Hello, my distinguished readers, today’s edition of my article will be on decentralized venture capitals. Surely, after reading this article to the end, you would be left with no choice other than to start investing in this project massively because of its features, ideas behind it and the opportunity it offers to investors of all levels are magnificent.

OVERVIEW OF DAO.VC PLATFORM

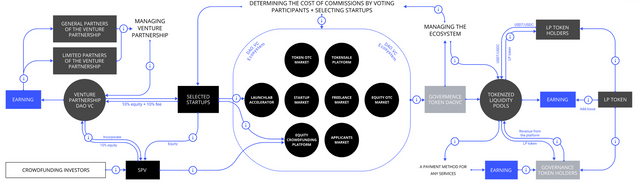

DAO.VC is a decentralized investment platform that helps promising projects to achieve their dreams by leveraging the fund and already existing followers from our community. The project was created in early 2020, and it was built on DAO. The project most attractive, unique feature is the ability of low-cap investors to invest in promising projects, however, making DAO.VC platform to be easily accessible by all.

The project main features include a marketplace, Launchpad project accelerator, investor’s social network, investment pool and venture partnership pool. Projects that successfully pass through the incubator (LaunchLab acceleration) are eligible to seek funds at DAO.vc too.

HOW DAO.VC PLATFORM WORKS?

Project developers manage the platform on their own, before seeking funds for the project. Developers will receive feedback from the DAO.vc team, investors and other experts from the industry. Project developers will always post the work progress and latest news about the projects for the community to digest. Investors and experts will evaluate the projects and gives financial and technical advice to project developers if necessary.

The released funds are utilized to accelerate new projects. Investors are entitled to 10% equity and 10% revenue from all projects supported by the DAO.vc.

DAO.VC investors will always have access to projects supported by the platform earlier and with low capital. Investors will have the privilege to diversify their investments via the platform index funds. Heavyweight investors will receive a bonus for their large capital in the pool and will also have the opportunity to invest in the best talents in the industry.

HOW DAO.VC MANAGED RISKS?

All projects on DAO.VC platform seeking funds must be passed through the security screening in the LAUNCH LAB, which ensures the projects are not fakes. DAO.VC team only approved projects that passed all the security checks and have prospects.

On DAO.VC platform, crypto-investors don’t buy projects native tokens or stake their assets in a project. An investor only acquires DAO.VC platform token in exchange for their money. Investors fund's liquidity is guaranteed by the platform’s services requested by projects in the LAUNCH LAB, rewards to employees offering their services to projects among others.

TOKENOMICS

Governance Token: It’s used to pay all services and products offered by the platform such as selecting new projects to be listed on the platform Index Fund, listing new DeFi projects among others.

LP Token: The DAO.VC liquidity token funds are channelled to the DeFi Index, where steady and constant revenue are generated if stablecoins were used to provided liquidity to the pool.

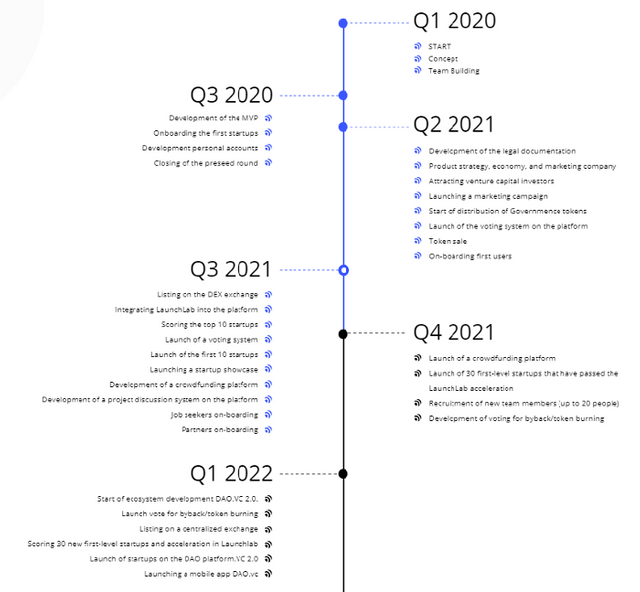

ROADMAP

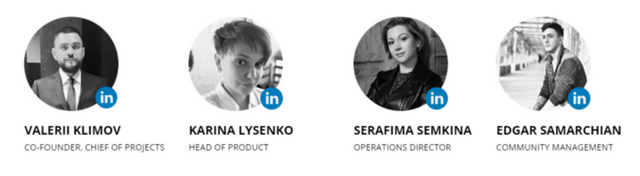

TEAM

CEO

CONCLUSION

Currently, many crypto-investors and venture capitals are being attracted to DAO VC project, as the project is capable enough to become the solution for many new startups seeking funds and also providing a reliable platform for investors to invest their hard earn money too.

Links

https://defi.dao.vc/

https://twitter.com/dao_vc

https://t.me/daovc_chat

https://www.facebook.com/dao.vc/

AUTHOR

Bitcointalk Username: Alaho15

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=2513944

POA: https://bitcointalk.org/index.php?topic=5358071.msg57898622#msg57898622

TRC20 Address: TFa3bHpqRyZPi1WQgqxcqme6uKyi5TmWem