Rapid digitalization in the past few years has resulted in a revolution in many sectors of the economy. Over the past few years, the financial institutions have also been hit by this rapid wind of change. Recently there has been a social focus on the shortcoming of the traditional credit agencies and the call for the use of block-chain technology to revolutionize the former.

This is because of its underlying potentials that can be used offers a better service to customers. The block-chain technology offers distributed credit reporting, debt registration, wealth management, and asset transactions. It has the capacity of making business participants in different countries around the world to deliver financial services in a more convenient and reliable way.

Through fair service to participants(users), it curbs the monopoly of conventional financial institutions. Distributed banking- an ecosystem of distributed financial services using block-chain technology opens this great door in the credit business.

Problems of a centralized credit service

Profiteering

Many credit agencies took the monopolistic advantage of a centralized credit to digress from their vision of offering a better service to become a centralized profiteering industry. They were more concerned about profit and expansion. They deducted heavily from lenders while squeezing borrowers.

Unbalanced credit reporting

Creating a credit report in many countries, most especially the third world is backward and unbalance process. More so, many customers do not have a credit record. Moreover, borrowers believe that their debt information is usually messed up by traditional credit agencies, this has hindered many borrowers from getting the desired loan

Creditworthiness

Borrowers do not have the ability to self-certify their credit, this makes intermediaries (brokers and customer managers) indispensable in consumer credit underwriting. Most times, the size of the loans available to borrowers is usually caused by the wrong evaluation of creditworthiness by the intermediaries

Advantages of a decentralized block-chain technology to credit business

It prevents monopoly

Unlike the centralized credit business where the intermediaries determine the interest on loans, the value of interest on loans in a decentralized blockchain technology is decided by the market itself

Protects user privacy

Users personal information will be encrypted and stored in the cloud, retrieval can only be done through local addressing. Users personal data will be transmitted to them in an encoded point-to-point or zero-knowledge proof form

Eliminates third party information monopoly

In contrast to the traditional way, where a third party keeps a record of individual’s credit history block-chain technology allows individuals to own and use their data. This eliminates the menace of leakage and unauthorized use of owner’s information

Risk control

The blockchain provides credit agencies with an anti-fraud and modeling algorithms which help financial institutions process personal data without them. This helps financial institutions improve their risk control capabilities in accordance with compliance requirements.

DISTRIBUTED CREDIT CHAIN

Distributed credit chain is a decentralized main block-chain launched by the cyber sheng foundation. It was designed to address the problems inherent in the centralized credit. It can implement liquidation and settlement services, deploy business contracts and other related distributed financial activities.

How does the distributed credit chain solve the centralized problem?

Through blockchain technology, encrypted algorithm, and al risk control system the distributed credit chain adopts a super standard credit ecosystem that will benefit the world. To achieve this great feat, inherent in the DCC are:

Account identification system

In a distributed credit chain each individual or credit agencies can generate a DCCID-a decentralized account system through public-private key pair to form an address. This address helps in identifying and associating all users’ attributes i.e. users name, the value of users properties, values of existing loans, credit history etc.

Data identification verification system

Through data identification verification, the distributed credit chain offers users an opportunity to have absolute control over their data. They can determine the storage and use of their personal data. The DIV (data identification verification) uses digital signatures and data digest in the circulation process to prevent falsification of data by users.

To prevent the risk of fraud and leakage of users information during verification, it uses a decentralized peer-to-peer verification system to establish a link between individuals and data institutions, as well as among data institutions

Cross-border credit credentials

The distributed credit chain is designed to become the main currency of the multi-national lending service ecosystem on the distributed credit chain. The system will provide a cross-border and cross-currency credit service of all digital assets to users. Also, it is capable of corresponding to values of diverse legal tender of loans in different countries.

The distributed credit chain platform

The distributed credit chain offers users a centralized system which serves as a source of data and transaction markets for data collaborators and credit structuring institutions. Moreover, the DCC offers collaborating institutions an avenue to publish their labor costs through its platform.

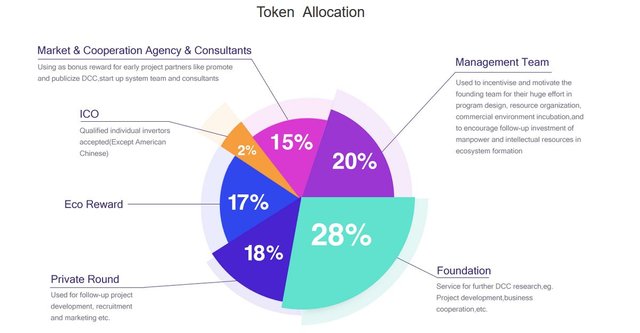

TOKEN ECONOMY AND ICO INFORMATION

Token Name: Distributed Credit Chain-Token

Token Ticker: DCC

Token Standard: Ethereum (ERC-20) Compatible

Token Total Supply: 10,000,000,000 DCC

Token ICO Price: 1 DCC = $0.05

Whitelist: YES

DCC public sales were conducted on May 28, 2018. DCC public sales sold out in 20 minutes for 1 ETH = 13,700 DCC

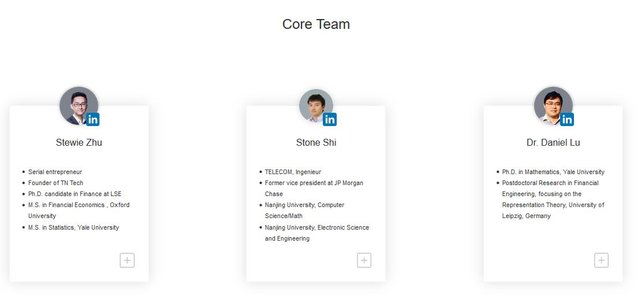

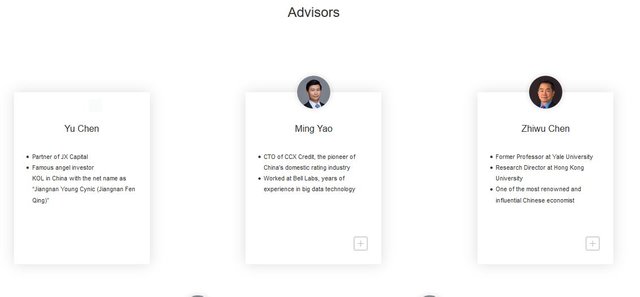

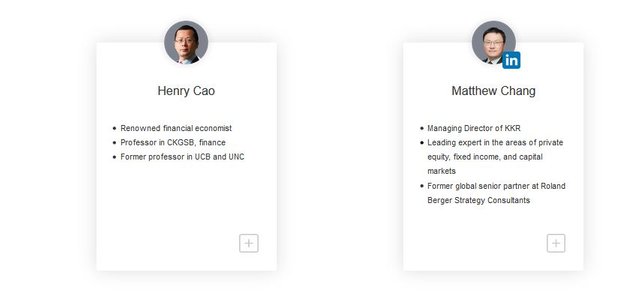

TEAM

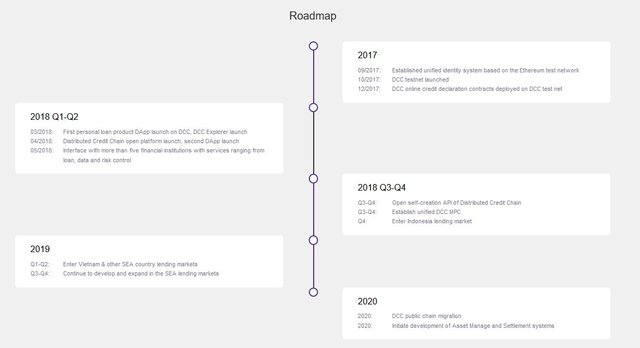

ROADMAP

For More Information about the Project, kindly visit any of the links below:

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Twitter: https://twitter.com/DccOfficial2018/

Facebook: https://www.facebook.com/Distributed-Credit-Chain-425721787866299/

Telegram: https://t.me/DccOfficial

Medium: https://medium.com/@dcc.finance2018

Reddit: https://www.reddit.com/r/dccofficial/

Github: https://github.com/DistributedBanking/DCC

Bitcointalk Bounty Thread: https://bitcointalk.org/index.php?topic=4185316.0

AUTHOR'S DETAILS:

Bitcointalk Username: bl3zzy

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1328702

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit