ABOUT DARTH

DARTH is revolutionizing DeFi with Darth Auto-Generation Protocol (DAP), offering industry-leading fixed APY, returns every 15 minutes, and a simple hold-on purchase system that helps you quickly grow your portfolio and invest in your wallet. provides

The strongest auto-stacking and auto-pooling protocol in cryptography

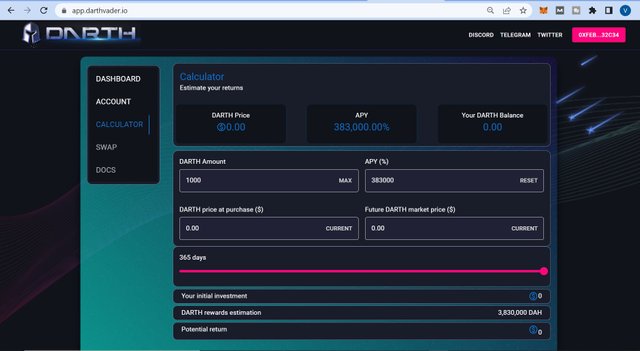

Best Return on Investment 383,000.00% APY

The best automatic collection and deposits from your wallet!

Earn every 15 minutes / 96 times a day!

Low risk with DATH Insurance Fund (DIF)

Darth overview

DARTH offers a decentralized financial asset where investors are rewarded with fixed compound interest using the proprietary DARTH protocol.

DARTH Autostaking Protocol is a financial protocol that makes staking easier and more efficient and provides stable cryptocurrency returns to $DARTH token holders.

Darth has a fixed APY of 383,000% of the crypto space.

DARTH: A company focused on DeFi innovation that aims to create benefits and value for preferred token holders.

NO INSURANCE FUND RISK - 5% of all transaction fees are allocated and guaranteed to the Darth Insurance Fund, minimizing the risk of deterioration and ensuring the stability and validity of the protocol.

Simple and secure process - The process of registering DATH tokens in your wallet is from the moment you start purchasing the tokens, there is no need to transfer tokens over the internet from the moment you purchase them, you start and receive revenue first.

Automatic payments and interest - you don't have to bet any more when you first start betting. The setup and staking mechanism automatically pays interest directly to your wallet at any time.

Crypto's Strongest APY - DATH pays 3830.0% in first 12 months to compete with DeFi. After the first 12 months, the interest rate gradually decreases according to a predetermined long-term interest rate cycle for the token contract.

Cumulative Profit Payments - DATH will be paid out to each DATH token holder every 15 minutes or 96 times a day.

Auto-Burn - A system that aims to make tokens more stable through automatic token burning to prevent them from getting out of control or being rolled back, where 2.5% of all market sales of the same tokens will be burned.

What is Annual Yield (APY)?

According to Bankrate, the average bank savings rate in the US is 0.06%. With traditional savings rates bottoming out, it's no surprise that crypto savings, staking, profit nurturing, and crypto lending accounts are receiving significant interest. After all, who doesn't want to earn passive income?

Annual Yield (APY) is a general term used in traditional finance as well as cryptocurrencies to describe the amount of money that can be earned from an asset. The main difference usually lies in whether the revenue is combined (i.e. whether the revenue generates revenue) and in the time period. As a crypto investor, APY is an important metric to help you compare returns across platforms or assets.

This article explains what APY is, how it works in crypto, and why APY makes APY a significant investment opportunity.

What Is APY?

APY is the annual return on an investment, including compound interest or balanced growth. Compound interest includes interest on the initial deposit and interest on it.

Although often associated with traditional savings, APY is an important indicator for cryptocurrency savings plans and similar activities. Cryptocurrency investors can earn APY for their cryptocurrencies by leaving margins, putting them into savings accounts, or providing liquidity to their liquidity pools through profitable farming.

You can quickly earn cryptocurrency APY through cryptocurrency exchanges, wallets, and DeFi protocols.

In general, investors get the same return on the cryptocurrency they earn and the cryptocurrency they earn. However, there are cases where payment can be made in the same currency or in a different currency.

DARTH Insurance Fund

Personal wallet of the Darth system, Darth . Insurance Fund

To take a simple example, staking products are distributed every 15 minutes, backed by an insurance fund that maintains a constant interest rate in dollars to DATH token holders.

5% of all trading fees are stored in our trust fund, which sustains and supports profits through active income.

Insurance funds keep owners safe by:

Stable token price with fast collision avoidance

DARTH's long-term sustainability

Significantly reduces downside risk.

Address: 0xd1a807757B15B7d1E46a7970b514Ed7793666537

DARTH Buy and Sell Fees

Transaction fees play a very important role in efficiency as they provide the capital to carry out important functions of the protocol.

Bond sales are also subject to token holders fees. Reduce the amount of APY that can be delivered and find a way to reliably deliver APY.

The commission rate (14% on buy and 16% on sale) allows DARTH to offer holders of DARTH dollars a fixed high return of 383,000.00% per year.

The rest of the protocol uses bond sales to support a similar function of DARTH fees, but this approach is riskier because the tokens lose support and are sold if the bond is not purchased.

More Info :

WEB : https://darthvader.io/

WHITE PAPER : https://docs.darthvader.io/index

DISCORD : https://discord.com/invite/YQ4qeyGgMA

TWITTER : https://twitter.com/Darth383000

TELEGRAM : https://t.me/Darth383000