastics are trending higher in bullish territory (above the median or neutral lines). USD/JPY needs to see a break of the May and July swing highs near 114.50 before new long positions are eyed. For USD/CHF, the double bottom target of 1.0108 remains in play following the break through 0.9770 last month.

See the above video for technical considerations in the DXY Index, EUR/USD, GBP/USD, AUD/USD, USD/JPY, USD/CHF, and NZD/USD.

Read more: FX Markets Turn to Asia-Pacific Region for Top Drivers in Week Ahead

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks @ mdo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit