2017 was one of the worst years for hacking on the record. We have seen reports of unsolicited installations - minor ware generating millions of dollars from Monero, the result of Coincheck's breach in nearly half a billion dollars of losses, ICO phishing scams, and well Moreover. This cycle is repeated since Mount Gox was violated in 2011. As all those who follow the news knows, this trend is not exclusive to the Crypto world. A reporter said, "2017 was the year of Hacks. Before predicting 2018 would worsen.

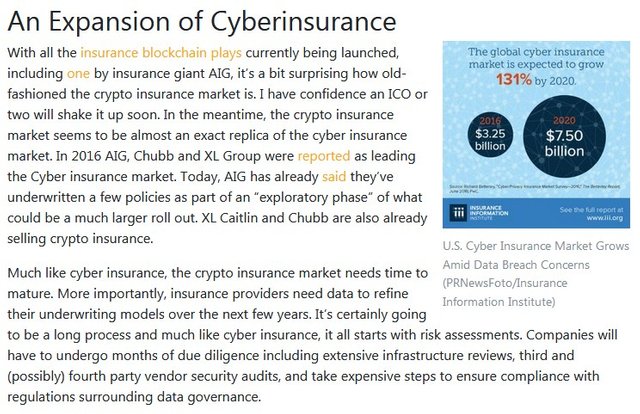

As with most other things related to Crypto, the potential cyber insurers of more blockchain has created tons of buzz. We have already reported on the deployment of Mitsui Sumitomo Insurance of a small scale Crypto insurance product in Japan. On a larger scale, we also discussed the massive Coinbases policy with Lloyds of London that covers 2% of coins that are not kept in "cold storage". These policies are certainly the tip of what is becoming a fast-growing iceberg.

As with most other things related to Crypto, the potential cyber insurers of more blockchain has created tons of buzz. We have already reported on the deployment of Mitsui Sumitomo Insurance of a small scale Crypto insurance product in Japan. On a larger scale, we also discussed the massive Coinbases policy with Lloyds of London that covers 2% of coins that are not kept in "cold storage". These policies are certainly the tip of what is becoming a fast-growing iceberg.

Remain the obstacles

Despite some of these policies being sold now, questions remain. On the one hand, conventional cyber insurance policies rely on the stability of fiat money. If there is a $ 100 million stolen in a violation (excluding relatively predictable legal fees, investigations ...) the maximum amount the insurance company can pay $ 100 million. If, however, Bitcoin was insured in January 2016, insurance companies must face price increases of thousands of percent. To remedy this, many insurance companies will insure depending on the value regardless of price fluctuations (in the case of gold, for example). Ongoing readjustments can lead to significant fluctuations in premiums that may be unacceptable to both policyholders and their clients.

Despite some of these policies being sold now, questions remain. On the one hand, conventional cyber insurance policies rely on the stability of fiat money. If there is a $ 100 million stolen in a violation (excluding relatively predictable legal fees, investigations ...) the maximum amount the insurance company can pay $ 100 million. If, however, Bitcoin was insured in January 2016, insurance companies must face price increases of thousands of percent. To remedy this, many insurance companies will insure depending on the value regardless of price fluctuations (in the case of gold, for example). Ongoing readjustments can lead to significant fluctuations in premiums that may be unacceptable to both policyholders and their clients.

Another issue, both cyber-insurance and cryptoinsurance, is that of phishing scams. If an attack on a DNS companies leads to be sent to the cryptocurrency purse false, is the insurance company still responsible? Should not the client have checked the SSL certificate to verify the identity of the server? All these questions are answered in cyber insurance and will have to answer independently by crypto insurance markets. Especially in the light of the recent rise of astronomic phishing scams targeting crypto investors.

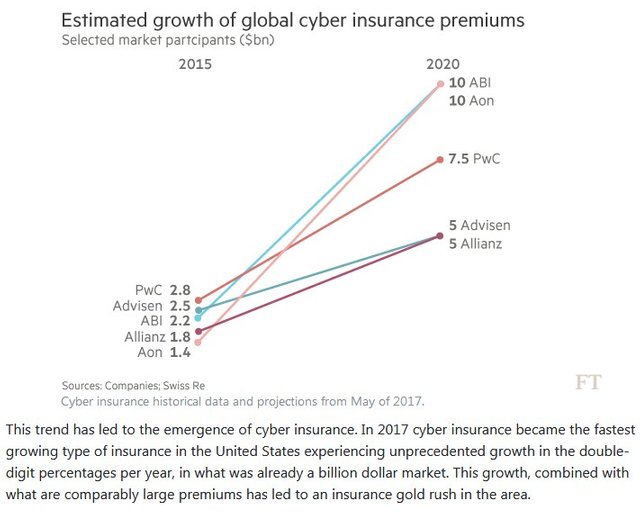

Despite the risk, insurance companies seem to be entering this industry. Crypto insurance is likely to form an increasingly important part of the Crypto insurance market. Its growth has been and will continue to be exacerbated by frequent hacks. It will be interesting to see where this industry ends.

Despite the risk, insurance companies seem to be entering this industry. Crypto insurance is likely to form an increasingly important part of the Crypto insurance market. Its growth has been and will continue to be exacerbated by frequent hacks. It will be interesting to see where this industry ends.

Similar Article:

Dubai-based currency exchange signs up with Ripple - XRP Latest News https://steemit.com/ripple/@ultraspace/dubai-based-currency-exchange-signs-up-with-ripple-xrp-latest-news