DAO VENTURES is a multi-chain platform dedicated to decentralized finances. It is the perfect place for investors and fund managers. It counts with a lot of features and financial tools that will allow users to receive high returns. One of the best features of this ecosystem without a doubt is the smart contract running on every investment strategy which has the function of seeking the best yield farming protocol in the market to generate income in an automated way.

But the truth is that thanks to this automated performance this platform is made also for people with low experience or none in cryptocurrency. There is no need to have specialized knowledge in cryptocurrency, blockchain and investment strategies in order to use the platform. This is the reason of the DAO VENTURES globally growth as people can take advantage of all automated strategies it offers in order to invest in the new blockchain trend METAVERSE or in top cryptocurrencies like BTC, ETH and others.

DAO CITADEL is a crypto ETF investment strategy which goal is to provide access and exposure to BITCOIN, ETHEREUM and other ERC-20 altcoins allowing users to receive some of the highest returns in the market through typical activities of providing liquidity in decentralized exchanges and lending protocols. In a general vision, this concept is giving people a reliable and profitable source of passive income.

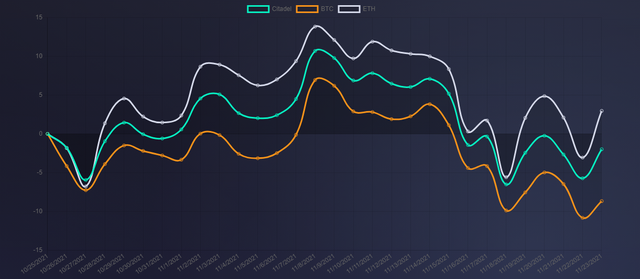

STRATEGY PERFORMANCE

People could think this is a simple BTC or ETH buying in order to hold and get rewards base on the coin appreciation but this strategy doesn’t take long positions on cryptocurrencies. The idea is to provide WBTC and ETH liquidity for example, in the best and more profitable decentralized exchanges in DeFi sector like SUSHISWAP, CRV and PICKLE. This will generate a series of associated benefits like:

- Appreciation on the cryptocurrency.

- Trading fees related to providing liquidity activities.

- Yield farming incentive.

The allocations are structured in the following way:

- 30% for ERC-20 BTC

- 30% for WBTC-ETH

- 30% for DPI-ETH

- 10% for DAI-ETH

ALLOCATIONS

It is important to say that all rewards and incentives received from yield farming are sold in order to buyback more LP tokens and received more incentives; this is an automated performance executed for DAO VENTURES smart contracts. This is the magic of auto compounding in which users don’t have to touch anything; they just have to watch their investment to growth.

This strategy takes care of every detail in order to provide a positive performance. The portfolio is rebalanced few times a day in order to maintain an ideal allocation. The fee structure is similar to others DAO VENTURES features and it is defined for a 0.5%-1% on deposits, a 20% on profits sharing and a 10% on harvesting rewards and depositing LPs.

There are some associated risks and the one who causes the most restlessness is the impermanent loss because in cryptocurrency you never know the behavior of the assets. But like I always say when speaking about DAO VENTURES, The profits most of the time give better returns than BITCOIN AND ETH.

Performance of DAO CITADEL compared to BTC and ETH

I introduce you a solid way to increase the amount of your crypto-assets by using a unique strategy that works with the cryptocurrencies with more market capitalization which are BTC and ETH so you can imagine the big potential this strategy offers in its performance and returns.

Humanity runs toward ways in which they can have alternative sources of income and not depend only in one. DAO VENTURES definitely will help people in this mission by offering them an entire ecosystem with automated investment strategies that will work in the most profitable sectors of cryptocurrency to generate big profits.

https://app.daoventures.co/

https://twitter.com/VenturesDao

https://t.me/DAOventures

https://www.linkedin.com/company/daoventuresco/

https://daoventuresco.medium.com/