01

Us stocks fell more than 7 percent at the start of trading on Monday night (including a nearly 2000 point drop in the Dow Jones industrial average), before triggering the "circuit breaker" mechanism.

Its main function is to trip immediately and cut off the circuit when a short circuit or serious overload occurs, so as to avoid the impact of large current on the whole system.

The circuit breaker mechanism of the US stock market is derived from the function of the circuit breaker.

On October 19, 1987, the biggest crash ever occurred in the US stock market, when the Dow Jones Industrial Average plunged 22.6% in one day, leaving many millionaires destitute overnight.

This day is also known as "Black Monday" by the American financial community.

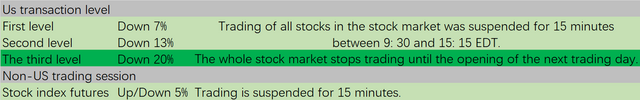

A year later, the United States officially launched the circuit breaker mechanism, which stipulates (adjusted in the middle, the following are the adjusted values for 2013):

When the market fell by 7%, a level 1 circuit breaker was triggered and trading in the US stock market stopped for 15 minutes.

When the market fell 13%, a level 2 circuit breaker was triggered and the US stock market stopped trading for another 15 minutes.

When the market falls by 20%, a level 3 circuit breaker is triggered, and trading is stopped directly on the same day.

In short, when the stock market falls too much, trading is suspended to cool the panic of the market and prevent the stock market from falling faster because of emotion. (with the popularity of quantitative trading, many institutional investors are already establishing mathematical models to formulate investment strategies and trading automatically by computers, but any model will be flawed when the market plummets.

Model defects may accelerate the decline of the stock market, while the circuit breaker mechanism can provide a time window for human intervention.

Since the introduction of the US stock circuit breaker mechanism, it has been triggered only twice in history, once on October 27, 1997, and the other on Monday.

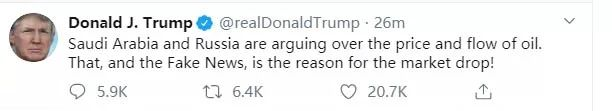

Trump immediately sent three tweets in an attempt to "put out the fire."

He first said that the oil price war between Saudi Arabia and Russia, coupled with the hype of fake news, led to a sharp fall in the stock market.

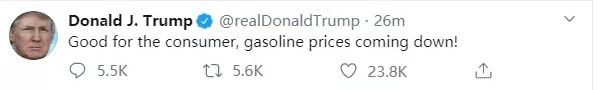

Then Trump tweeted that [Saudi Arabia and Russia are fighting an oil price war] is good for consumers, and oil and gas prices will fall.

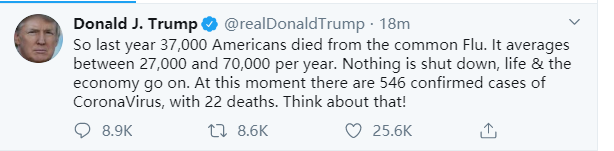

After that, Trump commented on the epidemic.

Trump said that 37000 people died of the flu in the United States last year, with an average of 27000 to 70, 000 deaths a year. Life and economy did not stagnate, while the number of confirmed cases of the epidemic was 546 and 22 died. Think about it again.

After watching Trump's "Twitter 3", I went to bed.

When I took a look at US stocks before going to bed, the decline had narrowed to about 5 percent.

However, when I woke up on Tuesday morning, I found that all three major indexes of US stocks had fallen by more than 7%, of which the Dow Jones index fell more than 2000 points.

After all, Trump's third company of Twitter is no match for the market.

Considering that not long ago, in the last week of February, U. S. stocks fell the most in a week since the 2008 financial crisis, and were included in the TOP10 list of weekly declines in U. S. stocks.

What happened to the American stock market?

I think there are three major factors behind this: the epidemic, oil prices, and America's own economic problems.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit